Business tips: best ways to make an international payment

|

Getting your Trinity Audio player ready...

|

You’ve got customer orders agreed, product specifications have been signed off, and now it’s time to arrange for the various components and production materials to be delivered, which could mean dealing with suppliers overseas. Once you’ve settled on pricing and agreed on terms, you’ll want to transfer funds. But what are the best ways to make an international payment? There are a number of things to keep in mind when selecting overseas payment choices. And to highlight the different options and the fees incurred, we compare the costs of sending GBP 10,000 from the UK to a US bank account.

Anti money laundering supervision

Many articles examining the best ways to make an international payment will start by diving into the various money transfer methods. But it’s worth brushing up on anti money laundering (AML) regulations first, so that you can have the right information to hand. Also, if your payments provider isn’t asking for any AML details, then something could be amiss.

There may not be any legal limit on the amount of funds that can be transferred internationally, depending on the destination country. But banks and other payment providers will likely impose their own limits. And, as noted, financial institutions will have AML obligations to meet. Payment service providers must have ‘complete information’ about the payer and payee and send this along with the transfer of funds.

As a payer, you’ll be expected to provide your name, full postal address, including postcode, and an account number (or a unique identifier) that allows the transaction to be traced back to you. In place of the postal address, you could be asked for your date and place of birth, a customer identification number, or national identity number, such as a passport number. And you should expect to be asked for verification if the payment is equivalent to EURO 1000 or more, or if any part of the transfer is funded by cash or anonymous e-money, according to UK Government guidance.

FCA authorized?

Another useful business tip when it comes to determining the best ways to make an international payment is to check whether the money transfer companies that you are considering carry UK Financial Conduct Authority (FCA) authorization – or equivalent, if you are sending funds from another country. FinCEN (the US Treasury Financial Crimes Enforcement Network) has a Money Services Businesses registrant search page.

FCA authorization indicates that the payments provider adheres to certain financial standards and brings confidence that the transfer of funds will be safe and secure. And if something does go wrong, you’ll have channels for complaint handling.

Next, once you’re up to speed on the background research, it’s time to focus on the international payment options in detail. You might be tempted to pick the cheapest – all providers will include a fee somewhere, either as a fixed cost or percentage of the transfer amount, a platform subscription fee, or markup on the foreign exchange rate – but cost isn’t the only consideration. The time taken to complete the transfer of funds from payer to payee will likely be important too.

And those two factors combined, cost and the time taken for the funds to arrive in the recipient’s account, are likely to influence the choice of international payment method strongly. In the main, the selection will come down to a choice of sending funds from bank to bank, making a wire transfer, or using online payment services.

Money transfer comparison websites

Travel comparison websites such as Hotels.com, Booking.com, Skyscanner, TripAdvisor, and others, have changed the way that we shop for hotels and flights and make other travel plans. And digital start-ups such as Monito are applying those same smarts to customers looking to make international payments. Browsing money transfer comparison websites is a useful option for quickly identifying the best ways to make an international payment.

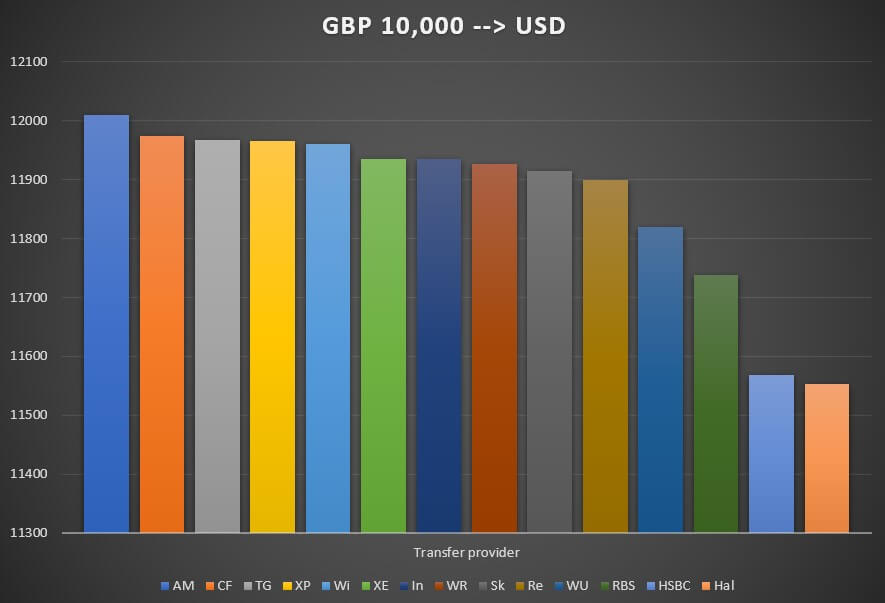

Putting our example request of transferring GBP 10,000 from the UK to a US bank account into Monito’s money transfer comparison website highlights the difference that fees and currency exchange markups can have on the final sum. And to visualize the range of offers we’ve plotted the data on a chart (shown below).

Chart comparing the costs of sending an international payment from the UK to the US. Data source: Monito. Chart compiled by TechHQ.

One of the most striking features is the difference that international payments provider selection can make to the cost. The difference between the amount received using the cheapest payment provider and the most expensive money transfer option amounts to USD 456 in our example. There’s also a big difference in the predicted transfer time, which customers should keep in mind. The quickest payments provider predicted a money transfer time of just a few minutes, while the longest advised that it could take up to four business days before the funds would arrive in the recipient’s account.

There are also cryptocurrencies to consider. And while some people may be hesitant, in certain situations, cryptocurrencies can be the most immediate way of making an international payment – for example, to help with disaster relief. Cryptocurrency exchanges are reportedly accepting donations in a number of coins, which can then be converted into Lira and sent to an NGO providing disaster relief to those affected by the recent earthquakes in Turkey.