Nvidia’s Q3 revenue soars thanks to Singapore

- Singapore contributed around 15%, or US$2.7 billion, to the quarterly revenue of Nvidia.

- Expenditure on Nvidia chips per capita in the quarter for Singapore was US$600, significantly higher than US$60 in the US and approximately US$3 in China.

- Analysts suggest this is because of the city-state’s significant density of data centers and cloud service providers.

In Singapore, the data center sector has served as a cornerstone of technological advancement, propelling the digital ambitions of businesses spanning diverse industries in the last two decades. Renowned for its strategic location, resilient infrastructure, government backing, and commitment to sustainability, Singapore has continued to assert its prominence in the global data center landscape. This significance recently came to the forefront as Nvidia Corp revealed that the city-state alone contributes a substantial 15% to the quarterly revenue of the US chip giant, underscoring Singapore’s pivotal role in the technology sector’s global narrative.

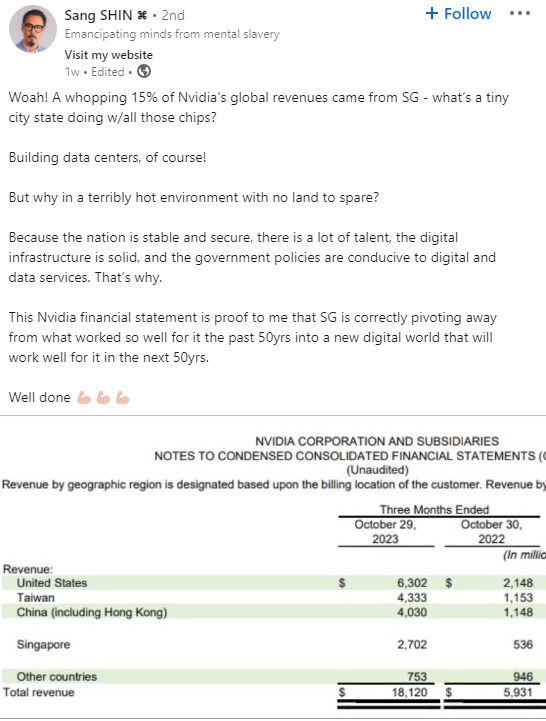

As per a filing with the US Securities and Exchange Commission, Singapore emerged as a pivotal contributor to the recent financial triumph of the US chip giant. For the quarter ending October, Singapore accounted for a notable US$2.7 billion out of the total US$18 billion revenue, reflecting an extraordinary surge of 404.1% compared to the US$562 million reported in the corresponding quarter of the previous year. This impressive performance outpaced Nvidia’s overall revenue growth, which stood at 205.5% from a year ago.

The growth puts Singapore ahead of every country except the US (35%), Taiwan (24%), and China, including Hong Kong (22%), based on CNBC’s observation. In the third quarter, 80% of Nvidia’s sales, as disclosed in the SEC filing, came from the data center segment. The remaining portion was attributed to gaming, professional visualization, automotive, and other sectors.

“Cloud service providers drove roughly half of data center revenue, while consumer internet companies and enterprises comprised approximately the other half,” said Nvidia in the filing. That said, Singapore had its advantagea, considering it is a global data center hub, hosting significant players such as Amazon Web Services, Microsoft Azure, IBM Softlayer, and Google Cloud.

What’s more, due to a robust network supported by 24 submarine cables, the country is also the landing site for a dense network of undersea cables, connecting it to other parts of Asia, Europe, Africa, Australia, and the US. A quick check on the Speedtest Global Index by Ookla shows Singapore has the world’s highest median fixed broadband speed.

Even Citi analysts acknowledged in a November 27 report that “Singapore is also a growing area of specialized CSPs standing up data centers in the region. The contrast becomes more pronounced when accounting for Singapore’s size. On a per capita basis, Singapore spent US$600 on Nvidia chips in the quarter, whereas the US spent only US$60 and China spent approximately US$3 per capita.

“That’s the billing location of the customer and not necessarily the point of consumption,” said Srikanth Chandrashekhar on LinkedIn, responding to a post by former Temasek director Sang Shin. Sang Shin had suggested the chips might be bound for data centers in Singapore, which seems reasonable since most Nvidia chips are headed for data centers, and Singapore has many such facilities.

Singing the praises of Singapore. Source: LinkedIn

What’s next for Singapore’s data center sector?

According to an article by ASEAN Briefing, 7% of total electricity consumption in Singapore goes to data centers, and it is projected to reach 12% by 2030. The city-state will likely attract more players in the market, especially after lifting a moratorium on data centers in January 2022. Initially enacted in 2019, this moratorium responded to the considerable energy consumption associated with data centers.

Singapore has rapidly emerged as a prime destination for this pivotal industry due to its technological prowess, regulatory strength, and enticing incentives. Firstly, the Pioneer Certificate Incentive (PC) program encourages companies, including those in the data center sector, to enhance their capabilities and undertake new or expanded activities in Singapore.

The incentive is aimed at companies involved in global or regional headquarters (HQ) activities, managing, coordinating, and controlling business operations for a group of companies. Designed to drive substantial investment contributions and foster advancements in leading industries, the PC aligns with the characteristics and potential of the data center sector.

The incentive is a win-win situation for both companies and the city-state as to qualify, businesses must introduce advanced technology, skillsets, or know-how, surpassing prevailing standards in Singapore. Additionally, they should engage in pioneering activities that substantially contribute to the economy.

Another allure of incentives includes GST waivers on importing data center equipment and covering servers, networking gear, and cooling systems. Then there’s Singapore’s dedication to sustainability that stands out through initiatives such as the SS 564 Green Data Centers Standard and the Data Center Carbon Footprint Assessment (DC-CFA) program.

The nation’s commitment to data security and privacy is also reflected in its regulatory framework, notably the Personal Data Protection Act (PDPA) and the Cybersecurity Act, fostering a trustworthy environment for data center operations.