Making it count – the best expense tracker apps for business

- Effective financial management requires proper management of income and expenses

- In order to manage one’s expenses, it is best to track of all spending

- Keeping track of expenses will ensure an individual or a business can work within a budget

With hectic schedules and fast-paced lives, keeping track of personal finances can be easier said than done. Essentially, it is best to do it every day throughout the month and given the convenience in this day and age, thanks to an explosion of quality expense tracker applications, it’s now easier to track your expenses than ever before.

Be it individual or small businesses, expenses come in many forms such as rent utilities, equipment, furniture, inventory, or even licenses, insurance, and marketing, as well as staffing, it is nearly essential to keep careful track of them all to stay on budget. TechHQ researched dozens of popular money-tracking apps to narrow down the top picks for 2022.

Budget watch: Spendee

Spendee’s detailed graphs and insights will allow you to be able to get a clear picture of how you are spending your money. (Spendee official website pic)

A rather neat budgeting app, Spendee features an intuitive interface that is fully customizable. Users can set a budget as per needs and set the target to achieve at their own pace. Spendee analyzes your expenses and automatically organizes them so that it’s easier to track each spending type.

The infographics, detailed graphs, and insights will allow expense to be able to get a clear picture of how you are spending your money. It is available for free with premium features at both App Store and Google Play. All of the data can then be synced and backed up across devices for household-wide accountability and transparency. The apps come with paid plans that support multiple users. Users can also pick different currencies.

Granular expense tracker: Monefy

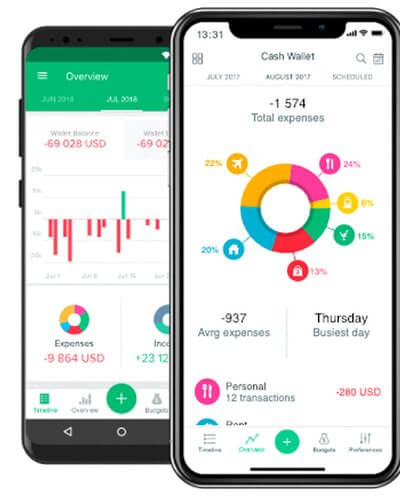

The app features tracking recurring records, multiple currency support, and the built-in calculator (Source: Monefy)

Moneyfy, for starters, is an app that provides one of the most detailed charts that are designed to offer thorough insight into spending. So, whether you are willing to bump up savings or get rid of all the overspending that has been hurting your bottomline, you can count on it to sort out your financial mess and put things back on track.

The app has also featured tracking recurring records, multiple currency support, and a built-in calculator. With the detailed reports, it keeps you in the know about your expenditure and it also offers pro tips to prevent overspending. Furthermore, the app supports both Google Drive and Dropbox to let you synchronize your data and make it accessible across devices. If you don’t want anyone to obtain access to the app without your permission, you can enable a strong passcode to ward off unauthorized access.

Personal expense tracker: Mint

Known to be one the best expense tracker apps known for personal finance tools. (Source: Mint)

Touted to be one the best expense tracker apps known for personal finance tools, Mint is free and supports a wide range of banks and lenders. It comes from one of the largest financial software services providers, Intuit. The app, available on iOS and Android, helps in expense tracking, bills, credit monitoring, and budgeting.

It is the budgeting feature where Mint shines the most especially for the fact that you have to link your bank, loan, and credit card accounts, and then make use of information from those accounts to suggest budgets for you based on your spending, classifying them into categories such as “Entertainment,” “Food & Dining” and “Shopping.” Users will be able to see how much they can save by cutting back their spending in any specific category.

Bookkeeper pro: Expensify

As an automated business app that aims to manage expenses in real-time, Expensify cuts out all the hassle in accounting and ensures bookkeeping is up-to-date. Through the app, users can track their business, personal expenses, scan receipts, book travel, even scan receipts and log outgoings. It’ll then generate reports and submit them to you for approval. Since Expensify analyses company policies too, it knows exactly what to send.

What’s also useful is that the software sports an automatic reimbursement system. The latter will rapidly deliver money to employee bank accounts based on past accounting reports. Given how the app is cloud-based, all changes are recorded in real-time. You needn’t worry about losing important financial data. Custom report exports, data-oriented tracking, and advanced tax reporting all play a vital role in keeping you aware of the things that must be done to boost your personal financial planning.