Deal activity ‘strong’ in cybersecurity technology

“Hype” around the cybersecurity segment saw strong deal activity in cybersecurity technologies in 2018, despite a fluctuating trend in venture capital (VC) funding and mergers and acquisitions (M&A) in the years prior.

According to a report by data and analytics firm GlobalData, last year saw a break in what had been an inconsistent four years in sector investment. As major cybersecurity events caught our attention, the industry saw an uptick as companies made bids to strengthen their market position.

In 2017, high-profile attacks such as WannaCry and the data breach of Uber dominated headlines and did much to kick up interest in the cybersecurity market, explained GlobalData’s Financial Deals Analyst, Aurojyoti Bose.

“As a result, VC investors took it as an opportunity for investment, which also reflects in the growth in total funding value and volume in 2018,” he added.

That said, the cybersecurity technologies market has also become increasingly crowded. An increase in the number of startups offering very similar products in an already competitive marketplace raises concerns about whether the capital supposedly raised for innovation is used for the purpose or not.

“This may result in investor fatigue, and in the coming years we may see VC investors supporting companies focused on innovation and sound business models, ensuring good returns on investments,” explained Bose.

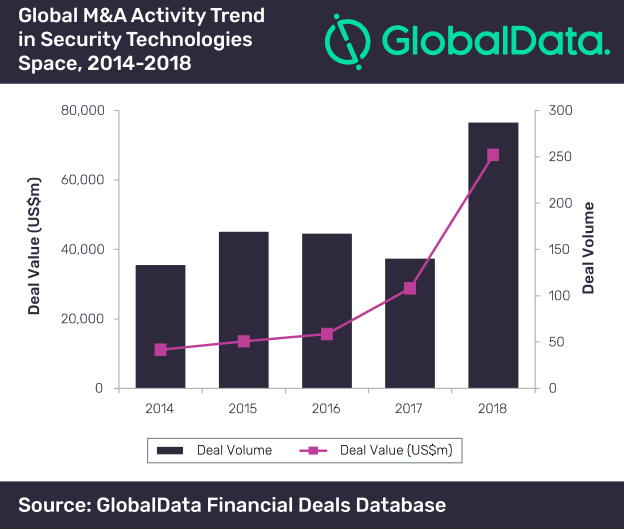

M&A deal volume increased at a CAGR (compound annual growth rate) of 21.2 percent during 2014 – 2018.

However, it declined in two consecutive years– 2016 and 2017– before registering a massive growth in 2018. M&A deal value also increased at a CAGR of 56.8 percent during 2014-2018.

In 2015, high VC funding value was mainly due to big-ticket deals such as the US$450 million raised by Palantir Technologies and US$300 million raised by DocuSign.

YOU MIGHT LIKE

Poppy Gustafsson: ‘The war on cybercrime needs AI’

M&A deal value was highest in 2018 on the back of some of the high-value deals announced during the year. Some of those more notable include Broadcom’s US$18.9 billion acquisition of CA Technologies, a provider of software solutions, including security; and the US$4.2 billion merger of Science Applications International with Engility Holdings.

Bose concludes: “While competing and standing out in a crowded market place remains a challenge for security tech firms, generating returns on investments will be a key area of concern for investors.

“However, this may emerge as a key driver for M&A with security tech firms undertaking M&A to avert competition and VC firms considering profitable exits for their investments through sale of their holdings.”