AI beyond fraud detection: saving costs with smart expense management

There has been a world of difference between the emerging technology of AI and its attainment of the status of being usable every day by ‘normal people’. As a discipline, AI has been around for many years but was consigned to rarefied academic institutions where researchers in computer science, linguistics, and statistical modelling brought the concept from idea to reality. Now, thanks to OpenAI and its ChatGPT model, machine learning has become an everyday, usable system that has a significant impact on people’s lives across multiple areas, particularly in the area of expense management.

Artificial intelligence is finding more uses in many areas, but when models are built from scratch, significant work is needed to tune them to different areas of the business.

AI has been used in finance offices for a while now, for example, in optical character recognition, which is already common practice. Further up the scale of business size, large financial institutions use machine learning to spot fraudulent activity in the multiple transactions that flow through their systems daily.

Now, the same type of algorithms can flag potentially fraudulent expense claims submitted to every Finance department. In small companies, every misspend can have an impact on cashflow that is, in relative terms, worse than in a large corporation.

Source: Rydoo

The usability issue

The big hurdle to adopting any technology, AI included, is usability by the people in the workplace who aren’t necessarily Computing Science graduates. In fact, any technology implementation lives or dies by its uptake by employees.

To implement a finance tool, the software must be intuitive and straightforward for everyone who uses it daily, whether end-users, managers or finance teams. Elements like user interface (UI) design and simple task completion steps make a big difference for all the parties involved. Everything has to be done intuitively and easily, from daily expense claim submission right up to detailed strategic report formulation.

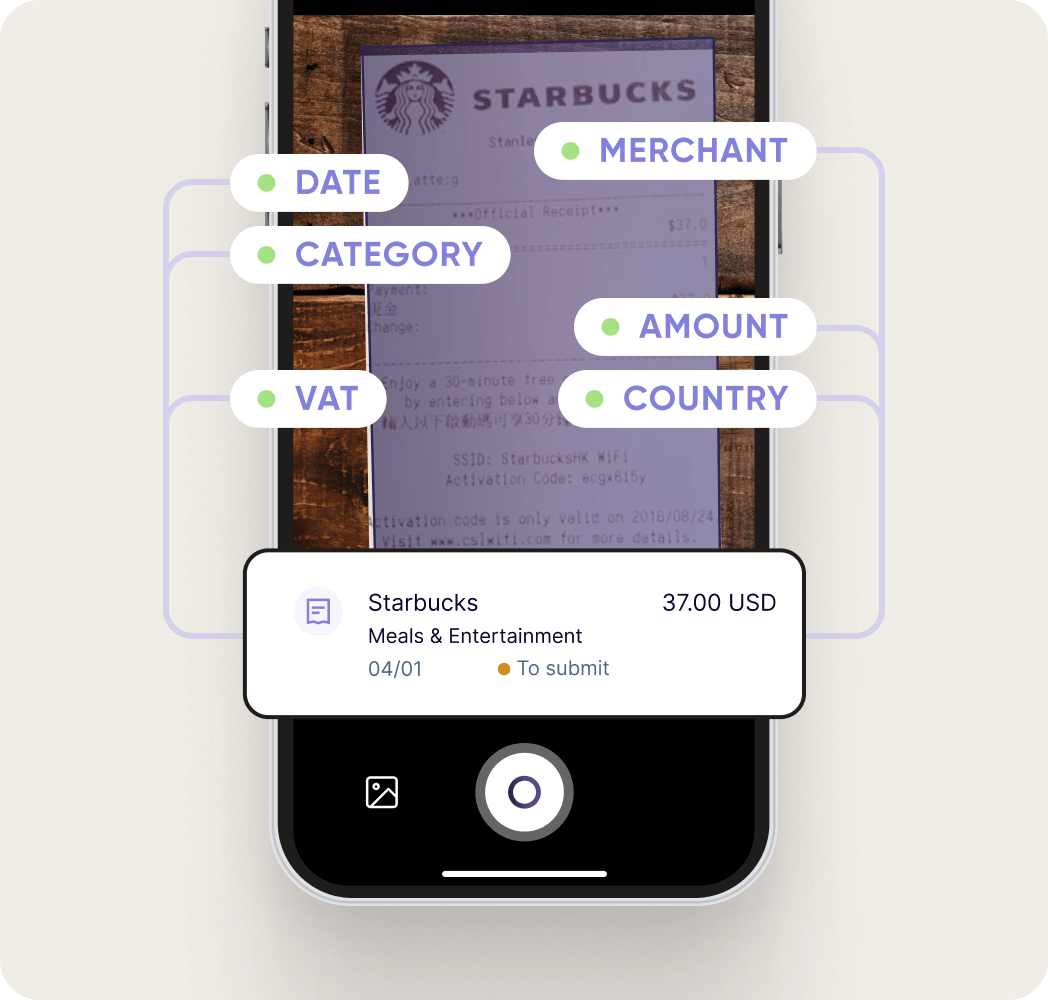

AI can drive wide adoption among a workforce by simplifying individual software choices, automating everyday tasks, and cutting out the mundane, repetitive steps such as submitting an expense claim.

Finance teams also benefit from usable, directed AI-powered software with specialised tools on the same platform as end-users. For example, complex financial compliance regulations can affect many aspects of spending and expense management. Policies might be local to certain jurisdictions, so what’s acceptable to spend in the UK by employees working out of the Zurich office may not be the same as those that apply to UK workers at a conference in the US.

Teams applying those policies to expense claims must be able to upload rules and apply them easily, with clear oversight of their effects. This ability is just as important as the need for a simple-to-use expense submission app or webpage.

How AI tools help save costs

In addition to their usability, expense management software are worth the investment because they can streamline processes and thereby reduce business costs.

