The race for satellite smartphones begins

|

Getting your Trinity Audio player ready...

|

With the news that Iridium and Qualcomm are joining forces to open up satellite connectivity for Android smartphones, alongside Apple’s iPhone 14 which already offers the service in an incredibly limited, barely headline-worthy way, it seems undeniable that the “race” to add satellite connectivity to your smartphone is likely to dominate handset news for at least the next two years.

That being the case, we sat down with Richard Wharton and Jonathan Nattrass, co-founder and Chief Product Officer respectively at Bullitt Group, a UK maker of rugged technology which was actually first to the satellite connectivity punch – and which seems not the least intimidated by the big boys turning up to what was originally its party. We asked them how they saw the race unfolding.

The finish line.

THQ:

The race for satellite smartphones is deemed to have “begun” now some huge players have woken up to its potential, but it also feels like it’s going to be a long, long race from this point. What’s the ultimate endpoint as far as you’re concerned?

RW:

Well, it’s begun in a much wider sense, but we’ve been making rugged devices for 13-14 years, and people who need rugged devices are frequently on the fringes of signal availability, so we put a proof of concept together for a satellite smartphone back in 2016, and showed it to some people at Porton Down (Location of the UK’s Ministry of Defence Science and Technology Laboratory). They were very impressed by it, but it wasn’t commercially viable back then.

More recently though, we’ve taken a standards-based approach to the idea, and it’s become clear that there’s actually a huge need for this. The opportunity in the US is enormous, because no single carrier covers more than 70% of the landmass. In Canada, it’s even more acute – there’s 30% less coverage. In Australia, just 30% overall on any one carrier. Obviously, in the UK, we have better landmass coverage, but we still have topographical issues.

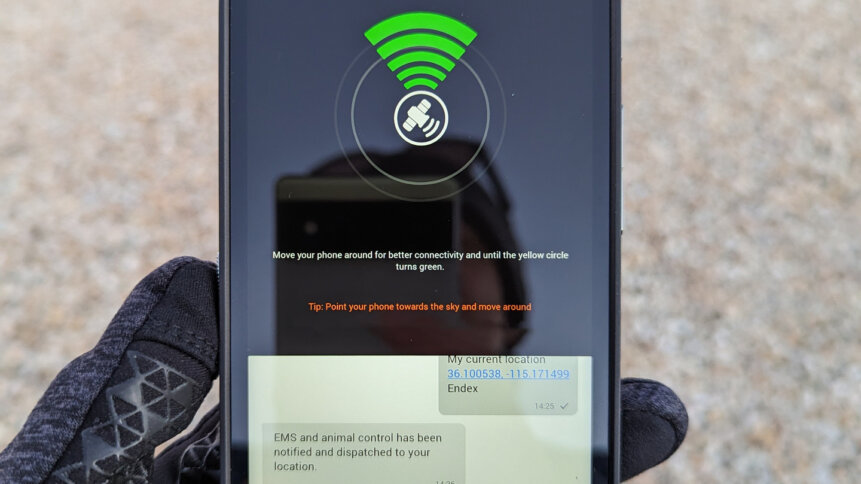

So there is absolutely a need for this technology, but it goes far beyond just the SOS service. I mean, the SOS service is a little bit of a red herring in a way. Sure, it obviously provides a key service when you need it. But not every time you want to message someone is a life-threatening emergency, Sometimes you’ve just broken down, not broken a limb. And sometimes you just want to let people know you’re going to be late, or you just want to find people in certain environments, you know? So there are a lot of reasons why you’d want to message someone when you don’t have a signal other than a real emergency.

Democratizing connectivity.

For us, it’s about democratizing that satellite connectivity, so we’re not just going to limit it to Bullitt phones. Our business model around this is that we will be licensing it to other handset manufacturers, enabling them to be able to offer NTN-connected devices (Non-Terrestrial Networks) and leverage the service that we’ve created.

And then beyond that, you know, NTN services are based on SMS now, but with release 18, under the 3GPP standards we get 5G new radio, so you’ll greater bandwidth, which will enable data and voice services – and that’s only a couple of years away.

So in the context of the environment, you’ve got these big infrastructure plays that have been talked about with Vodafone and ASD systems and, you know, AT&T with an ASD system, Amazon Telephonic, T-Mobile with Starlink on SpaceX? Well, those plays are in their infancy. They’ve got to build out new satellite constellations, they’ve got to get regulatory approval to utilize spectrum that is not meant to go up into space. That’s billions of dollars of infrastructure.

Beating big infrastructure to the punch.

The approach that we’ve taken, that Apple has taken, and that Qualcomm has taken, even though they’re a little bit behind, is that we’re going to leverage existing satellite constellations, existing spectrum, and so we will get to that 5G new radio capability ahead of those big infrastructure plays.

So that’s where it’s going. It’s the race for infill of not-spots, connecting the hundreds of millions of people in emerging markets that can’t access reliable communications, the race for competitive pricing rather than trickle-down technology, and then the race for 5G new radio.

Whether it’s emerging markets, whether it’s people with outdoor lifestyles, whether it’s military applications, it’s going to deliver a whole new chapter in mobile communications.

THQ:

An idea whose time has started to come.

RW:

And with big momentum behind it.

THQ:

So that’s the roadmap? Ubiquitous landmass coverage, potential military markets, ubiquity across handsets and price-points, and straight on till 5G new radio?

RW:

Yes, we think so. It’s like text messaging, which we can do now, is the gateway drug for 5G new radio, right?

THQ:

Satellite smartphones – the gateway drug of business tech. *Scribbles notes for a future article.*

The art of the now.

RW:

I mean, thankfully for us, we are in a leading position. Because we started early, because we had a target audience more likely to need emergency satellite connectivity in their rugged devices, we are many months ahead of the chasing pack. Qualcomm announced something for their Snapdragon integration, and what we saw at the recent CES show was that they’re at a stage that we were at some time ago. We’ve got the chip in consumer ready devices, these things are actually in production. Now.

We’ll be launching with the Motorola device at Mobile World Congress in Barcelona in February this year. That gives us a significant first mover advantage in the market, and our ambition is that other OEMs are enabled by us. And we’re seeing a great level of interest from the network operators, because in those markets where there are large land masses, or topographical challenges, we are offering that infill opportunity straight away. That level of resilience to service and that 100% reassurance that you can connect and you can get to get a message to somebody. And our chipset can be put in any range of devices in terms of pricing.

THQ:

Whereas the Iridium-Qualcomm offering is trickle-down technology, starting only in premium handsets and flagship devices, so you’re paying out of pocket at a significant rate to get their satellite option, as and when it becomes available.

RW:

Exactly. Our solution lets you have satellite connectivity, right now, using existing satellite networks, in any level of handset, not just the premium ones that will compete in the market with the iPhone 14.

THQ:

Which given the economy and the overall expected downturn in tech sales, could be important.

RW:

Right. And what we’re planning to do is also provide an SDK (software development kit) for the Android app ecosystem. So native messaging platforms could use a satellite link, so we’ll enable that level of integration. So there’s a well thought-through plan and an ecosystem that we’re going to be developing.

In Part 2 of this article, we’ll go deeper into the potential that satellite-connected smartphones could bring – and the pathway from the here and now to across-the-board, seamless ubiquity for this innovation.