South Korean Rebellions is eyeing the AI chips market

We have watched US chipmaking giant, Nvidia Corp, evolve from being a designer of graphical processing units (GPUs) used for video games to the artificial intelligence (AI) powerhouse it is today. In fact, in the booming AI chips market, Nvidia is estimated to hold a global share of 85%, powering data centers and AI applications, from autonomous cars to robots to cryptocurrency mining.

However, many observers believe the AI chip market is still in its infancy and expect it to explode in the next five years. Moreover, the emergence of quantum computing and the surge in the implementation of AI chips in robotics is expected to drive the growth of the global AI chip market considerably. For context, AI chips are specialized silicon chips, which incorporate AI technology and are used for machine learning.

AI helps in eliminating or minimizing the risk to human life in many industry verticals. Due to the huge increase in the volume of data, the need for more efficient systems for solving mathematical and computational problems has become crucial. Thus, more players in the technology industry are focusing on developing AI chips and applications.

Up until now, there is data suggesting that Nvidia has had virtually no competition to its dominant chips. MLCommons, the industry consortium overseeing a popular machine learning performance test, MLPerf, said that the number of competitors Nvidia has had in three years is just one: CPU giant Intel. Should that remain unchanged, rapid growth from ChatGPT usage, according to Citigroup Inc, could result in a spike of sales for Nvidia between US$3 billion and US$11 billion over the next 12 months.

In short, Nvidia will inevitably be one of the biggest beneficiaries of the “AI arms race” triggered by OpenAI’s ChatGPT. On top of that, the US chip designer has a commanding share of high-end AI chips, making up about 86% of the computing power of the world’s six biggest cloud services as of last December, according to Jefferies chip analyst Mark Lipacis. Reaching Nvidia’s level would take any competitor years, even at the rate of technological progress we are currently seeing.

But one company in South Korea intends to give Nvidia a run for its money, specifically in AI chips. The South Korean government aims to create a market that can be a test bed for AI chipmakers to foster global competitors. The local government intends to invest more than US$800 million over the next five years in research and development.

The aim is to lift the market share of Korean AI chips in domestic data centers from essentially zero to 80% by 2030. In 2020, the country’s information and communications technology regulator even announced plans to develop up to 50 types of AI-focused system semiconductors by 2030, Yonhap News Agency reported. The government will hunt for thousands of local experts to lead the new wave of innovation.

South Korean-made AI chips, starting with ATOM

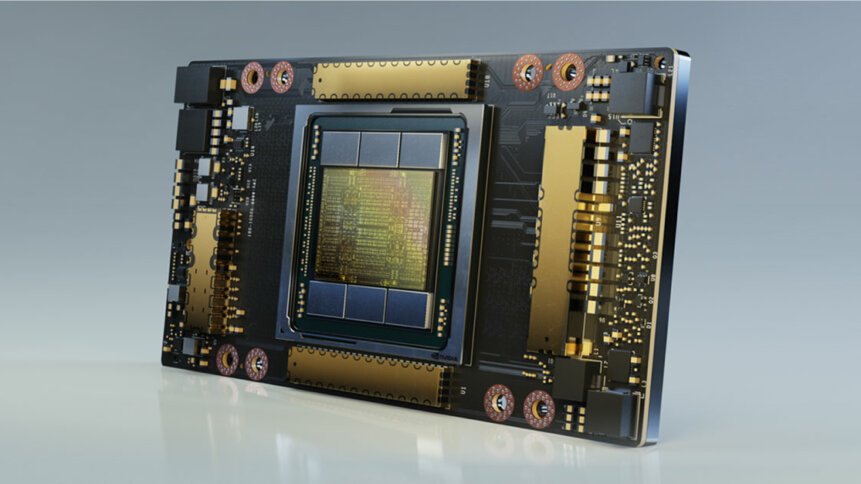

In line with the country’s goal, a Korean startup, Rebellions Inc, launched an AI chip this week, racing to win government contracts. Known as ATOM, the chip marks the latest Korean attempt to challenge global leader Nvidia Corp in the hardware that powers the potentially revolutionary AI technology.

In a report by Reuters, Rebellions’ ATOM is said to be designed to excel at running computer vision and chatbot AI applications. “As it targets specific tasks rather than doing a wide range, the chip consumes only about 20% of the power of an Nvidia A100 chip on those tasks,” the report stated, quoting Rebellions co-founder and chief executive, Park Sunghyun.

Nvidia’s A100 is the most popular chip for AI workloads, powerful enough to create and, in industry jargon, “train” the AI models. ATOM, on the other hand, designed by Rebellions and manufactured by the Korean giant, Samsung Electronics Co, does not do training. “The government is twisting the arm of the data centers and telling them, ‘Hey, use these chips,'” Park added.

Without such support, he said, data centers and their customers would likely stick with Nvidia chips. Gartner analyst Alan Priestley also explained that there has been a lot of momentum behind Nvidia’s developments, so startups in South Korea have got to build momentum, “so that will take time.”

According to an official at the Ministry of Science and ICT of South Korea, Seoul will be putting up a notice this month for two data centers, called neural processing unit farms, with only domestic chipmakers allowed to bid.

Sapeon Korea Inc, the first Korean company to deliver an AI chip, also plans to participate in the project, the SK Telecom Co subsidiary said. Even FuriosaAI, a South Korean AI-powered chip design house, will be a part of the bid. Meanwhile, Rebellions will seek to participate in the government project in a consortium with KT Corp, a big Korean telecom, cloud, and data center operator, to win Nvidia customers off the US supplier.

“Amid high dependence on foreign graphics processing units (GPUs) globally, the cooperation between KT and Rebellions will allow us to have an ‘AI full stack’ that encompasses software and hardware based on domestic technology,” KT vice president Bae Han-Chul said.