Can Intel take on TSMC to regain its chipmaking crown?

- Intel announced plans to make the world’s most advanced semiconductors by 2024, aiming to regain the global chipmaking crown the year after

- A day later, TSMC said it is building a 2-nm chip facility in Hsinchu, one of Taiwan’s most important chipmaking hubs

- Intel also reached an agreement to use new technology to make mobile chips for Qualcomm — a key customer of both Samsung and TSMC

When global manufacturing operations ground to a halt due to the pandemic, companies were left at the mercy of the Taiwan Semiconductor Manufacturing Co., better known as TSMC – the company that accounts for over half of the world’s semiconductor foundry market. The chip dependence has made TSMC the world’s biggest semiconductor company, passing the likes of Intel and Samsung when it comes to market capitalization.

American chip giant Intel has, over the past year-plus, been trying to stay on top of the game as TSMC climbed the apex of chip manufacturing, at a time when global chip demand is exploding. Intel committed itself to making chips for other companies in a bid to increase industry capacity back in March 2021, near the start of Pat Gelsinger’s tenure as CEO. As part of that ambition, Intel is investing US$20 billion to build new factories in Arizona.

More recently, it was reported that Intel was eyeing a purchase of chipmaker GlobalFoundries for US$30 billion. GlobalFoundries is among the biggest specialist players in the chip industry. The company was spun out of Advanced Micro Devices in 2008. It still counts AMD as a key customer, making any potential buyout by AMD rival Intel a tricky proposition.

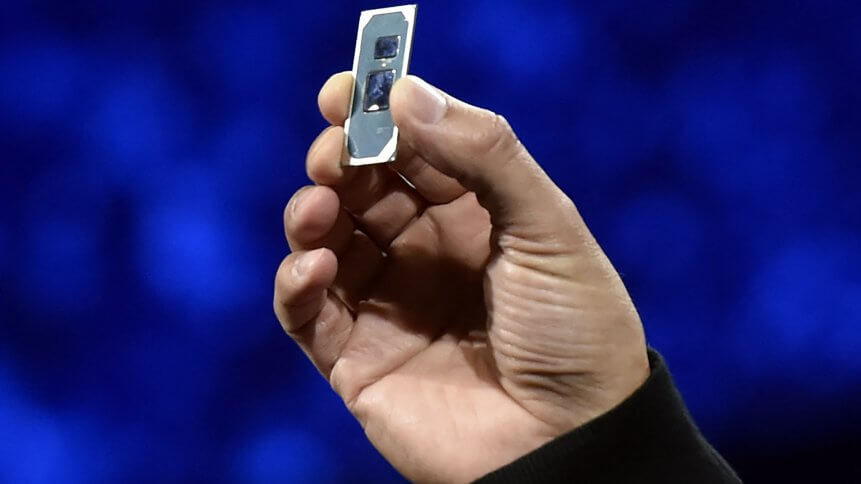

But earlier this week at Intel’s Accelerated event, Gelsinger and Ann Kelleher, Intel general manager of technology development, outlined a processing and packaging roadmap that they argue will bring Intel to process performance parity with other semiconductor leaders by 2024, before breaking out as a clear market leader the year after. The idea is to leverage technologies available now – such as the SuperFIN manufacturing process and Foveros 3D integrated circuit – and bring on newer innovations over the next three years, with the drive to remain competitive in the present while aiming for the leadership position down the road.

However, just one day after Intel’s announcement, TSMC announced that it has received final approval to build its most advanced chip plant yet. The plan is to build a 2-nanometer (nm) chip facility in Hsinchu, one of Taiwan’s most important chipmaking hubs. Sources familiar with the plan told Nikkei Asia that TSMC will start construction of the facility in early 2022, and begin installing production equipment by 2023. The Taiwanese company is currently constructing a 5-nm chip facility in Arizona while expanding its 28-nm capacity in Nanjing, China, and is further eyeing new facilities in Japan and Germany.

Taiwan’s importance as a source of advanced semiconductors was highlighted earlier this year when car-making economies like Germany, Japan, and the US all pressured Taiwan to increase production of automotive chips amid a global shortage. Intel, the biggest US microprocessor maker, has fallen behind its Asian rivals in recent years after a series of delays in bringing advanced production technologies to market.

Currently only Intel, TSMC, and Samsung are able to manufacture chips using sub-10-nm process technologies. TSMC for one is set to put its 3-nm tech into mass production in the second half of 2022. On the other end of the spectrum, Intel has struggled to roll out advanced process technologies. The company hit another delay in mass producing its next-generation Xeon processor for data servers, and will not begin mass production with its 7-nm tech until late 2022 or 2023 — trailing both TSMC and Samsung.

It is worth noting that Intel is both a rival and a client of TSMC, which controls 50% of the world’s chip foundry market. Nikkei Asia further reported that the American conglomerate is testing its chip designs with TSMC’s 3-nm technologies as a contingency plan, buying itself more time to overcome its delays.