Huawei and Xiaomi outshine Apple in China’s Singles’ Day sales

- Apple is facing stiff competition, particularly from Huawei in China, on top of lingering supply chain challenges affecting the availability of its latest iPhone 15 models.

- Huawei and Xiaomi witnessed impressive YoY growth of 66% and 28% during the Singles’ Day.

- Apple encountered a 4% decline in smartphone sales during the same two-week period.

The smartphone market in China is characterized by intense competition among key players such as Huawei, Xiaomi, and Apple. Traditionally, Apple enjoyed undisturbed success, particularly with the iPhone, which eventually became a status symbol within the country’s social circles. However, there have been notable shifts as domestic players like Huawei and Xiaomi returned to prominence in recent months.

Armed with innovative features, competitive pricing, and diverse product offerings, Huawei and Xiaomi have been reshaping the dynamics of the Chinese smartphone market in recent months, challenging Apple’s longstanding dominance. So much so that Huawei is now grappling with the challenge of meeting unexpectedly high demand.

Xiaomi’s 14 series, launched in late October, has received over one million orders, contributing to the company’s increased market value by around US$20 billion since a low in June. This success poses challenges for Apple, the world’s most valuable company, which has relied on nearly 20% of its revenue coming from greater China in recent quarters.

Smartphone sales in the world’s biggest mobile market surged by 11% compared to the previous year in the opening four weeks of October, marking a noteworthy indication of the market’s rebound from an eight-month decline. Before October, China’s mobile industry had been mired in a prolonged contraction, following an inventory glut built up a year ago amid Covid Zero lockdowns.

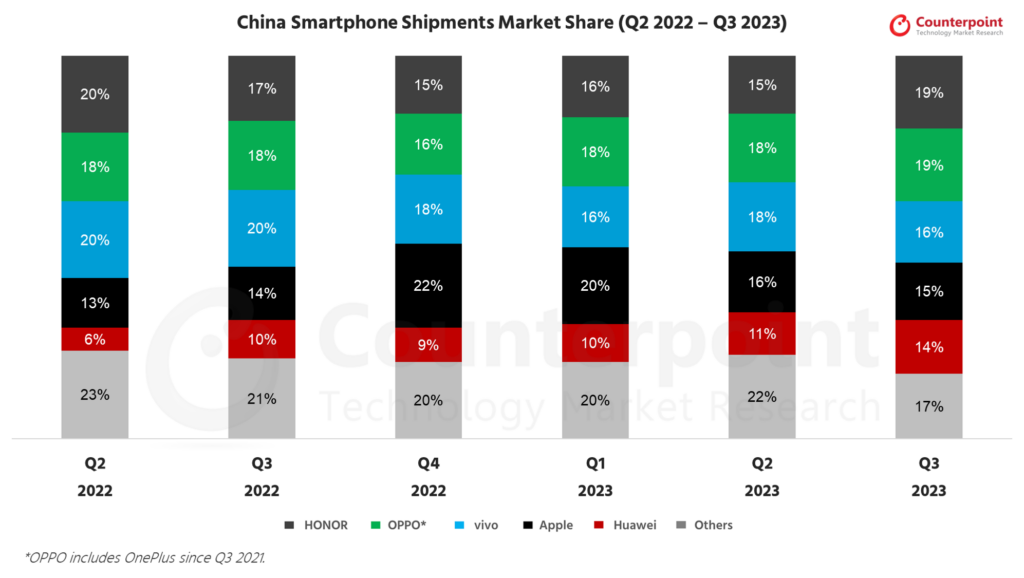

China smartphone shipments market data.

Now, domestic brands are coming out and outpacing Apple. According to a report published by Counterpoint Research, Xiaomi, Honor, and Huawei Technologies were the main forces behind the growth in the Chinese smartphone market. Huawei saw sales rise 90% year-on-year (YoY) during the period. The increase in overall demand indicated that China’s smartphone market is close to exiting an extended slum.

Apple has been under pressure to meet demand for its new devices, all while Huawei and Xiaomi released their latest flagship smartphones. “The clear stand-out in October has been Huawei with its turnaround on the back of its Mate 60 series devices,” Counterpoint China analyst Archie Zhang said in the report, referencing the Shenzhen-based company’s latest handsets launched in late August, including the Mate 60 Pro.

Despite US sanctions intended to stifle access to such technology, that device is equipped with an advanced made-in-China 5G chip. On the other hand, Xiaomi’s latest flagship, the Xiaomi 14, released on October 26, experienced a 33% sales surge in China within four weeks. The company achieved over one million unit sales in under two weeks, as Xiaomi founder and CEO Lei Jun reported on Weibo.

Despite receiving less media coverage than Huawei’s Mate 60 Pro, the Xiaomi 14 is notable for being the world’s first device powered by Qualcomm’s Snapdragon 8 Gen 3 chipset and running Xiaomi’s new Android-based operating system, HyperOS.

Apple vs. Huawei vs Xiaomi: who did it better for Singles’ Day?

Source: Counterpoint Research Smartphone 360 Weekly Tracker, China. (*2022 spans Oct 31 – Nov 13; 2023 spans Oct 30 – Nov 12.)

During this year’s two-week Singles’ Day sales event, smartphone unit sales in China grew by 5% YoY, indicating a positive fourth quarter, according to Counterpoint’s report. “This is a good start to the rest of the quarter,” says Mengmeng Zhang, senior analyst for China. “Huawei is continuing its strong run along with Xiaomi, which is enjoying a further spike in sales with the launch of its new 14 series devices.”

Apple appears to be struggling from hiccups regarding supply, Ivan Lam, added senior analyst for manufacturing at Counterpoint, added. He added that Apple is improving compared to last month. “Considering last November’s supply snafu was an anomaly, the YoY numbers could move into positive territory as current supply tightness normalizes,” he concluded.

In total, the number of Apple smartphones sold declined 4% YoY during the two-week sales from October 30 to November 12, the research consultancy said last Thursday. In comparison, the number of units sold by Huawei and Xiaomi grew 66% and 28% YoY, respectively over the same period.

Huawei up, Apple down. Is this the new normal for the CHinese smartphone market?

A Reuters report indicated that the price for Apple’s latest iPhone 15 model starts at 5,999 yuan (US$832), while Huawei’s Mate 60 smartphones start from 5,499 yuan (US$763). Xiaomi’s latest Mi 14 smartphone is priced at 3,999 yuan (US$555). E-commerce giants like Alibaba and JD.com refrained from disclosing Singles’ Day sales figures this year, continuing a practice they adopted last year.

JD.com did share that the transaction volume for Apple products on its platform exceeded 10 billion yuan (US$1.39 billion). Meanwhile, Xiaomi reported a cumulative gross merchandise value of more than 22.4 billion yuan for the shopping event.

Apple is navigating a fiercely competitive landscape in China’s smartphone market, especially since the launch of the iPhone 15 collection.

Traditionally a dominant player, the tech giant is now contending with challenges posed by formidable domestic rivals, reshaping the dynamics of the world’s largest smartphone market.