Telcos might miss a chunk of the trillion-dollar enterprise 5G market

- The enterprise 5G market promises to be vast, with huge applications in manufacturing, communications and retail

- Telcos provide the connectivity, but they could be sidelining themselves from a more valuable, hands-on role

Businesses are truly excited about the potential applications of 5G mobile technology. While this technology is at an embryonic stage, it promises gains in productivity, automation, customer experience and enables products to be enhanced and reimagined.

Ultimately, 5G could be a catalyst for the creation of new commercial and business models. It can be a milestone technology for industrial digitization – and ambitious businesses are ready to invest.

That confidence is evident in statistics; 71 percent of enterprises believe in the “big impact” 5G networks will have on their market, and more than a third (36 percent) believe the technology will actually be “transformational”. But so far the telcos – or communications service providers (CSPs) – developing and powering this game-changing tech seem to be overlooking the potential of the enterprise market.

That’s according to findings in the Omdia ICT Enterprise Insights 2019/20 survey. The resulting report commissioned by BearingPoint suggests that while CSPs have been predominantly tech-focused, and set on getting 5G consumer-ready first, they haven’t put themselves in prime position to capitalize on lucrative industrial interest.

5G in business is going big

5G will “go big across the globe” this year. But of the 40 CSPs offering 5G-eMBB and approximately 25 offering 5G-FWA, most propositions are aimed at consumers – albeit without translating to a large rise in revenue just yet.

Telcos know that the enterprise market is where the real money is. According to the study, 72.8 percent believe most 5G revenue lies in B2B, B2B2C, and from governments for things like smart city infrastructure. But the problem is that they have not positioned themselves to be strategic suppliers of 5G for businesses.

The report says mobile connectivity is “still perceived as a commodity” and CSPs are unable to offer tailor-made services quickly that are both cost-effective and ready for the business customer to scale down the line.

As a result, with 5G’s enterprise focus showing signs of being horizontal and industry-specific, telcos may well be bypassed by other IT supplier ‘brokers’ who can help businesses tap the potential more effectively – in this case, the CSP will be “relegated” to providing connectivity, while vendors get hands on with enterprise customers.

Of all deals currently captured to date, CSP-led deals – where telcos are working directly with business customers in both selling and managing 5G services – represent just a 21 percent minority. In the remaining cases, the carrier is left at a distance.

These are huge commercial opportunities at stake here, and a chance for telcos to become key, involved players in the future of 5G – globally, the economic value of the networking technology will account for US$13.2 trillion, or 5 percent of global output. The value of 5G in manufacturing alone is expected to constitute 5.4 percent of the industrial 5G market, worth more than US$4.6 trillion.

Missing opportunities?

Other lucrative sectors will include information & communications (US$1.5 trillion), wholesale & retail (US$1.1 trillion), public services (US$985 billion), and construction (US$731 billion).

Looking at the kind of opportunities CSPs could miss out on, the report highlights the example of German carmaker Volkswagen group which issued an RFP for 5G networks across its 122 factories. The request was part of its Digital Production Plan, intended to create a common architecture for IT and operational technology through the company and its supply chain.

The data analytics and applications in the project are being built as part of a contract with Amazon Web Services while the pilot deployment will use Ericsson equipment, but whether the networks will be managed by a CSP, by an alternative provider or internally remains open.

Just one example, the case demonstrates the scale and profile of 5G transformation in global industry, and raises a question as to the clarity or presence of the CSPs role.