If the process of an expense submission is easier and helps prevent fraudulent claims (a way to save costs in itself), then the cost of creating expense reports also falls.

A 2022 report from the Association of Associated Fraud Examiners claims that about 20% of expense reports can contain errors that need to be manually corrected. These errors often start as a mistake when the end-user submits the expense. The same report also states that, on average, it costs £58 to create such a report and a further £50 to correct it. That’s a significant cost burden due in part to the business paying a highly qualified Finance team to sift through line items one by one.

Source: Rydoo

Therefore, it’s simple to see that if an employee’s expense claim process stops misspending as its details are entered, the savings are twofold: less money spent on fraudulent claims and fewer hours spent tracking down potential fraud.

Even a modestly sized business’s Finance team can find itself doing a disproportionate amount of manual work, which is the type of work that AI algorithms can automate away. Among many, it’s just one area where having the right back-end system behind a user-facing expense app is vital for an efficient Finance function.

The necessity of fine-tuning

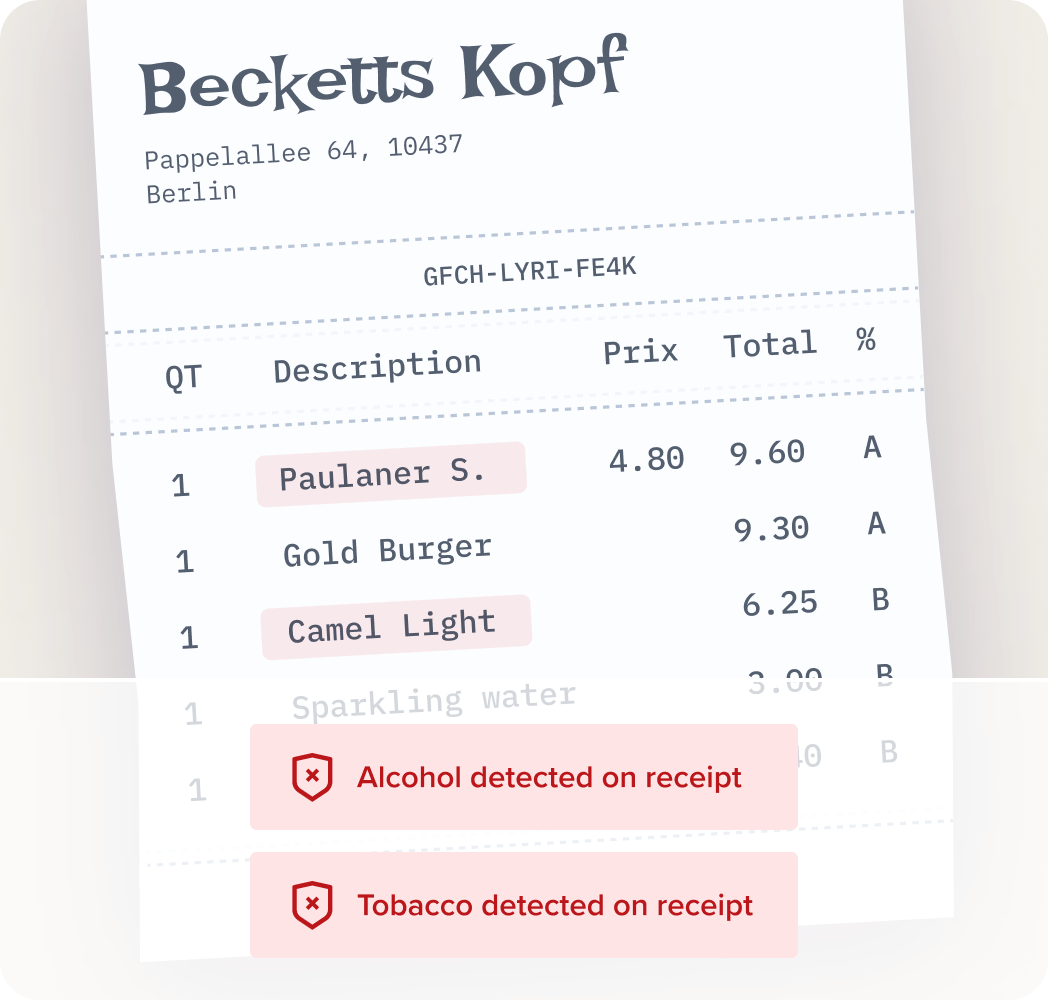

The AI algorithms in today’s most advanced expense management software have to be adaptable, as no two companies have the same policies. While AI can make decisions and help enforce policies, it’s important for administrators to upload them into the platform so the software can understand the rules and automatically flag or approve expenses, depending on the context. Submitting an expense for a team dinner where alcohol is shown in the receipt might go against policy, while a Board member taking a potential client to dinner and ordering a bottle of wine might be acceptable as an exception, given the context, for example.

AI-driven software allows complex rules and exceptions to cover every eventuality in businesses of any size because there’s no added work burden for Finance teams – it’s the type of work better done by algorithms that work quickly, 24/7 and with virtually no mistakes.

Rydoo understands and targets the pain points teams often experience when controlling expenses. It’s developed a specialised and highly personalised platform with usability at its heart. Rather than an implemention of technology for its own sake, the Rydoo platform addresses the key needs for cost control, smoother processes, compliance with laws and policies, and lowering costs while also providing accurate data and reports.

In later articles, we’ll be looking at some of Rydoo’s capabilities in the sector and focus on specific functionality. But with the right approach and offering the right tools available now, we recommend you find out more for yourself.

(1) Association of Associated Fraud Examiners, 2022, Global Business Travel Association, 2022.