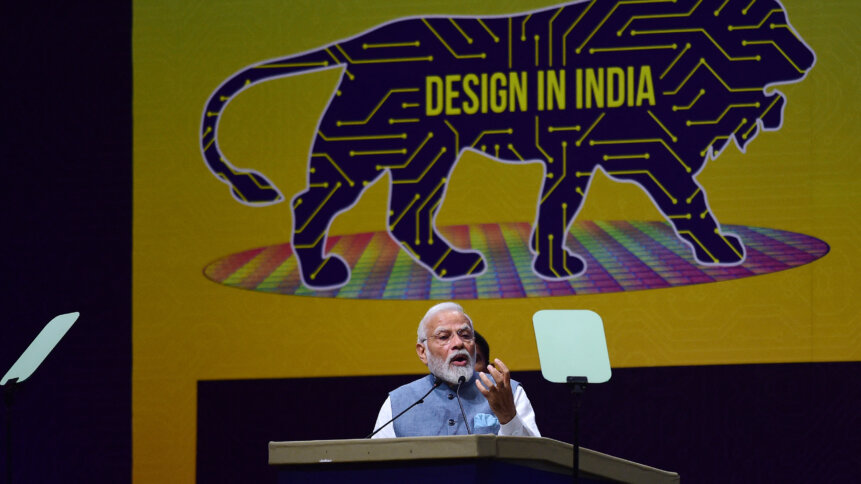

Does India have what it takes to be a semiconductor superpower?

• India semiconductor superpower plans struggling for realization.

• The country had a staggered start in the industry.

• Even new funding has struggled to strike the right deals.

India’s tryst with semiconductors began in the 1970s when the country first ventured into electronics manufacturing. However, at that time, India was primarily an importer of semiconductor chips, relying on other nations for its technology needs. By 1976, the need to develop indigenous semiconductor capabilities grew more prominent, leading the Cabinet of India to approve the formation of Semiconductor Complex Limited (SCL).

SCL was supposed to play a pivotal role in advancing India’s capabilities in semiconductor and electronics manufacturing. Its mission was to promote the indigenous manufacturing of semiconductor devices, integrated circuits, and other electronic components. However, SCL faced challenges and setbacks along the way, including a devastating fire in 1989, which affected its progress.

It took eight painstaking years for the facility to restart operations in 1997, continue producing DRAM chips, and eventually expand into manufacturing other semiconductors. Then, in 2006, the Indian government decided to restructure the company as a research & development center within the Department of Space, renaming it “Semiconductor Lab.”

India had a staggered start in semiconductors. Source: Forbes India.

Despite the restructuring, to date, SCL has stood as India’s sole semiconductor fab and is the only government-owned semiconductor fabrication unit that produces chips for strategic purposes.

Local reports claim that it can fabricate 200 millimeters (mm) of silicon wafers using the 180 nanometres (nm) process node, at a rate of several thousand units per month.

Those chips were also used to power the country’s recent Mars Mission, but are considered legacy chips.

Identifying the need to benefit from the already existing fab, in May 2023, the Union government announced a US$2 billion investment for the commercialization and modernization of SCL.

But for many, India had missed the semiconductor bus owing to poor policies of the government in the late 80s.

That’s why India remains generations behind in the global race, a setback Narendra Modi, the current premier, would like to change.

The pandemic provoked new ambitions in the current Indian government, and now Modi wants India to transform itself into a semiconductor superpower.

The road to chip supremacy is paved with good incentives

The Covid-19 pandemic changed the landscape of the semiconductor world. A shortage of chips emerged, and it became evident how reliant the world was on Taiwan for chip production. The worsening geopolitical situation between China and the US was only making a tense supply chain situation worse.

India saw an opportunity in this situation.

The country began aiming big–to bring semiconductor manufacturing within its borders, this time with a new approach. Its open economy and improved infrastructure, coupled with various foreign companies operating manufacturing facilities, created favorable conditions for the country to begin making genuine progress in semiconductors.

Then came December 2021, when India unveiled a substantial US$10 billion incentive plan for the semiconductor industry. Manufacturers were offered government money if they produced and exported a specific quantity of chips from India, with the government covering nearly 50% of the initial setup costs. But incentives were something familiar to India.

The country introduced semiconductor policies in 2007 and 2013, but those policies had only limited success. In 2007, the government introduced India’s initial Semiconductor Policy, intending to attract INR 24,000 crore investments over three years and establish three fabrication units. During this time, AMD and Intel contemplated establishing fabrication units in India.

