What’s the downside of facial recognition payments?

- The use and acceptance of biometric technology especially facial recognition, varies widely, depending on which part of the world you’re in

- The obvious downside: A facial recognition database would leave a data trail

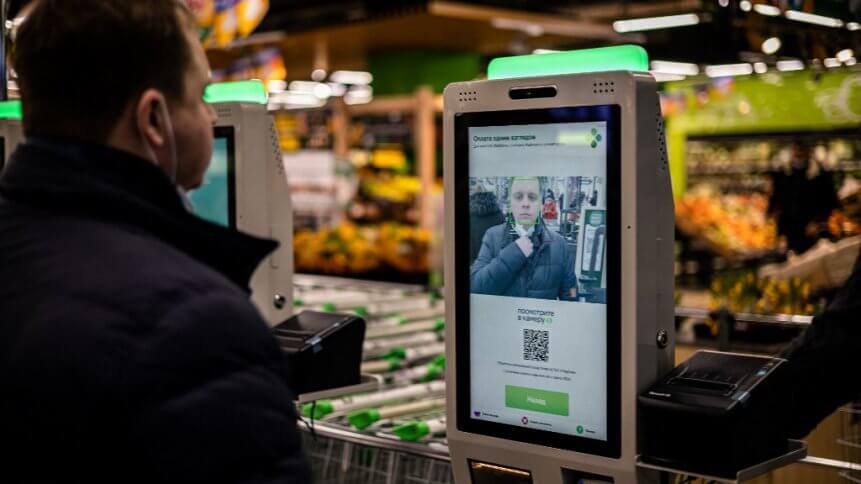

2020 was the year of everything contactless. It was also the year that countries, besides China, embraced the e-wallet technology by default. There are more cashless cities than ever and just when we thought we are caught with QR code as the latest contactless technology, facial recognition payment can come into play.

Thanks to the Covid-19 pandemic, the trend towards deploying facial biometrics has been accelerating. While the use of biometrics and other personal data has given rise to a host of new regulations in the West, the situation is not the same in the East.

In China, where mobile payment is already one of the most advanced in the world, customers can make a purchase simply by posing in front of point-of-sale (POS) machines equipped with cameras, after linking an image of their face to a digital payment system or bank account.

In 2019 alone, some 1,000 convenience stores in China have already installed a facial payment system, and more than 100 million Chinese have registered to use the technology. Alipay, the payment app operated by e-commerce giant Alibaba Group, and its main rival, WeChat Pay, offered by Tencent, have been powering the trend.

New facial payment systems are mostly linked to these apps. Alipay and WeChat Pay subscribers can use the systems by simply registering images of their faces. Indeed, Chinese technology giants have leapfrogged US companies in popularizing mobile payments.

In brief, In the US and many parts of the West, facial recognition systems—including those from Apple, Google, Amazon, Microsoft, and Facebook—have sparked intense consumer debate and are under heavy fire from privacy advocates for their ability to scan people’s faces and identify them without their consent.

But does it sell?

According to a report by Wall Street Journal, it was pointed out that “The payment technology has largely failed to gain popularity, analysts say, as some consumers have found the sign-up process cumbersome and had concerns about how their images and data would be used.”

It reflects that even a major fintech innovator with a large customer base can face privacy concerns and struggle to change user habits. That too in a country like China, where facial recognition is used widely.

Nearly 80% of Chinese people are concerned about possible breaches of facial biometric data, according to survey results announced last year. Another study suggested that first-time face biometric payment users did not understand the process and were concerned for their privacy.

Elsewhere, systems launched on three continents showing a few different ways the technology can be implemented. Spain is expected to soon have one of the largest networks of facial recognition-powered ATMs in the world.

Yet, there could be 2.5 million biometric payment cards issued in 2021, ABI Research forecasted, indicating that it could be “the de facto payment type of the future” in the longer run.

BI Research Digital Security Research Director Phil Sealy said, “These higher contactless transaction limits are here to stay and could be considered a significant signal of intent that contactless will ultimately become the de facto digital payment type of the future”.