Apple strives in China and India amid a global smartphone slowdown

- Apple sales in China grew 8% from the year-earlier period to US$15.76 billion, after slipping last quarter.

- Apple Services segment saw revenue reaching an all-time high.

- Right before the iPhone 15 launch, Apple acknowledged the US smartphone market was in a slump.

The global smartphone industry has been on a downward spiral, with unit sales falling for two straight years. But customers were still buying pricey iPhones, especially in China and India, and Apple had managed to escape the worst of the downturn.

Now though, the world’s most valuable company is finally feeling the brunt, just weeks ahead of its iPhone 15 launch.

READ NEXT

Apple GPT: An AI work-in-progress?

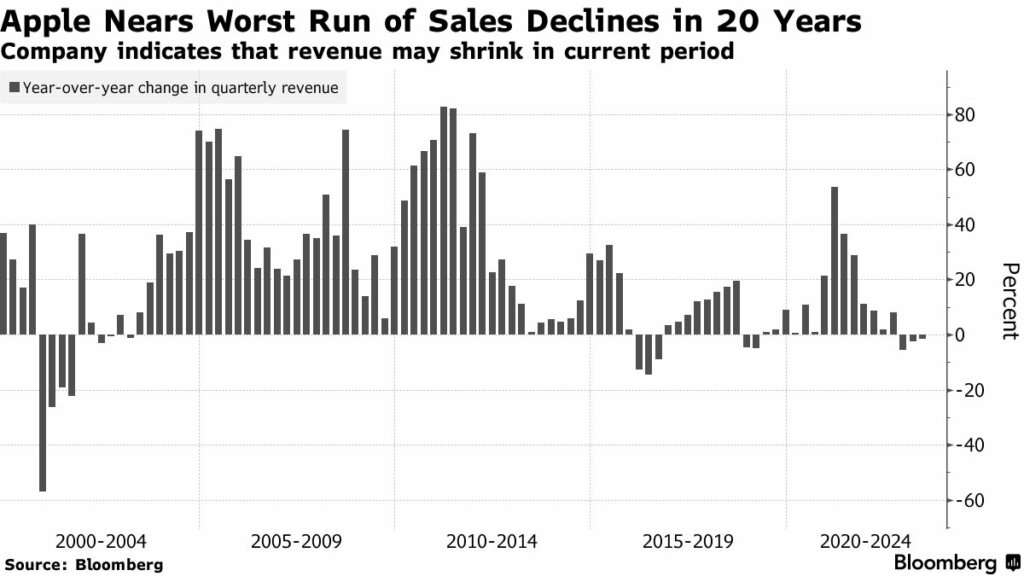

But to say the iPhone maker has been thriving is not entirely true. In fact, Apple has been facing its most prolonged sales slowdown in decades, even in China in some recent quarters. When Apple unveiled its fiscal 2023 third quarter, ending July 1, 2023, it was a third quarter of declining sales. Any additional drop for the current quarter would mark the longest streak of declines in two decades — a startling slowdown for the tech giant.

To make matters worse, the company doesn’t see an end to its decline, at least for the current quarterly period. After reporting on its sluggish iPhone sales on July 3, 2023, sending Apple stock sliding, the company disclosed that “the smartphone market has been in decline for the last couple of quarters in the US.”

But amid all the doom and gloom, there were some bright spots for the tech giant – its revenue growth in China and record iPhone sales in India. In China, where total smartphone industry sales fell 4% during the quarter to their lowest levels since 2014, iPhone sales increased 7%, according to Counterpoint Research. That helped Apple post 8% sales growth in China, bucking the broader trend of malaise buffeting the world’s second-largest economy.

In Apple’s defense, it has done “a really good job with affordability programs worldwide,” according to Luca Maestri, Apple’s chief financial officer, during a call with analysts last week. “The majority of iPhones are sold using some kind of a program, trade-ins, installments, some kind of financing.”

