How is enterprise set to spend on quantum computing?

Spend on enterprise quantum computing is tipped to hit US$5.8 billion globally by 2025, according to a new report by Allied Market Research (AMR)— representing a compound annual growth rate (CAGR) of 31.7 percent.

In contrast, the market garnered US$650 million in 2017.

The Enterprise Quantum Computing Market report cites a “growing demand for high-performance computing” across various industries, including aerospace & defense, BFSI, healthcare & life sciences, energy & utilities.

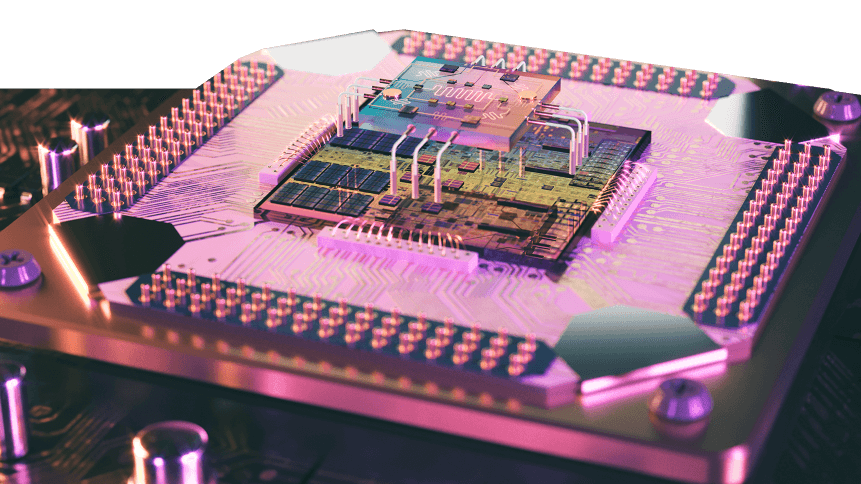

Unlike classical computers, which use a sequence of binary bits whereby each bit is always in one of two definitive states— 0 or 1— that act as an off or off switch for computer functions, a quantum computer uses quantum bits or qubits.

These can represent both a 0 and 1 simultaneously, and the result means that far more information can be stored than their binary counterparts, and massive amounts of calculations can be processed in parallel. Ultimately, quantum computers will be a million times, or more, faster than what we use today.

The majority of investment in quantum computing across industries— contributing about a third of market share— will be motivated by the need to optimize problems associated with financial analysis, traffic optimization, airline scheduling, reads the report, among other related sectors.

Meanwhile, cybersecurity needs could play an increasingly frontal role, set to grow at a CAGR of 36 percent, owed to the demand for the development of new technologies such as quantum-safe crypto solutions which can secure systems from hackers.

At present, quantum computing is still relatively nascent but, last month, IBM claimed to have created the first standalone quantum computer— standing at a meager 9ft tall— which the computing firm said would more likely be rented out for processing power than sold for businesses to use in-house.

The AMR report gives credit to that approach, predicting that while on-premise equipment could maintain the bulk of spend throughout the study period— led by several government entities and organizations— cloud deployment, such as the model IBM is considering, will grow the fastest.

That’s because cloud-based deployment does not involve capital cost and has low maintenance— users can develop, test, and run their programs on quantum devices without needing any physical quantum computer.

While, so far, operational challenges and stability & error correction issues have hampered the growth of the quantum computing market, AMR expects the market to gather speed rapidly in the new few years as enterprises demand more secure platforms and increased capabilities for simulation and modeling.

Drilling down into which areas of quantum computing will see that ramped up spend, the report says hardware will be a dominant focal point for investment within the timescale, having also made up more than half of market share in 2017.

This is due to the “increased need for creating the basic building blocks” of the machines says AMR.

Quantum computers are made up of a number of components, including reinforced chambers to hold the qubits which handle computation; tanks of liquid helium and other cryogenic equipment to keep the qubit temperate at zero; and racks of electronics to control their action and read their output.

Meanwhile, certain industries and use cases demand quantum computers to operate effectively in different conditions, driving demand for technology such as superconductors, which are capable of zero resistance under maintenance of certain temperature.

To manufacture all this requires a number of specialist companies, and predicted spend on hardware also accounts for the investment made into startups developing quantum computing components.

In terms of fastest growth, however, the services segment will lead between 2018 and 2025, with enterprises expected to budget increasing amounts for consulting, training, maintenance, and support services with quantum computers’ growing deployment.