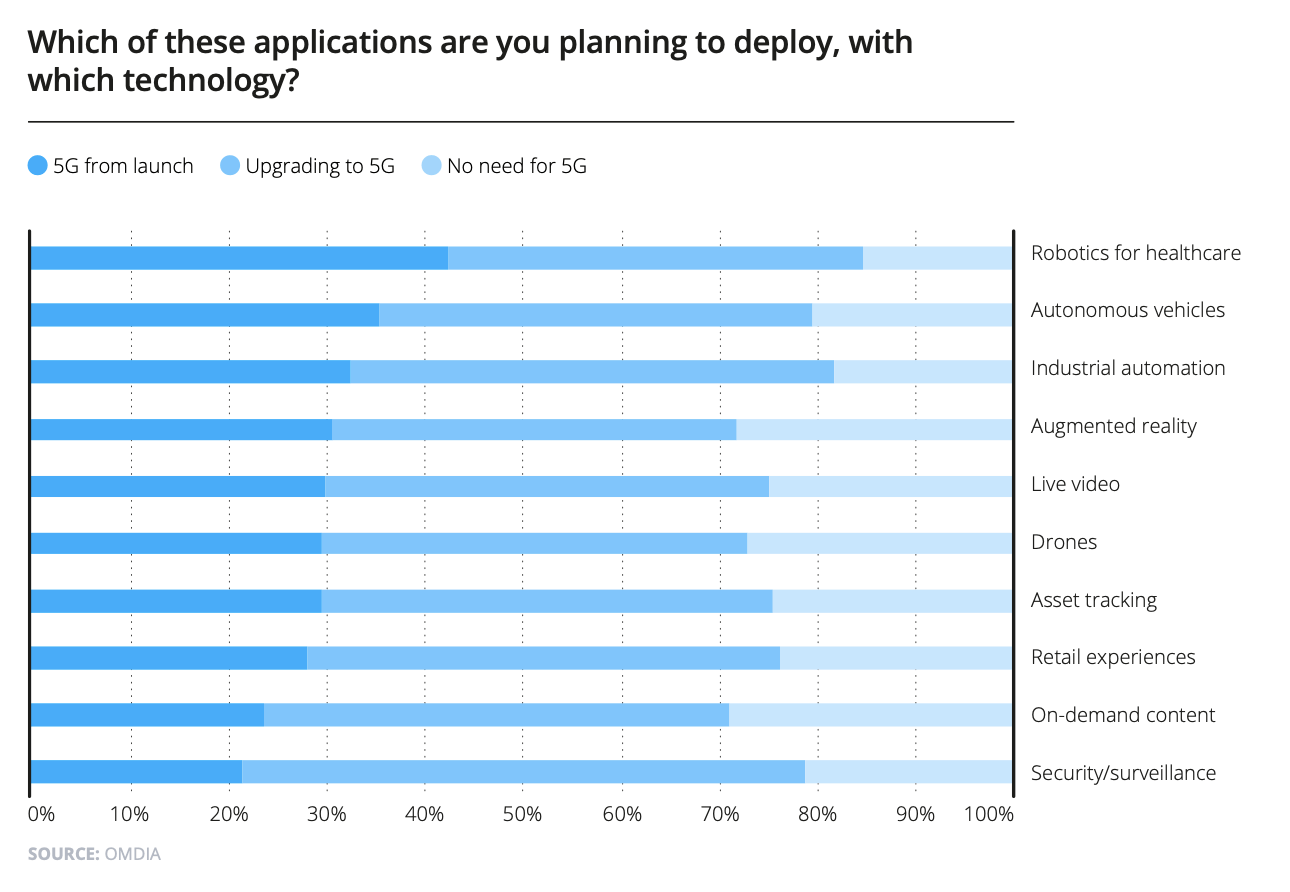

The report notes that CSPs themselves might lack traction with enterprise decision-makers. Applications such as physical security and monitoring, asset tracking, and industry-specific machinery, for instance, are areas in which CSPs will rarely lead the discussion with decision-makers.

But these are areas that will form part of transformational new solutions, and achieving them will take multiple technologies and providers, and a combined approach between technologists and industry specialists.

“The upshot is that CSPs will only realize value from 5G if they can identify, partner, codevelop, implement, and run a proposition with application-specific and industry- specific specialists,” reads the report. “CSPs that can orchestrate such a complex web of relationships will be capable of capturing a greater share of the market and will not be relegated to being one of many connectivity providers competing solely on price.”