Disappointing demand drags down iPhone, iPad sales

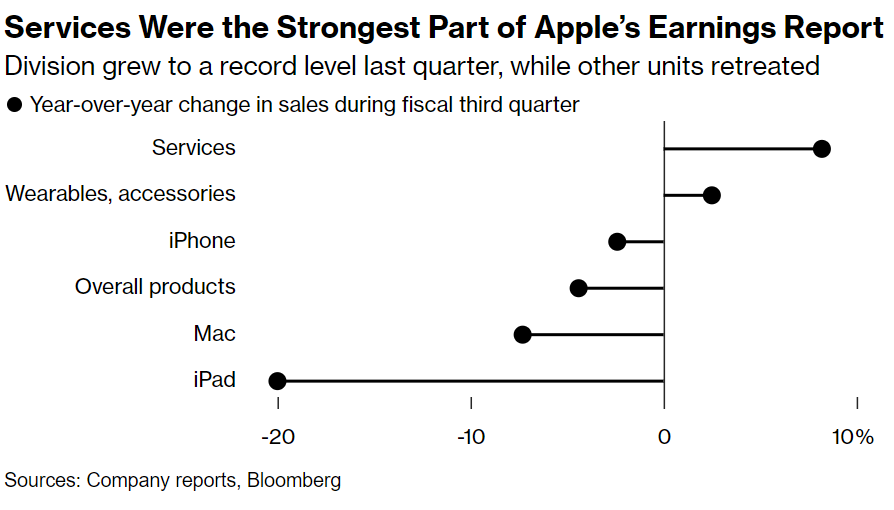

Overall, for the recently concluded fiscal third quarter, Apple reported a revenue decline of 1.4% to US$81.8 billion, and according to the tech giant, that includes record-setting service sales. Profit increased by 2% to US$19.88 billion.

Unfortunately, iPhone demand was weaker than predicted. “The environment is challenging,” Daniel Flax, a senior research analyst at Neuberger Berman, said in an interview with Scarlet Fu on Bloomberg Television.

“Consumers face pressure from general interest rates, higher inflation. There are a lot of cross-currents that Apple, like many other companies, cannot outrun,” Flax added. To put it into context, sales of the iPhone, Apple’s biggest moneymaker, slipped 2.4% to US$39.7 billion in the third quarter. The iPad also suffered a sales decline of 20% last quarter.

Bright spots in China, India, and Apple Services segment

In a statement, Apple CEO Tim Cook also shared that the company recorded an all-time revenue record in services during the June quarter, driven by over one billion paid subscriptions. Apple’s services revenue business — which includes Apple Music and Apple TV+ — has been an increasingly important revenue driver for Apple. It reached a new all-time high of US$21.2 billion last quarter.

Services revenue was a clear highlight, climbing 8.2% to $21.2 billion. That topped estimates of $20.8 billion. The growth was “driven by over 1 billion paid subscriptions,” Cook said.

Cook also highlighted that Apple saw continued strength in emerging markets “thanks to robust sales of the iPhone.” Apple’s performance in greater China, including Hong Kong, Taiwan, and the mainland, was another highlight. In a conference call, Maestri said wearables — including the Apple Watch and AirPods — did exceptionally well in the country, with sales rising 2% to $8.28 billion.

The iPhone also held up in China, serving as “the heart of our results there,” Cook added. Overall, sales in the region grew 8% from the year-earlier period to US$15.76 billion after slipping last quarter. It’s Apple’s third largest sales region, and Cook said he sees “definite acceleration.” iPhone sales in India also grew substantially – in double-digits – to a new high. Apple executives, however, didn’t disclose precise numbers on the Indian acceleration.

The Indian performance also vindicates the company’s renewed focus on a market where the iPhone has long been beyond the reach of many consumers. In recent years, Apple began viewing the fast-expanding country as a massive retail opportunity and a substantial production base for its gadgets in the longer term.

Reports indicated that Cook, who presided over the opening of Apple’s first two Indian retail outlets last month, joined his executives in mentioning India roughly 20 times during the conference call with analysts after unveiling earnings. Though the company did not mention Indian revenue in its earnings statements, reports earlier noted that the iPhone maker posted almost US$6 billion of sales in the country through March.

“It was quite a good quarter for us. India is a fascinating market. It’s a major focus for us. I was just there, and the dynamism in the market, the vibrancy is unbelievable,” Cook told analysts. “Over time, we’ve been expanding our operations there to serve more customers, and three years ago, we launched the Apple Store online, and then… we launched two stores just a few weeks ago, and they’re off to a great start, one in Mumbai and one in Delhi.”

Cook also said India is “at a tipping point.” Apple has recently made inroads into the Indian market through refurbished devices. Data from Counterpoint Research signposts an 11% share for refurbished iPhones in 2022, up from 3% the previous year.

How will the launch of the iPhone 15 play out?

What lies ahead in the holiday quarter for Apple?

The iPhone 15 launch date is less than six weeks away, and Apple has finally acknowledged a hard reality: the US smartphone market is mired in a slump. Experts also brlieve that the sales prospects of the new iPhone will hinge on its features.

“Apple will have to work harder to coax shoppers into opening their wallets,” a report by Bloomberg reads. While Apple mostly blamed currency headwinds for its recent painful results, the company also admitted that US shoppers aren’t spending on its products the way they used to.

So much so that sales in Apple’s home country paled compared to those in China, which Cook called out as a quarter highlight. The company also warned that overall revenue would probably stay in the same range as the past quarter when it fell. In fact, some expect Apple to suffer its fourth straight quarterly sales decrease, something that has not happened since 2001.

Company poised for fourth straight period of declining revenue.

Overall, it will be a challenging backdrop for the iPhone 15, slated to launch on September 22, 2023. The timeline suggests that Apple will get about a week of iPhone 15 sales in its fiscal fourth quarter, which runs through September. But the real test will be the holiday quarter, when its sales period extends from October through December, which is supposed to be the company’s busiest time of year.