The US$1 chip that triggered a crisis within the global semiconductor industry

- There’s a global shortage of a US$1 chip that is essential for every display panel that needs to be manufactured

- The tech industry now can’t keep up with the demand for screens

- Demand for everything with a screen has only increased over the last year, so electronics aren’t getting any cheaper that quickly

One dollar is the price of a display driver – the chip that has lurched the US$450 billion semiconductor industry into a crisis. Display driver chips, a tiny chip that sends instructions and signals to the display, are ubiquitous, and many devices can’t function without them.

Of course, there are hundreds of different kinds of chips that power the industry, with the flashiest ones from Qualcomm Inc. and Intel Corp. going from US$100 apiece to more than US$1,000. Those run powerful computers or expensive smartphones while a display driver chip is mundane by comparison, with the purpose of conveying basic instructions for illuminating the screen on phones, monitors or navigation systems.

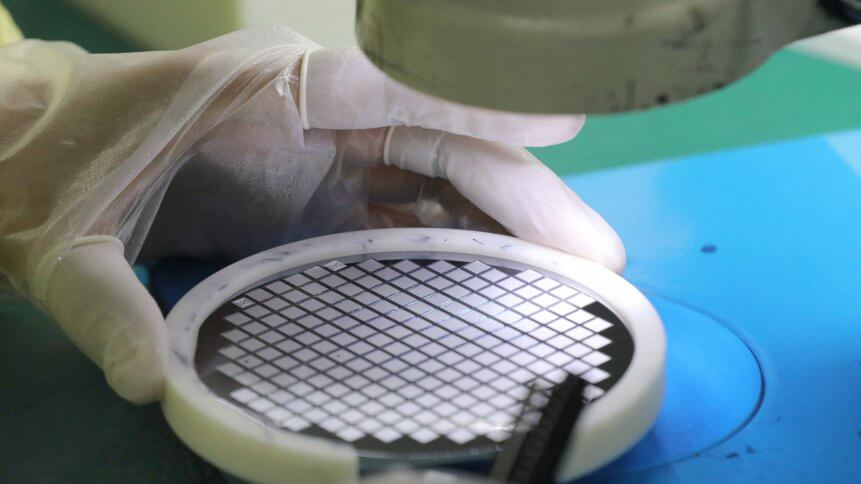

In general, as a result of a combination of factors, the current global shortage within the semiconductor industry will probably not change until the end of next year, as claimed by market experts. Since the world went into a lockdown due to the pandemic, carmakers have been slashing production, PlayStations are getting harder to find in stores and even aluminum producers warn of a potential downturn ahead. All have one problem in common: an abrupt and cascading global shortage of semiconductors. Otherwise known as integrated circuits or more commonly just chips, they may be the tiniest yet most exacting product ever manufactured on a global scale.

Specifically, a Bloomberg report stated that there is now a serious shortage of display driver chips that is creating headaches for manufacturers of LCD and OLED panels in particular. The lack of it in turn will affect all manner of consumer devices, from the lowly smartwatch to smartphones, tablets, laptops, computer monitors, TVs, smart appliances, and infotainment systems. Every new car or plane comes with one or more display panels which only adds to the demand. Generally, companies don’t need to use their most advanced process nodes to manufacture display driver chips.

Nevertheless, the shortage of these driver chips will likely cause further delays and price hikes for products that are currently in high demand, and the manufacturers of these chips don’t see a solution in sight. The shortfall is already visible in the doubling of prices for large LCD panels over the last year.

Taiwan’s Himax Technologies CEO Jordan Wu told Bloomberg “I have never seen anything like this in the past 20 years since our company’s founding.” Himax, alongside MagnaChip, Samsung, Novatek, FocalTech Systems, Synaptics, Raydium, MediaTek, and Silicon Works are among the key players in the display driver IC market, which was worth US$7.1 billion in 2019 and is expected to reach US$9.1 billion by 2023.

Samsung Electronics Co. warned of a “serious imbalance” in the industry, while Taiwan Semiconductor Manufacturing Co. (TSMC) said it can’t keep up with demand despite running factories at more than 100% capacity. Likewise, Wu also explained that making more display driver ICs isn’t possible as these are all fabless companies depending on foundries like TSMC, which have relatively limited production capacity for older process nodes that are typically used for fabrication.

Opting for building additional capacity and more advanced process nodes is too expensive and risky of an option to make economic sense. It is mainly why most of these companies are perfectly happy with mature process nodes where equipment value has already depreciated and allows them to supply display driver ICs at a lower cost.