How fintech Revolut grew in Asia during a financial crisis

While a global pandemic drastically altered most expectations in the financial services industry from still hesitating on contact-free payments to full-blown digital adoption, the timing couldn’t be worse for an established European financial technology (fintech) platform like Revolut to be expanding into a virgin market which has yet to be educated on its financing offerings. But the shift towards digital was underway in earnest in Singapore, and that included its fintech scene.

In Singapore, contactless or digital payments saw healthy adoption increases amongst both physical shoppers and online consumers, as users shied away from physical contact payment methods like cash. E-commerce platforms experienced strong online spending as well, and it looks like Singapore’s pandemic-delayed digital banking assessments are finally going through, with the Monetary Authority of Singapore announcing the first four successful digital bank applicants, in what will be another digital milestone for Singapore fintech.

Singapore also has a vibrant fintech startup culture, attracting investors, entrepreneurs, and foreign powerhouses with its mix of friendly regulatory environment, reputation as a financial hub of fast-growing Southeast Asia, and its central location amongst popular trade routes.

But even before the pandemic came and accelerated digitalization even further, popular financial services app Revolut had already opened its doors in Singapore following a beta test over the course of 2018-2019, with 30,000 customers already onboarded by mid last year.

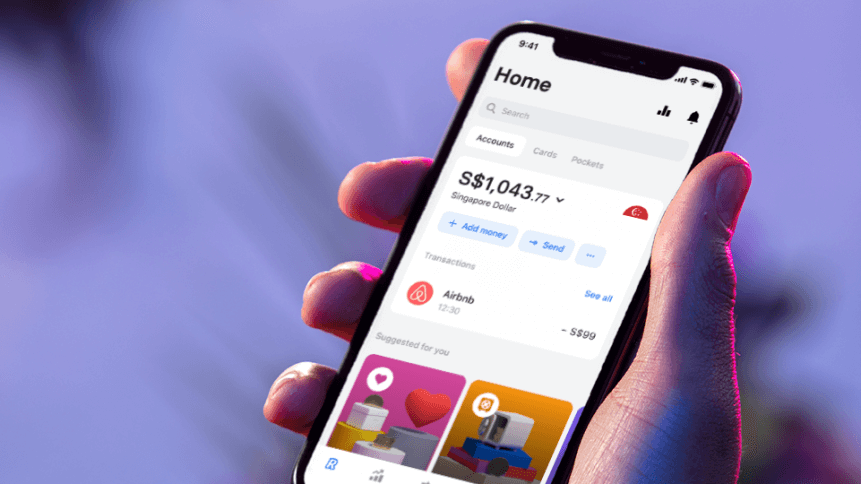

British-based Revolut has attracted more than 13 million retail customers since its launch in 2015 with a range of money management tools, including a debit card connected to an app that allows users to spend different currencies at the interbank exchange rate but with very low fees – its competitive fee structure is what sees Revolut accumulating a strong take-up when it enters a new territory.

“But we do see Singapore as a hub for the region. So surrounding Singapore, 6 million people, but of course surrounding us could be 600 million people [potential Revolut customers in Southeast Asia],” said James Shanahan, an experienced operator in the banking and wealth management space, who is also the CEO of Revolut Singapore.

Aside from Singapore, the firm is currently available in the United Kingdom and Europe where it has additional services such as online card payments. and in 2020 has expanded its range of money remit services to Australia, Japan, and the United States, with more territories planned.

“For me, the dynamics of Asia and then Southeast Asia in particular, are prominent in that it’s a very heterogeneous environment, where regulations and licenses in one country, don’t help you in the next country,” Shanahan explained the fragmented regulatory dynamics for fintechs in Southeast Asia to Tech Wire Asia.

Well-established in Europe, Revolut has designs to become a “global financial super app”. What that means for Revolut Singapore is to extend its services across Southeast Asia, eyeing Vietnam, Cambodia, Thailand, Indonesia, and the Philippines as they represent a “tremendous opportunity”, says CEO Shanahan.

“So when we talk about Revolut as a global financial super app, the problem underneath that is to enable the customer so they have a universally common experience. The problems we have to solve in Southeast Asia are different from the problems we have to solve in Europe, you know, you can pass all your licenses in Europe, there’s one separate payment system for mainland Europe.

“In Southeast Asia, we have to connect to everybody, we have to do a deal in every country, we have to get licenses in every country. And so the challenges underneath that are quite different,” continued Shanahan. “But the ambition is the same. The ambition is that everybody anywhere can enjoy the value of the Revolut fintech ‘super app’, regardless of where they are, regardless of who they are.”

The total number of e-commerce transactions among Revolut customers more than doubled during Singapore’s ‘circuit breaker’ period earlier this year. Contactless payments also grew by 30% during that time, and now comprises 90%of its Singapore transactions, as well as seeing a recovery in in-store spending, particularly restaurant dining, with close to 3x growth in total transactions.

This is very positive momentum for the fintech brand, which has grown a lot in the span of a year and amidst troubling financial times. “We’ve grown throughout COVID. Now, we’ve hit more than 70,000 signups here in Singapore. And we are in the midst of launching a whole range of additional services,” said Shanahan. “We would like in Singapore – subject to licensing, of course – to offer the full suite of Revolut products and services that we have in Europe and UK. So partway through next year, I believe we’ll have will have reached that mark.”

Revolut Singapore CEO, James Shanahan

Shanahan believes that introducing Revolut’s diverse range of financial products, including trading, commodities, cryptocurrencies, and business accounts, will increase the “stickiness” of the Revolut brand in Singapore.

“Can we find innovative products in this part of the world that could then be scaled through the Revolut network globally? We have 12, 13 million consumer customers around the world and 500,000 businesses. We’re in more than 35 countries. So we’re already becoming close to what you would call a global bank, or a global financial super app.

“That’s a tremendously powerful network when it comes to scaling innovative products, wherever we might find them.”