Moolec goes full beans as agritech powers future breakfast

|

Getting your Trinity Audio player ready...

|

Soybeans are big business. Soybean production has risen from just under 27 million tonnes at the beginning of the 1960s to over 370 million tonnes today. And the bulk of those soybeans are used as livestock feed. But that could all change in the future if molecular farming takes off, as developers have shown that animal proteins can be produced directly from the soybeans themselves. And it’s another example of how agritech is transforming the food industry.

Meet the molecular farmers – plant-based agritech

Using plants to grow animal-protein is taking off as indicated by a growing ecosystem of biotech firms.

Plants as small factories

Moolec, which last year became the first molecular farming foodtech listed on the Nasdaq, highlights how the commercialization of molecular farming is progressing. The plant-based technological platform works by introducing real animal genes directly into seeds. And the foodtech breakthrough enables plants to function as small factories by growing animal proteins within main food crops – for example, in yellow soybeans and peas.

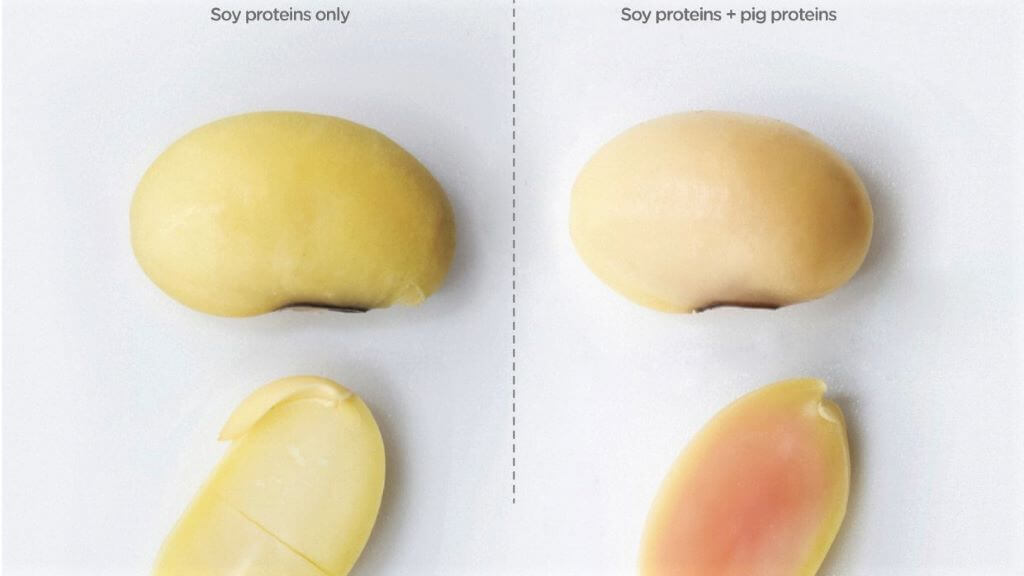

Moolec has hit the headlines most recently for growing soybeans that were rich in pork protein. And the results were four times higher than the firm had expected based on earlier experiments. In the latest announcement, Moolec said that the animal protein reached a high expression level up to 26.6% of total soluble protein in soy seeds.

A regular soybean (left) and one grown by a molecular farming host plant that’s been designed to produce animal protein. Image credit: Moolec.

Moolec’s soybeans carry a distinct pink color, which reveals the animal protein that’s been grown by plants in the field. And in safflower plants, which the company has engineered to produce a nutritional oil (gamma-linoleic acid), the company is reporting expression levels of around 60%, up 10% on initial expectations.

As well as using the plants to produce so-called neutraceuticals, Moolec is using safflower as a host for plant-based cheese replacements. And the project has advanced beyond the research stage to move into scale-up operations. “In early January, 25 tonnes of SPC2 (Safflower Chymosin) were harvested from the production campaign 2022/2023,” writes the firm in its Q3 FY 2023 business update.

One of the big benefits of molecular farming is that the growing infrastructure is already there. Farmers have been growing crops for generations and can continue to use existing skills and equipment. The agritech element – although disruptive as molecular farming enables producers to skip the livestock stage of animal protein production – complements existing workflows and benefits from operations already available at scale.

Producing animal protein in the lab, on the other hand, requires a complete rethink of traditional farming practices – and implies additional cost and energy. For example, precision fermentation and cultured meat have sprung out of the pharmaceutical industry. But medicines are typically much more expensive than food.

However, disrupting conventional agribusinesses from within – or, more accurately, on the land using agritech – doesn’t have to carry the same cost penalties. And, in fact, there are multiple savings to be had.

Making a pitch to investors, Moolec’s senior management team points out that compared with conventional animal-based food production, molecular farming requires 35x less land usage. Carbon dioxide emissions are 60x less, and the water footprint is reduced too. And these numbers, which apply to any meat-free diet, not just one rich in molecular-farmed plant produce, point to opportunities for more eco-friendly foods.

A new vertical in food – alternative proteins

Supermarket aisles are the ultimate testing ground for food producers. Competition is fierce, particularly in established categories where shoppers have long discovered their favorite brands. And getting consumers to switch from one brand to another is expensive for companies – just ask Pepsi!

So when a new vertical in food opens up, it’s no surprise to see a rush to win market share. And alternative proteins is a rapidly rising food vertical with huge growth potential. Consumers are warming to plant burgers for various reasons. And Moolec’s hope is that plant-grown animal proteins will make meat-free products tastier and more appealing.

The larger the plant-based market gets, the more alternative proteins – including those produced by yellow soybeans – will be consumed in place of regular meat products.

At a high level, Moolec sees itself as an ingredients supplier – providing seeds to contracted growers and plant-grown animal protein to clients. The firm believes that the total addressable market for alternative protein ingredients could be worth over $70 billion by 2025.

And of that share, Moolec estimates that it could service around $350 million in plant-derived diary ingredients and $4.5 billion across nutritional oils and meat replacement segments. Also, Moolec isn’t the only company using agritech to open up new business opportunities.

Strawberries turn out to be a star attraction for deploying fruit-picking robots, and applying machine learning image recognition to select optimally ripe crops to reduce food waste.

Foodtech is an exciting area for developers to bring solutions that take pressure off scarce resources and reduce the global environmental footprint associated with protein production. And next time you bite into a soybean, who knows what flavors will be in there – molecular farming and agritech takes Jelly Belly BeanBoozling to a whole new level.

And did we mention that beans can play a role in quantum computing too?