It has been a rollercoaster year for Chinese technology firms. Since the spectacular collapse of the Ant Financial IPO, touted as the world’s most valuable public listing at the time, the Chinese technology ecosystem has endured a slowly-tightening regulatory environment, renewed data privacy restrictions, a weakening local economy, and is once again at odds with its rival superpower, the US.

The latest salvo was fired by the US, when the Biden administration added yet another dozen Chinese technology companies to its restricted trade list, amid simmering tensions between the two superpowers over perennial talking point Taiwan, and other things.

Eight Chinese technology companies were added to the ‘Entity List’ for supposedly aiding the quantum computing program of the Chinese military, as well as being accused of sourcing for items that originate in the US, but have military applications for China. A total of 27 new entities were added to the list from China, Japan, Pakistan, and Singapore.

The new listings will help prevent American technology from supporting the development of Chinese and Russian “military advancement and activities of non-proliferation concern like Pakistan’s unsafeguarded nuclear activities or ballistic missile program,” Commerce Secretary Gina Raimondo said in a statement.

For its part, the Chinese government has contested all along that it coerces technology companies to engage in industrial espionage, and to share the collected data with Chinese authorities.

Nevertheless, allegations like the Trump administration’s accusations of corporate spying and the fallout from the global pandemic that originated from the Chinese mainland, have only served to cause the once-reclusive nation to once again close ranks, withdraw certain diplomatic ties, and retreat within itself.

And that, among other factors, are some of the draw-downs facing the Chinese tech ecosystem, that had been flourishing in various sectors prior to November 2020 and renewed sanctions from the US.

Here are some areas that the Chinese technology landscape will need to shore up, if it hopes to remain competitive on a global stage.

Chinese technology clampdown

The world’s most populous nation has been tightening corporate legislation ever since halting the blockbuster IPO of Alibaba’s Ant Financial — expected to become the biggest IPO valuation of all time.

