The business case for one-off expense payments done well

The shifts in the ways companies are beginning to work have affected everyone. At least for the discernible future, remote or hybrid working models are here, and most organizations have adapted pretty well: Collaboration and communication platforms are up to speed; cybersecurity concerns specific to remote working are being covered off; many companies can now concentrate on employee well-being, deeper operational matters, and getting the balance right between on-premise and at-home work.

Like all business areas, spend management is adapting, and it’s been interesting to note how some business processes, once thought to be “normal,” are being shown to be outdated and over-complex. Issues like spend requests, getting approval, providing justification and paperwork, receipts, cost-center allocation — all these manual processes now take up twice as much time as they once did, because many of the players are remote. But it’s now obvious that manual processes around spend management were a major time and resource drain even before the coronavirus pandemic.

A single, one-off purchase for PPE or a home worker’s office chair, for example, can highlight just how problematic spend management has become.

Many companies are looking beyond the “standard” offerings from big banks, frustrated by slow processes to change cardholders’ names, issue new cards, increase or decrease card limits — and all at a high cost. The specific problems around spend management for one-off or occasional purchases in the “new normal” are particularly problematic. Employees feel they must justify their purchase decisions via the medium of paperwork, and employers worry about the use of favored suppliers, cost center tracking, and a host of other back-office issues.

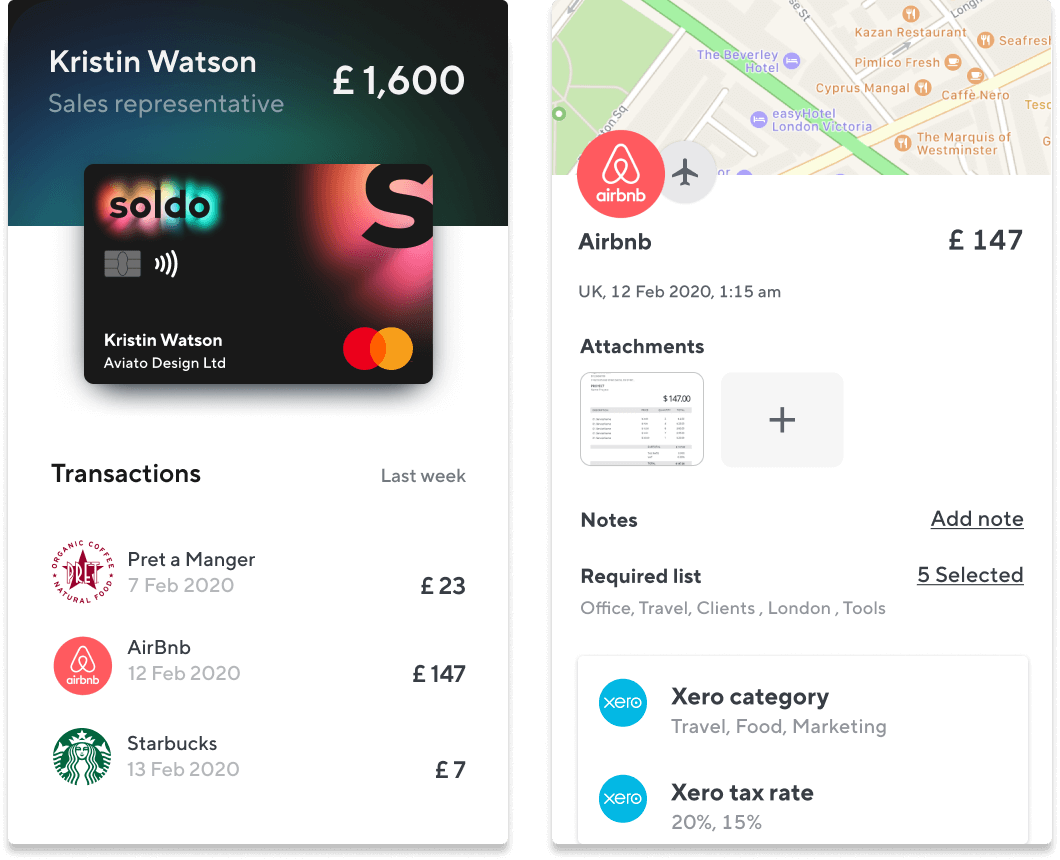

However, Soldo (a company whose products we have covered previously here on Tech HQ) now provides a new Single-Use Virtual Payment Card, which can be used with all the purchase and approval workflows the company’s spend management platform offers (see this article published a few weeks ago).

Source: Soldo

It’s a perfect solution for those times when and if employees need to purchase something — like work boots or a new monitor — up to a pre-approved budget. The monies are allocated (but not necessarily spent), so cash flow isn’t interrupted, and it provides the employee with the autonomy they need to make their own decisions.

When remote employees need extra training materials or to make essential work-related purchases (new computer hardware & peripherals, for example), making payments online with single-use virtual cards empowers the employee, allowing them to make the choices that are right for them and their specific situation — within a pre-set budget. Plus, there’s no need for a new piece of plastic from the bank to be approved, co-signed, issued, tracked, and paid for.

Virtual cards sit alongside the plastic cards option — which continue to have many uses — and both are overseen by the spend management processes that Soldo applies to all facilities. All payments are registered through the secure, encrypted digital platform and can be accompanied by scanned receipts, digital paperwork, fast approval turnaround, and fraud prevention: all the features modern spend management facilities offer to resource-conscious finance departments.

In the day-to-day work of the finance professional, some of the more manual and time-consuming processes can be avoided: setting up a new approved supplier for a one-off purchase, for example. Efficient payment requests and processing for one-time purchases save work hours alongside the existing resource savings created by the Soldo spend management platform’s capabilities.

It’s the perfect solution for companies in transition: in terms of overall growth, but also between remote and office work. As the demands on the finance function grow and evolve, the Soldo spend management platform solutions are there to take the strain.

To learn more about how payments and spend management solutions from Soldo can help your business’s finance processes adapt and improve, reach out to a Soldo representative today.