China is resisting the downgraded AI chips from Nvidia. What’s next?

- Firms from China, like Alibaba and ByteDance, have suggested that they’re not interested in the downgraded AI chips by Nvidia.

- The H20 chip, the most powerful among three China-focused chips by Nvidia, is set for mass production in Q2 this year.

- Offloading the chips may prove troublesome if Chinese firms are not interested.

In a narrative woven through with technological intrigue, reports from foreign media unveil Nvidia Corp’s plans to initiate mass production in the second quarter of 2024 for an AI chip meticulously tailored for the Chinese market in adherence to the latest US export regulations. Initially slated for a grand debut last November, the chip’s entrance into the spotlight in China faced delays attributed to integration challenges encountered by server manufacturers.

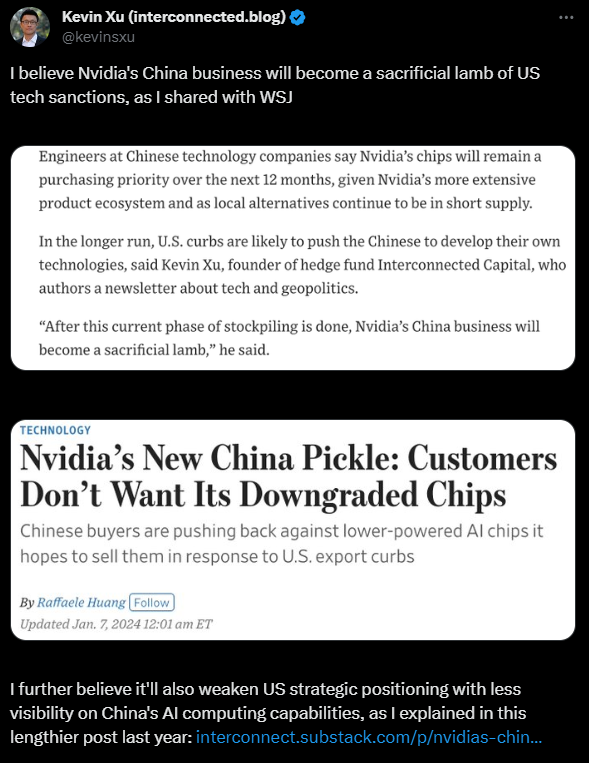

Simultaneously, whispers from certain foreign media outlets suggest a reluctance among Chinese customers to embrace the “downgraded” iterations of these chips, sparking a fiery debate echoing across both Chinese and US territories. Despite differing perspectives, a shared understanding has emerged that this abnormal state of affairs is inherently unsustainable.

Day by day, the plot thickens in this delicate dance between technological prowess and geopolitical maneuvering, leaving the stage open for an unpredictable interplay of innovation and regulation.

What has Nvidia been doing for China?

In adherence to the latest US regulations governing chip exports, Nvidia has consistently introduced specialized AI chips and graphics cards explicitly tailored for the Chinese market. It all started with the A800 and H800, introduced as alternatives for Chinese customers in November 2022, about a month after the US first restricted exports of advanced microchips and equipment to China.

