GlobalFoundries share price is overvalued

- Semiconductor manufacturer’s share price might indicate the state of the sector amid US/China chip row.

- Assuming forecast accuracy, GlobalFoundries could be 34% overvalued.

- The company has seen a 30% drop in its mainstay business.

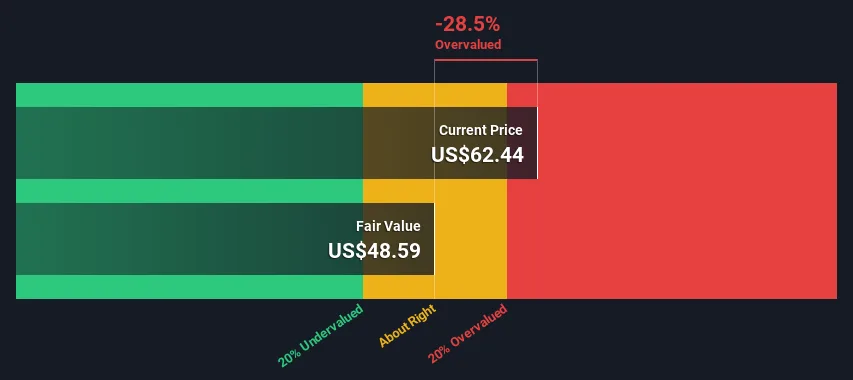

Shares for semiconductor manufacturing company GlobalFoundries inc. could be 28% above their intrinsic value estimate. Investing in a seemingly safe bet (because naturally, semiconductors are in demand) could actually cost more than it’s worth.

GlobalFoundries describes itself as one of the world’s leading semiconductor manufacturers and the only one with a truly global footprint. It has 14 locations spread across three continents, and it’s the fourth-largest manufacturer globally.

GlobalFoundries’ stock is currently overvalued, which means that a sudden drop could, and likely will, occur. So, how is intrinsic value calculated?

There are multiple ways to work out the value of a company’s shares, but to evaluate the fair value estimate of GlobalFoundries (NASDAQ:GFS) stock, we are using the workings of this article.

By projecting its future cash flow and then discounting that to today’s value using the Discounted Cash Flow (DCF) model, a more accurate analysis of its value can be achieved. A DCF is the idea that a dollar in the future is less valuable than a dollar today.

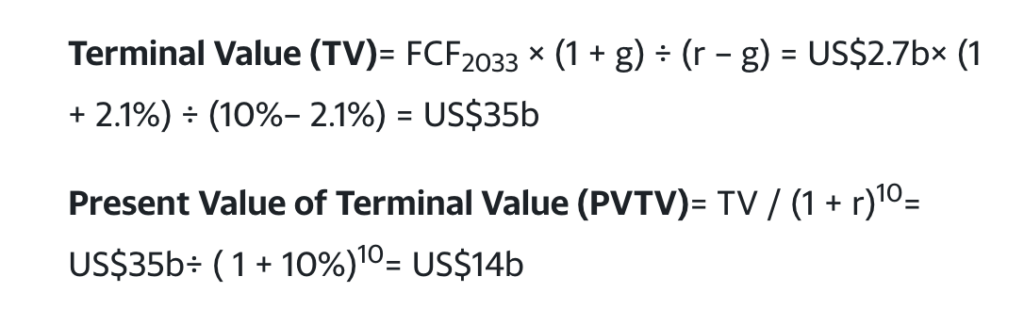

The calculations for GlobalFoundries share price.

The present value of future cash flows in the initial 10-year period is calculated, followed by the Terminal Value.

The total value is the sum of cash flows for the next ten years plus the discounted Terminal Value, which results in the Total Equity Value, which in this case is US$27b. Dividing this number by the total number of shares outstanding results in the Total Equity Value.

Source: Yahoo!News

It’s worth keeping in mind that valuations are imprecise instruments and, in this case, they are dependent on assumptions.

Assuming that the forecast is accurate and the fair value of GlobalFoundries share is 34% lower than the analyst price target of US$73.24, why is the company projected lower earnings?

Semiconductor supply chain issues

Arguably the lifeblood of the modern economy, crucial to every electronic device and system, it’s impossible to imagine semiconductor chip demand has dropped enough to impact chip manufacturing.

But of course, you can’t talk semiconductors without thinking chip war. The ongoing battle between the US and China that has raged since October 2022 has global implications – especially for manufacturers, whose trade in China is restricted.

“1, 2, 3, 4, I declare a chip war…”

Just this week, China retaliated. The country has hit the brakes on the export of two critical metals for making chips, gallium and germanium, amid concerns that the move is only the beginning of an escalation in the chip war, which will inevitably impact manufacturers.

ASML CEO Peter Wennink admitted during an earnings call that there’s “significant uncertainty” in the market, citing “the geopolitical environment, including export controls” as one of the reasons.

In May, GlobalFoundries projected quarterly revenue below estimates, having taken a hit from dropping smartphone sales. Alongside the geopolitical concerns, the slumping economy is impacting electronics sales, and thus, chip demand has dropped.

Slowed orders from data center operators and consumer electronics makers are expected to pick up later this year. GlobalFoundries forecast second-quarter revenue between $1.81 billion and $1.85 billion – with a profit outlook below expectations.

The company reported a nearly 30% drop in revenue at its mainstay business that caters to the smartphone market and accounts for more than a third of its total sales.

Keep an eye on analysis for GlobalFoundries here. Semiconductor share price seems set to fluctuate in coming months.