- VMware for free heads into the sunset.

- VMware vSphere free edition axed.

- VMs’ alternatives threaten company’s future.

Following Broadcom’s acquisition of VMware, the company has axed its free tier that offered the ESXi hypervisor to test labs, hobbyists, and home lab builders.

In a knowledge base article, the company stated that the “VMware vSphere Hypervisor (Free Edition) has been marked as EOGA (End of General Availability). At this time, there is not an equivalent replacement product available.” While VMware for free is no more, “not an equivalent replacement product” is a significant misnomer.

What is a hypervisor?

Hypervisors are pieces of software that control virtual machines and encapsulated instances of operating systems, allowing multiple virtual computers to be run on a single computer. The technology of virtualization is one of the ways that servers can deploy multiple applications and services using fewer pieces of hardware than dedicating a single piece of hardware to each. It’s possible because a typical combination of computer + operating system rarely utilizes all its resources at any one time. Hypervisors share resources on a host machine across all of its virtual machines, allocating processor cycles, memory, and I/O across its fleet.

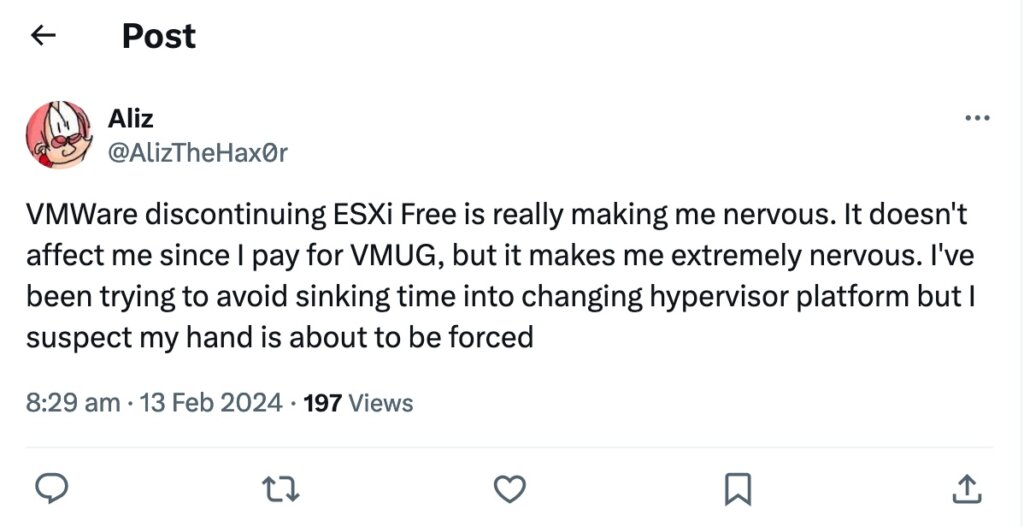

Source: Twitter

VMware established itself as one of the main suppliers of virtualization technology in the early 2000s, just as commonly-available hardware capabilities became such that virtualization was viable. Relatively low-cost hardware was able to run multiple instances of servers, meaning organizations and data centers could offer server facilities without necessarily needing to supply dedicated hardware for each server instance. Today, it’s possible to rent a VPS (virtual private server) for as little as the cost of a round of take-out coffees, one that’s capable of running, for instance, a web server, database, and security stack.

Broadcom’s decision to limit its offerings is driven in part by a desire to recoup some of the $61bn cost of its acquisition of VMware. Previously, VMware had been bought and sold by EMC and Dell. By ensuring that the majority of its users will pay for licenses from now on, the company guarantees itself a revenue stream. The company has also ended perpetual licenses in favor of subscriptions.

Five threats to VMware’s future

While Broadcom may be content with its market consolidation and ensuring all users pay their dues, there are five threats to VMware that will ensure its eventual long-term demise, assuming its trajectory with regard to licensing remains the same.

- Competing products such as KVM, Harvester, Proxmox, and Zen offer IT teams alternative hypervisors and virtualization technologies that, in monetary terms, are free at the point of use. Their widespread use means that a large body of users are able to refine, update, and extend their solutions without the restriction of either fees or the closed strictures of the proprietary VMware platform. A significant portion of those users will also upstream their improvements and bug fixes and release new capabilities of the software to all other users under less restrictive license terms.

- By removing the ‘free to play’ tier, VMware and Broadcom have effectively removed the up-ramp to the paid tiers. Students, hobbyists, and career-minded IT staff are less likely to consider the platform to learn virtualization technology on. Large institutions offering CS courses, for example, can choose between free-to-use or paid-for licenses for software that is at least equal in capability.

- Organizations operating test environments for their development and deployment activities no longer have the wherewithal to experiment to the degree they might require. Strictures on using VMware in environments that can be created and torn down (test labs) will be subject to the same fees as production environments. That places a barrier created by financial constraints on how organizations’ solutions can be tested.

- Advances in container-based workload deployment and management now make microservice-based applications and services viable in many contexts. Containerization is one area in which cloud computing has significant advantages for the creator. New projects are more likely to opt for containers over full virtualization if the latter seems to come with a price tag.

- The specter of a large company owning the rights to technology on which its customers depend brings with it several undesirable elements. Broadcom can, and might, either further raise prices, limit hypervisors’ capabilities, or ditch the project altogether. Or not. It’s the unpredictability of decisions made well away from the customer base that represents significant danger to organizations looking to bed in for the long term. Vendor lock-in may have been effective in previous decades when technological advancements were made by a single party in combination with a crushing marketing budget. Windows NT and Oracle, to take two such examples, were able to near-monopolize their chosen sectors (desktop and database, respectively). But such practices were very much of their time; in 2024, end-users have to deliberately choose their degree of lock-in and, of course, can opt for next-to-none. Existing license fee-paying customers find themselves offered two expensive alternatives: the devil is to be milked for license revenue until the end of time, and the deep blue sea is to make deep investments in moving to a different platform.

“The devil and the deep blue sea” by WarmSleepy is licensed under CC BY 2.0.

The end of VMware for free: consequences

It’s a common misconception that companies are bound by law to deliver increasing value to their shareholders – an idea, albeit an incorrect one, that might explain why Broadcom and VMware have chosen the path of license-fee revenue generation over ensuring a healthy intake of new users. What both companies’ decision-makers are bound by, however, is a need to stay in a position from which a board of directors and/or a shareholder vote can remove them.

Making shareholders happy at least ensures a short-term future that promises high salaries, stock options, and performance-related bonuses. If the desire for a third Ferrari or a modest mega-yacht outweighs the desire for the long-term viability of a software offering, then it’s easy to predict which way the wind will blow.