Indian plans to become a semiconductor superpower have been slow to deliver.

SemIndia, a group of Indian technologists, entered into a licensing agreement with AMD to utilize the latter’s technology for creating a semiconductor fabrication facility. Intel, which had initiated its operations in India in 1988, announced plans to invest US$1 billion in India, including possibly constructing a fabrication facility.

However, these plans did not materialize, due to factors including delays in the passage of the Semiconductor Policy and the policy’s stringent minimum investment requirements. AMD’s decision to spin off its fabrication units into a separate company, GlobalFoundries, also played a role, as did fundraising challenges and production delays.

Then came India’s final failed semiconductor policy in 2013-14, when the government made an effort to rejuvenate its chip initiatives by granting Letters of Intent (LOIs) to two consortia: Hindustan Semiconductor Manufacturing Corporation (comprising ST Microelectronics and Silterra Malaysia Sdn. Bhd.) and Jaiprakash Associates Ltd. (in partnership with IBM and Tower Semiconductor Ltd).

The latter group withdrew its proposal in 2016, citing financial challenges. In 2019, the government revoked HSMC’s permit due to prolonged paperwork delays on the company’s part. Experts believe the failure of the 2007 and 2013 semiconductor policies was simply down to their not being lucrative enough. There were also delays in implementing the policies, which meant India missed the chance to attract semiconductor manufacturers.

Unfortunately, the US$10 billion incentive plan isn’t panning out as India expected. Although the government is doing all it can to bring India to the global semiconductor stage, the efforts have yet to yield significant results. So much so that Modi’s government even went as far as reopening bids for its US$10 billion subsidy program for chipmakers after five initial applications, including one from a consortium of industrial group Vedanta and Taiwanese Apple supplier Foxconn, failed to qualify for government support.

Other applicants running for the first round of the government incentives announced in December 2021 included the International Semiconductor Consortium (ISMC) consortium led by Abu-Dhabi-based Next Orbit Ventures and Singapore-based IGSS Ventures. ISMC is a joint venture between Next Orbit Ventures and Israel’s TowerSemiconductor. Intel acquired the Israeli company in February last year, and the acquisition is yet to be completed.

When the US$10 billion application process was relaunched in June, India tweaked the specifications, seeking proposals to produce “mature nodes” of 40 nanometres or above — larger than the more expensive 28nm chips it previously specified. But some critics claim India’s aspirations in the semiconductor manufacturing sector are overly ambitious, attempting to jump into an exceedingly competitive industry dominated by countries like Taiwan, Japan, and the US.

India semiconductor infrastructure ready and waiting?

But India’s Minister of Electronics and Information Technology, Ashwini Vaishnaw, in an interview with the Financial Times, said, “The ecosystem is already there. Getting the fab is the next step, which is what we are focused on.”

However, following the fallout of Foxconn-Vedanta’s consortium, the only other big semiconductor company that has announced interest in the government incentives has been US-based Micron Technology.

Indian Prime Minister Narendra Modi talks with Minister for Information Technology Ashwini Vaishnaw during SemiconIndia 2023, at Mahatma Mandir in Gandhinagar on July 28, 2023. (Photo by SAM PANTHAKY/AFP)

Micron, in June, confirmed a semiconductor assembly testing facility in Sanand, Gujarat, where it will invest US$825 million in two phases of the project, with a total investment of US$2.75 billion including government incentives under the PLI scheme. The facility will be used for the assembly and testing of DRAM and NAND flash modules, and the project will create 5,000 direct and 15,000 indirect community jobs.

According to Vaishnaw, after Micron, there was renewed interest and momentum among leading semiconductor players in India, and the government was receiving inquiries from multiple players and geographies. But while India’s incentive plan is noteworthy in the nation’s history, there is no denying that it is smaller than the US$52 billion CHIPS Act by the US and €43 billion by the EU.

Since India is starting its fab journey from scratch, complications will unfold. Certainly, conjuring a thoroughgoing, competitive chipmaking industry will be no mean feat, and the road to becoming a semiconductor superpower will be a long, arduous one.

But wooing semiconductor giants is proving to be the first stumbling block, and one that India has yet to overcome. Then, if tech giants like Micron are to weave their way into the country’s semiconductor fabric through recent significant investments, the government must improve the business environment, create employment opportunities, and strengthen the country’s internal infrastructure.