Bitcoin mining costs to communities and the environment

The New York Times has revealed the real cost of the digital race for Bitcoin. The news outlet identified 34 large-scale Bitcoin mines in the United States that each put immense pressure on the power grid, and profit from doing so.

After Winter Storm Uri knocked out power plants across the state of Texas, tens of thousands of homes were left in darkness. By the end of February 14, 2021, nearly 40 people had died. At the same time, just outside Austin, computers were using enough electricity to power roughly 6,500 homes as they raced to earn Bitcoin.

Performing trillions of calculations a second, the computers kept running until just after midnight, when the state’s power grid operator ordered them to shut off. Over the next four days, Bitcoin company Bitdeer made more than $18 million for not operating. In return for keeping its computers offline, the state paid Bitdeer an average of $175,000 an hour.

For a business to profit from Bitcoin mining, it can require as much electricity as a small city. A computer guesses an elusive combination of numbers that Bitcoin’s algorithm will accept about every ten minutes, winning enough Bitcoin to be worth (at current prices) $170,000. The operations of these companies can create costs including higher electricity bills and carbon pollution, that impact everyone around them.

China, which was the site of most Bitcoin mining until June 2021, drove out Bitcoin operations citing their power use, among other reasons. The amount of electricity that Bitcoin mines are using in America, which soon became the industry’s global leader, and its effect on energy markets and the environment have been unclear.

Each of the 34 Bitcoin mining operations identified by the Times uses at least 30,000 times as much power as the average US home, consuming a collective total of 3,900 megawatts of electricity. According to the publication, it’s as though another New York City’s worth of homes were draining the nation’s power supply.

The Mawson Infrastructure Group mine in Midland, Penn., uses more than twice the power of the nearby Pittsburgh airport.

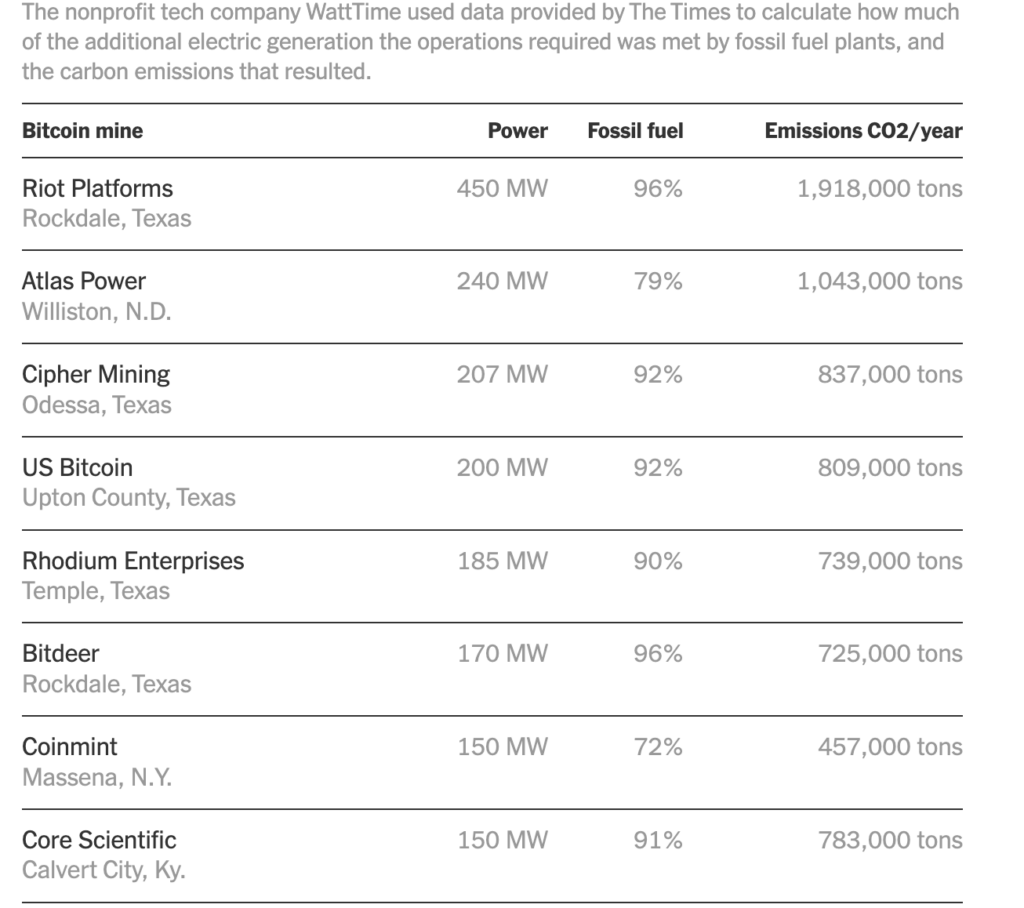

The additional power use in America causes as much carbon pollution as adding 3.5 million gas-powered cars to the country’s roads, according to WattTime. Bitcoin operations tend to market themselves as environmentally friendly, setting up in areas rich with renewable energy. Ultimately, their power needs are too great to be satisfied by these sources alone.