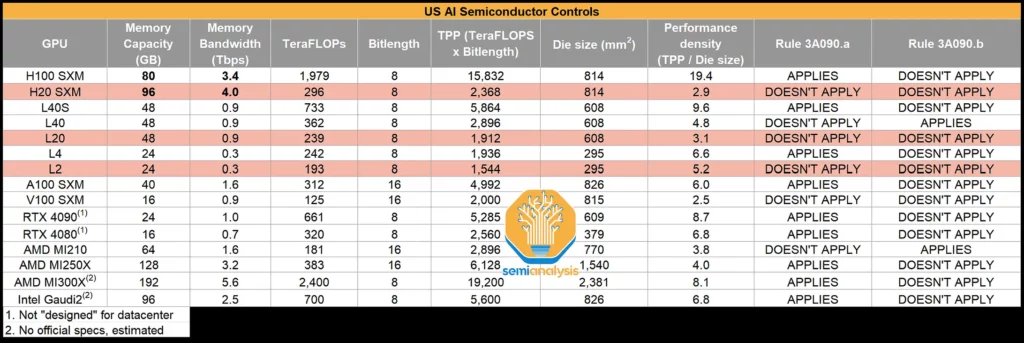

The table provides specifications for Nvidia’s latest GPUs—H20, L20, and L2—covering FLOPS, NVLink bandwidth, power consumption, memory bandwidth, capacity, die size, and more. Source: SemiAnalysis.

Unfortunately, a year into the October 2022 export control, the US further tightened its restrictions, which led to the barring of the shipments of advanced A800 and H800 AI chips to China. In response to the October 2023 renewed restrictions, Nvidia planned three other chips to comply with new US export rules – the H20, L20, and L2.

In November last year, citing two sources familiar with the matter, Reuters reported that Nvidia has communicated to its clientele that the speculated H20 GPU, crafted to navigate through the export control measures imposed by the Biden administration on China, is anticipated to be unavailable until February or March this year.

The H20, L20, and L2 include most of Nvidia’s newest features for AI work. Still, some. Still, some of their computing power measures were cut back to comply with new US rules, according to SemiAnalysis’ analysis of the chips’ specifications. But the question remains: does China even want the downgraded version of Nvidia’s AI chips?

China would instead source a domestic alternative

For a start, according to sources cited by The Wall Street Journal (WSJ), since November 2023, major cloud service providers (CSP) in China, such as Alibaba and Tencent, have been testing samples of Nvidia’s special chips. These Chinese enterprises have conveyed to Nvidia that the quantity of chips they plan to order in 2024 will be significantly lower than their initial plans.

The new challenge is that significant Chinese CSPs are not interested in buying these chips’ lower-performing versions. A report by TrendForce indicated that Chinese enterprises have been testing the highest-performance version, H20, of Nvidia’s “special edition” AI chips.

“Some testers have mentioned that this chip enables efficient data transfer among multiple processors, making it a better choice than domestic alternatives for building chip clusters required for processing AI computational workloads,” the report reads. Nevertheless, testers highlight the necessity for additional H20 chips to offset the performance difference compared to earlier Nvidia chips, leading to increased expense.

According to the report by the WSJ, the advantage in the performance of Nvidia’s “downgraded” chips over domestic Chinese alternatives is diminishing in the short term, making locally manufactured chips more appealing to buyers. The report indicates that influential entities such as Alibaba and Tencent are shifting some advanced semiconductor orders to domestic companies, leaning towards domestically developed chips.

This shift in sourcing behavior is also noticeable among the other major chip buyers, including Baidu and ByteDance. According to TrendForce data, around 80% of the high-end AI chips Chinese cloud computing companies use are sourced from Nvidia. But this proportion may decrease between 50% to 60% in the next five years.

Has Nvidia badly midjudged its approach in China? Source: X.com

In the long term, TrendForce believes Chinese customers will begin to express uncertainty about Nvidia’s ability to consistently supply chips due to the potential tightening of chip export controls by US regulatory authorities. Focusing on independent AI chip development, Chinese CSPs like Baidu and Alibaba will actively invest in autonomous AI chip initiatives.

Baidu introduced its first self-developed ASIC AI chip, Kunlunxin, in early 2020, with plans for the second generation in 2021 and the third in 2024. After acquiring Zhongtian Micro Systems and establishing T-Head Semiconductor, Alibaba began creating its ASIC AI chips, including the Hanguang 800.

TrendForce reports that while T-Head initially collaborated with external companies for ASIC chip design, post-2023, Alibaba is anticipated to increasingly rely on internal resources to strengthen the independent design capabilities of its next-gen ASIC chips, particularly for Alibaba Cloud’s AI infrastructure.