Apple to lead the AR/VR headset market into the mainstream

- Apple will likely drive substantive buzz around the AR/VR headset market, benefiting other entrenched vendors.

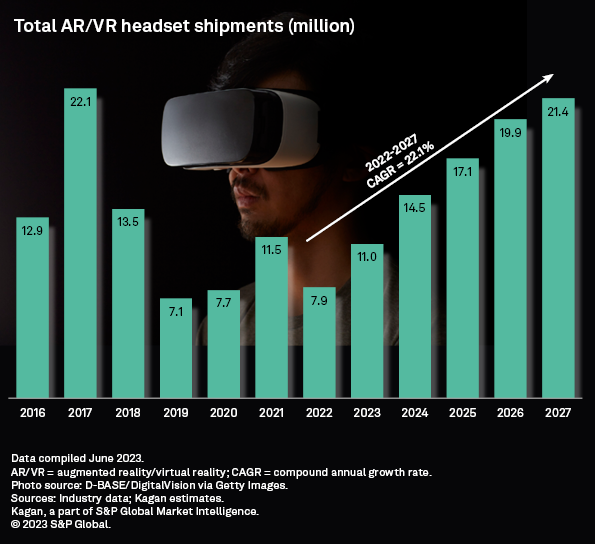

- AR/VR shipments are expected to increase from 7.9 million in 2022 to 21.4 million in 2027, a 22.1% compound annual growth rate.

When Apple officially revealed its first high-end AR/VR headset, the Apple Vision Pro, in June this year, experts began forecasting how the market, which has been slowly maturing for years, will soon find its mainstream appeal. Calling Vision Pro its “most ambitious product ever,” Apple understood that where it goes, mainstream culture usually follows.

Apple is certainly not alone in its optimism. In a recently published research report, S&P Global Market Intelligence shared its prediction that Apple to be at the forefront of the revitalization of the AR/VR headset market. Neil Barbour, associate research analyst at S&P Global Market Intelligence, noted that Apple has a solid track record in emerging hardware segments.

For a start, Barbour explained that the AR/VR hardware segment found a relatively low ceiling as an extension of the video game market after an initial surge in 2016 and 2017. “But a wave of new headsets hopes to find a broader market by emphasizing other popular computing tasks, such as video conferencing, web browsing, and media playback,” he added.

S&P analysis estimated that there were an estimated 39.7 million AR and VR headsets installed in consumer and commercial settings as of the end of 2022, down 1.2% from 34.2 million in 2021, as user churn outpaced slowing sales.

The research firm also predicted that AR/VR headset shipments will increase substantially, from 7.9 million in 2022 to 21.4 million in 2027, a 22.1% compound annual growth rate (CAGR).

There were an estimated 39.7 million AR and VR headsets installed in consumer and commercial settings as of the end of 2022, down 1.2% from 34.2 million in 2021 as user churn outpaced slowing sales. Source: S&P Global Market Intelligence

“Therefore, installed base growth base is expected to pick up in 2023, and over the forecast, the installed base is forecast to grow to 71.4 million,” Barbour said, adding that the core value proposition is that AR/VR headsets can merge the portability of a smartphone with the expansive workspace of a multi-monitor setup.

Why is Apple, not Meta, expected to champion the AR/VR market?

When Apple announced that it would throw its hat into the AR/VR hardware market with the Apple Vision Pro, it was the most precise articulation yet of the idea that AR and VR are not just for gaming or niche commercial settings, but can be used in daily life as one would use a laptop or a phone.

“While other VR headset vendors have incorporated or have said they were working on similar features to those announced for the Apple Vision Pro, Apple has a far stronger sales pitch because its hardware already commands a strong presence in users’ daily lives. Potential customers are far more likely to trust Apple in transitioning to a new computing platform, as many users have already done just that over the past two decades,” S&P said in its latest research report.

S&P indicates that with Apple’s Vision Pro, AR/VR headsets will develop into a relatively approachable computing platform over the next five years as advanced pass-through cameras and a focus on productivity and communication software make the technology available to a broader array of consumer personas.

You may need to be fitted for your headset.

“The AR/VR market’s next push into the mainstream will be spearheaded by Apple, which said it will start selling the Vision Pro in early 2024. However, Apple itself is not expected to drive substantial headset sales in 2024, as both demand and supply will be limited due to its high entry pricing of US$3,500 and high-end components, such as OLED screens,” S&P noted.

Instead, Apple will likely drive substantive buzz around the market that will benefit other entrenched vendors. That will help Meta Platforms build on its market-leading position with a new headset, Quest 3, later this year and a price reset on its existing hardware.

“The downside is that they will have to pay an Apple-size premium for the pleasure of being early adopters in that transition. Apple is bound to revitalize the AR/VR market, but it may take some time to find the right price-to-feature ratio to catalyze mass-market adoption,” S&P noted.

How Apple may or may not evolve in the AR/VR segment

Apple CEO Tim Cook described the headset as a way to “use your apps anywhere, any way you want,” accompanied by a video that showed the headset incorporating many of the apps with which Apple users are already familiar, such as photos, Facetime, Safari, notes, and messaging. The video also showed users in a virtual desktop setting, with access to a virtual keyboard and multiple app windows in the headset’s field of view.

“It’s probably best to think of this launch as a developer- and tech-enthusiast-focused pilot project. Apple will iterate and refine its approach to AR/VR slowly and methodically, as it does with most of its products. As key use cases become more defined, it can tweak the hardware to play to those strengths. Other features that early adopters ignore can be cut or minimized in future models to save on costs,” S&P predicted.

Overall, experts from S&P anticipate the steep price will limit sales to less than 500,000 units shipped in the first year of availability. “Apple will likely release more affordable models or, at the very least, it will continue to sharpen the value proposition to grow the installed base,” the report reads.