WattTime found that coal and natural gas plants meet 85% of the demand that Bitcoin operations add to their grids. In Texas, where 10 of the 34 mines are connected to the state’s grid, the increased demand has raised electricity bills for power customers by 5%.

Can Bitcoin operations’ power use be compared to hospitals?

In interviews and statements heard by the Times, many Bitcoin companies argue that they are no different from other large power users, like hospitals and factories, except for their willingness to shut off quickly to benefit the grid. Even though hospitals arguably have enough human benefit to warrant use of large amounts of power, there would be severe consequences if they reduced their power usage as routinely or dramatically as Bitcoin operators are able.

Bitcoin mining facilities’ ability to shut off almost instantly not only allows them to save money, but even to make money by manipulating the US power markets: they can avoid fees charged during peak demand, resell their energy at a premium when prices spike and even, as in Texas in 2021, be paid to turn off.

In practice, even though Bitcoin companies are paid by the grid to promise to power down if necessary to prevent blackouts, they are rarely asked to do so. As such, they earn extra money for operating as normal. In Texas, five operations have made a collective $60 million from the program since 2020. Bitdeer’s 2021 windfall came as a result of such an agreement.

Several companies are being paid through these agreements a majority of the time they operate. Most years, they are asked to turn off for only a few hours, at which point they are paid even more. “Ironically, when people are paying the most for their power, or losing it altogether, the miners are making money selling energy back to Texans at rates 100 times what they paid,” said Ed Hirs, who teaches energy economics at the University of Houston.

Alongside hospitals, industries including metals and plastics manufacturing also need a lot of electricity, causing pollution and raising power prices. Manufacturing might not save lives but it does at least bring jobs to an area. Bitcoin mines tend to employ only a few dozen people once constructed, spurring less local economic development.

Bitcoin operations’ financial benefit goes almost exclusively to their owners and operators. In 2021, the year Bitcoin’s price peaked, 20 executives at five publicly-traded Bitcoin companies together received nearly $16 million in salary and over $630 million in stock options.

Essentially, as well as the repercussions of such huge power usage, Bitcoin mining benefits only a very few, while the masses suffer the impact of carbon emissions and raised prices. Although Bitcoin’s value has dropped, seeing two of the largest United States-based companies file for bankruptcy, new mines continue opening across the country.

It’s not as though are aren’t options for operating cryptocurrency with less electricity: Ethereum, second-most popular cryptocurrency, switched its algorithm to cut the amount of electricity needed to power its network by 99%. Bitcoin advocates oppose changing its algorithm because proof-of-work has been resistant to attacks for longer and at a greater scale than any other approach to virtual currency stake creation.

Like centers for the development of Artificial Intelligence, cooling the masses of computers used in Bitcoin mining also drains power supplies.

Source: WattTime analysis, New York Times research Power levels are as of March 9 and based on information from each company or its most recent prior public statement. Fossil fuel percentages do not include energy imported from other states, the type of which is unknown; that results in low numbers for the Merkle Standard mine in Usk, Wash., and the Atlas Power mine in Butte, Mont.

Despite claims from the president of the Texas Blockchain Council, Lee Bratcher, that the industry incentivizes the development of renewable and natural gas plants, Dr. Jenkins at Princeton says that Bitcoin operations are more likely to keep fossil fuel plants in business than lead to more renewable energy. In New York, a gas-powered plant was able to reopen due to a sharp increase in power demand emanating from Bitcoin mining.

To round off: Bitcoin mining uses huge amounts of power, to the detriment of both the planet and communities near mining plants. It doesn’t just reduce job opportunities, but actively worsens local economies for the profit of a few individuals.

There’s a Bitdeer mine in an old aluminium smelter just outside Rockdale, where two of the largest mines (for fuel, not cryptocurrency) in the country operate. When the industrial plant where Bitdeer now operates shut down, “it just cut the legs out from under [the] community,” said city manager Barabara Holly.

At a time when everyone is making sacrifices for the good of the planet — or should be — it’s time that huge operations are held accountable. Without any widespread, material benefit Bitcoin mining is perhaps one of the first things that should go.

For the full report and data, read the New York Times article here.