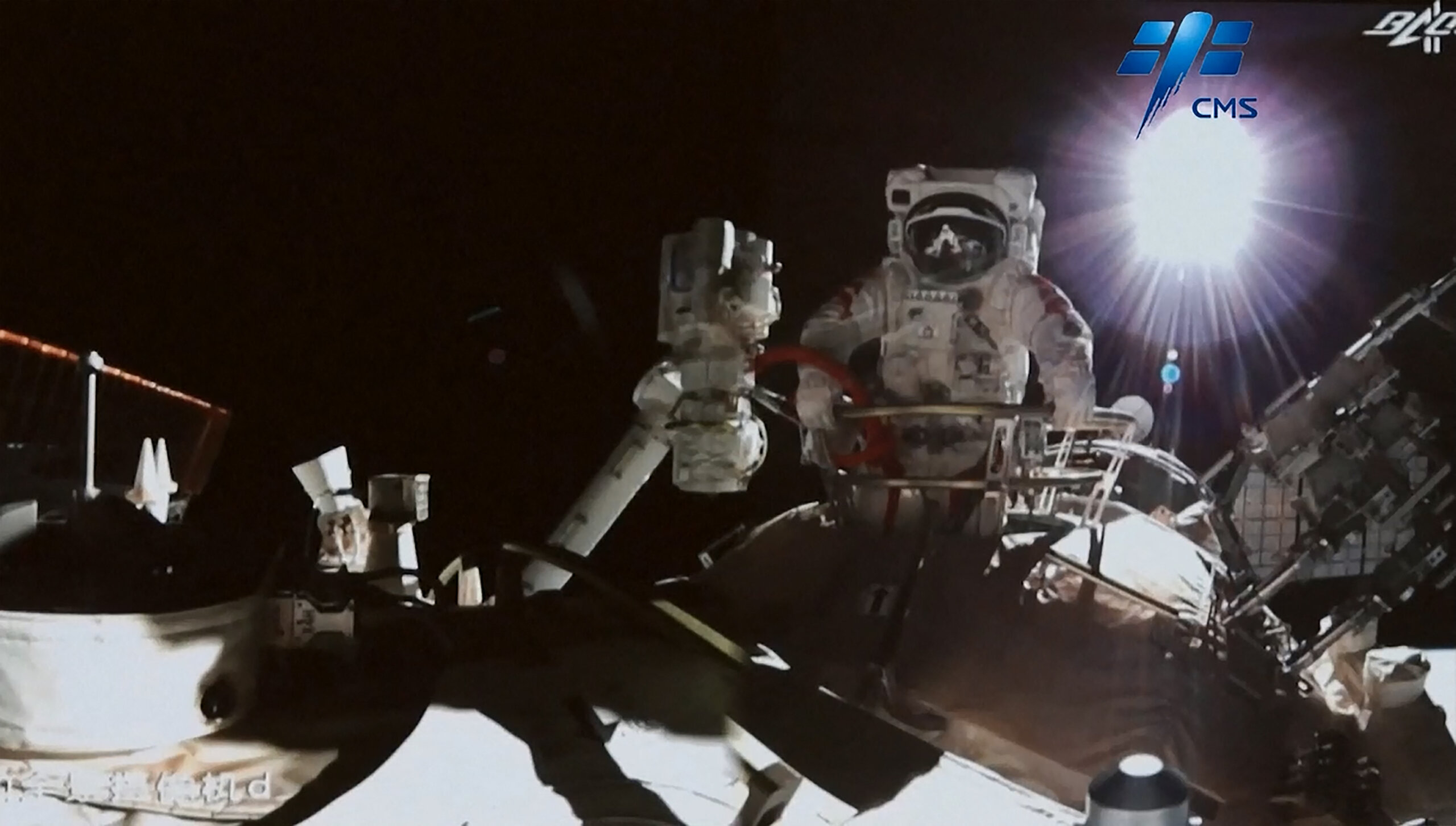

Chinese state broadcaster CCTV shows astronaut Zhai Zhigang stepping outside China’s Tiangong space station in orbit around Earth. (Photo by Handout / CCTV / AFP)

Authorities clapped back against statements made by Alibaba founder Jack Ma, censuring Ant and causing the effective collapse of the planned IPO. Other planned IPOs from the Chinese technology elite soon met similar fates, in stark contrast with previous years where more and more Chinese startups were getting listed overseas, from Hong Kong to the US.

Chinese tech conglomerates were soon facing restrictive legislative measures, and several were hauled up for antitrust proceedings where they were accused of monopolistic anti-competition sentiments, including the likes of Alibaba, Tencent, and JD.com.

China’s cyberspace watchdog is mulling further regulation of tech firms’ algorithms, not least after criticism of how food delivery apps like Meituan and Alibaba’s Ele.me treat financially vulnerable gig workers. Such apps have faced criticism for docking drivers’ pay if they don’t arrive fast enough, effectively encouraging reckless driving.

Chinese telecommunication heavyweights are not faring much better, as their former sterling international reputation has not recovered particularly in the US and with its allies. In fact, President Joe Biden recently signed the Secure Equipment Act of 2021, new legislation that will require the Federal Communications Commission (FCC) to adopt new rules that clarify it will no longer review or approve any applications for networking equipment that might pose national security threats.

To recap, the FCC categorized Huawei and ZTE as national security threats last year as the agency found that both companies had close ties to the Chinese Communist Party and China’s military apparatus. Besides Huawei and ZTE, the Secure Equipment Act of 2021 also flagged other Chinese companies as national security threats including Hytera Communications Corporation, Hangzhou Hikvision Digital Technology Company, and Dahua Technology Company

Chinese self-sufficiency supply woes

An aftereffect of the rivalry with the US is China pivoting with some urgency towards self-sufficiency in a number of technological sectors, including in so-called ‘frontier technology’ that it might have worked together with international collaborators.

Some of these innovative sectors include artificial intelligence (AI) and quantum computing, where China has been establishing some supremacy in academic areas. China has also made significant progress in its space travel ambitions, including the launch of its own space station Tiangong and ambitious plans to travel to Mars by 2033.

China also has the world’s biggest electronics market. Like a majority of technology these days, many consumer electronics rely on semiconductors to power them, from smartphones to cars. In this critical area, China lags in self-sufficiency, with its leading chip manufacturer, SMIC, trailing far behind market-leading Taiwanese firm TSMC and Korean consumer heavyweight Samsung.

One of the reasons SMIC is years behind its rivals is that some of the advanced equipment and tools required for the manufacture of high-end semiconductor chips are primarily found in its adversaries’ backyards — particularly the United States.

With sanctions and trade embargoes limiting Chinese reach to critical technology, some are wondering if China will be able to capitalize and regain some of its lost footing in electronics, especially as the global chip shortage rages on and permeates multiple industries. Some are infact wondering if the once-powerful Chinese technology sphere will be able to achieve its once-lofty international heights again, at all.