Weakening demand hits Foxconn, but expansion plans in India wait for no one

|

Getting your Trinity Audio player ready...

|

- Foxconn plans to actively deploy work in crucial components to raise its competitiveness in India.

- Foxconn expects sales to fall in the current quarter and the year overall as expectations of a worsening market for electronics linger.

There is no doubt that consumers have pulled back since last year after a pandemic-induced shopping spree saw people splurge on devices needed for telework and home study. However, the weakening demand’s end seems far from sight. More and more industry bellwethers are seeing faltering numbers, including Foxconn, the world’s largest contract electronics maker, actively planning a large-scale expansion in India amidst it all.

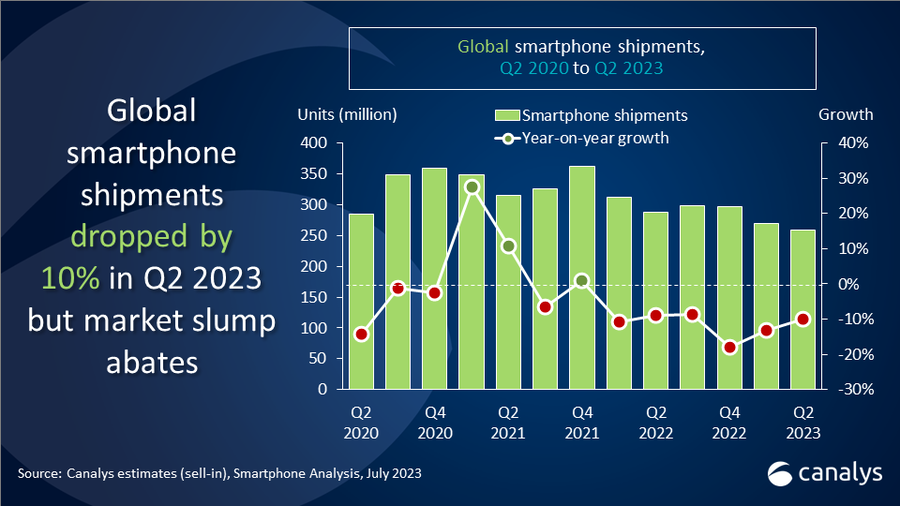

The Taiwan-based manufacturer, formerly Hon Hai Precision Industry, is best known for its relationship with Apple. Not too long after the Cupertino, California-based tech giant recorded its longest sales slump in decades, Foxconn also started seeing its sales dwindling. For context, according to Canalys’s latest research, the worldwide smartphone market fell by 10% to 258.2 million units in Q2 2023.

Global smartphone market decline softens as shipments drop 10% in Q2 2023. Source: Canalys

At this point, it is the eighth consecutive quarter of a year-on-year decline in overall smartphone shipments. For Foxconn, that’s significant because consumer electronics, including smartphones and wearable devices, are a major revenue contributor. After reporting a 1% drop in second-quarter net profit, Foxconn, the world’s largest contract electronics maker, said it anticipates that most of its main business segments will be in contraction for the year.

According to the company’s statement, in the second quarter of 2023, revenue totaled NT$1.3045 trillion, down 14% on the year. “Gross profit, at NT$83.6 billion, fell 14% at the same time; operating income was NT$30.9 billion, down 30%; while net profit fell 1% from a year ago to NT$33.0 billion,” Foxconn noted. The company reckons operating performance in the third quarter should warm up and show a trend of on-quarter growth.

“However, considering many external variables, in response to uncertainties such as global monetary tightening, geopolitical tensions, and inflation, the full-year outlook is now expected to decline from previous flattish expectations slightly,” Foxconn admitted.

As the South China Morning Post writer puts it, Foxconn’s results underscore expectations of a worsening market for global electronics as consumers and corporations hold off on spending during an economic downturn. To top it off, the company’s revenue could be affected by muted iPhone growth in 2023, according to Steven Tseng, analyst at Bloomberg Intelligence.

As it is, based on a report by Bloomberg, Apple is asking suppliers to produce about 85 million units of the iPhone 15 this year, roughly in line with the year before. The aim is to hold shipments steady despite tumult in the global economy and a projected decline in the overall smartphone market.

Foxconn in India

Over the last two years, Foxconn has had a renewed push into India, where it first invested 15 years ago. Today, India accounts for US$10 billion of Foxconn’s annual revenue, according to a presentation reviewed by the Financial Times. That makes up 4.6% of the company’s US$216 billion 2022 revenue, more than double the 2% registered in 2021.

YOU MIGHT LIKE

Exactly what’s going on with Foxconn in India?

So far, according to the internal presentation, Foxconn currently has nine campuses in India with 36 factories. Its operations are mainly concentrated in Tamil Nadu and Andhra Pradesh, producing smartphones, feature phones with fewer functions than smartphones, television sets, and set-top boxes for customers including Sony, Xiaomi, and Apple.

Foxconn Chairman and CEO Young Liu (L) greets Indian Prime Minister Narendra Modi, during SemiconIndia 2023, at Mahatma Mandir in Gandhinagar on July 28, 2023. (Photo by SAM PANTHAKY / AFP)

In recent months the group has broken ground for a factory near Hyderabad, the capital of Telangana state, that government officials said would make smart headphones. It has also acquired land near the airport in the Karnataka capital Bengaluru for an iPhone plant. According to the internal Foxconn presentation, another site near Hyderabad and two more in Karnataka are in the planning stage.

Liu also told investors in the recent earnings call that the company expected to invest “several billion dollars” in India and to start making critical components for consumer electronics and some electric vehicle components next year in Karnataka, Telangana, and Tamil Nadu, its largest existing iPhone assembly hub.

Liu also pointed out that since Foxconn entered India in 2005, its revenue, number of employees, and investment scale have grown exponentially. At present, it is mainly engaged in the ICT final assembly business. In the future, he said Foxconn would actively deploy work in key components to raise its competitiveness in India.

“In addition to existing operations in the Andhra Pradesh and Tamil Nadu states, Hon Hai will also deploy in Karnataka, Telangana, and other states. Hon Hai will plan to establish industrial parks and optimize the business environment regarding infrastructure, policies, and laws through close cooperation with central and local governments,” Foxconn said in the earnings statement.

Outside of India, Liu said Foxconn will continue to implement the build-operate-localize (BOL) strategy in Southeast Asia, including Vietnam, Thailand, and Indonesia, to assist local partners in improving the supply chain and enhancing indigenous competitiveness. In terms of China, he said the country accounts for 75% of Foxconn’s global operations, up from 70% before the pandemic.

However, experts believe that Foxconn will never return to the days when it manufactured almost the entire supply of a hit product in one location.