COVID-19, Lunar New Year to “further disrupt” shipping in China

- 60% of shipper and forwarder respondents to a global survey placed orders early this year ahead of the Lunar New Year holidays in early February

- Two-thirds of respondents expect Lunar New Year to “further disrupt” supply chains

- Almost half of the respondents expect Lunar New Year factory closures to result in higher container prices and freight rates

The shipping industry in China is one of the largest in the world. From electric vehicles to mobile phones to laptops, either the whole product or at least one piece of a component in them are from China. Even non-digital products are mostly made in China, due to their cheap labor and manufacturing costs.

However, things have been taking a turn in the shipping industry in China as the COVID-19 pandemic continues to cause problems in the global supply chain. China is already home to some of the largest shipping ports in the world and is now facing the challenge of keeping the ports in operation as the pandemic affects the operations.

Bloomberg reported that ships are now looking to avoid Covid-induced delays in China and are making a beeline for Shanghai, causing growing congestion at the world’s biggest container port. Part of this is to avoid delays at nearby Ningbo, China’s third-largest port, which suspended some trucking services near that port after an outbreak of Covid-19.

The New York Times reported China’s policy towards the pandemic has manufacturers on the edge as worries of another round of shutdowns at Chinese factories and ports. Many feel that another disruption to the global supply chain will only lead to rising prices for raw materials, extended delivery times, and worker shortages.

Container prices for shipping in China have also been reported to have increased in the last couple of weeks, causing more concern among manufacturers.

Shipping in China during the Lunar New Year

Now, the Lunar New Year is the biggest celebration period in China is bringing in more concerns of delays in the global supply chain. Despite concerns of the pandemic and lockdowns in some Chinese cities, more organizations and employees are taking long breaks during this festive period.

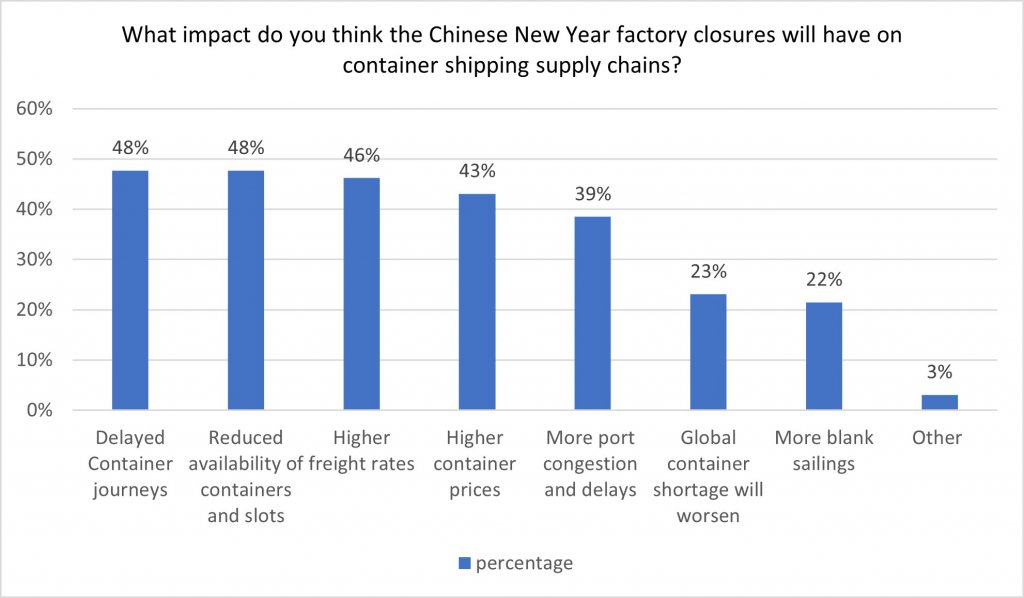

According to a global survey conducted by Container xChange, over two-thirds of the respondents expect the Lunar New Year factory closures to further disrupt container shipping supply chains. Most respondents also expect that the February Lunar New Year holidays in China will result in delayed transit times and reduced availability of containers.

For Dr. Johannes Schlingmeier, co-founder and CEO, Container xChange, a spike is always expected in container shipping demand ahead of the Lunar New Year holidays in China as shippers look to ship cargo ahead of factory closures as workers in coastal areas return to families inland, often for extended periods.

“Even though it is unclear if China will allow millions of workers to travel for holidays this year due to strict COVID lockdown policies, shippers and forwarders are still expecting output from OEMs to decline significantly next month and are planning accordingly by shipping early,” added Dr. Schlingmeier.

Key survey findings included the following:

- 66% of respondents said they expected Lunar New Year factory closures to further disrupt container shipping supply chains

- 53 % said Lunar New Year would make existing ocean supply chains “even worse”

- 60% said they had planned for Lunar New Year factory closures by ordering inventory earlier

Asked how they were planning for Chinese New Year factory closures by changing container sourcing strategies, 32% of respondents replied, “nothing specific” 25% said they would make use of shipper-owned containers and 24% said they would buy equipment.

With the start of the Beijing Winter Olympics in early February and the possibility of power cuts, there are increased concerns about the ability of manufacturers to predict output levels in February.

“There are a lot of uncertainties over the next few months. One potential upside is that if we do have reduced output from China in February, this could allow container lines to get vessel schedules in slightly better order which could improve the equipment availability situation globally and especially in China. The counterpoint to this is, of course, that we could see large backlogs of cargo building up in China which could be a factor at the end of the first quarter and into Q2,” explained Dr. Schlingmeier.

Technology and shipping

Emerging technologies might just be able to do deal with concerns about shipping in China disrupting the supply chain. Most shipping companies today are already relying on technologies like blockchain and AI to provide their customers with a more accurate situation of their shipments.

For example, blockchain in the supply chain enables businesses to have full visibility and traceability over their products in the entire supply chain from the factory to the port to the final destination. With blockchain, they will be able to detect weaknesses in their supply chain and find ways to deal with them.

As for AI and automation, modern ports around the world are already leveraging automated machinery in warehouses to help with the sorting of products and containers. The technology can be fully automated with minimal human intervention enabling workers to focus on more important logistic and shipping jobs.

Advancements in AI are also enabling container and cargo ships to be fully automated. Several years ago, Japanese shipping company Mitsui O.S.K. Lines claimed to have conducted the world’s first sea trial of an unmanned autonomous containership. More recently, the world’s first fully electric and self-steering container ship, owned by fertilizer maker Yara prepares to navigate Norway’s southern coast and play its part in the country’s plans to clean up its industry.

With such technologies being developed in the shipping industry, perhaps the shipping problem in China may eventually be a thing of the past. However, it may take some time before these ships are fully capable of solving the problem. Till then, businesses need to be resilient towards the supply chain and be prepared to deal with disruptions.