By Edwine Alphonse, Senior Controller at Ramp

The accounting month-end close process can be a routine that many finance teams dislike. Siloed data, unreconcilable reconciliations, inefficient tools, and clunky approval workflows turn what should be a smooth journey into a frustrating ordeal.

When I joined Ramp in 2021 as the first controller, our month-end close took 30 days. We were using an outsourced accounting firm that struggled to meet our timelines because they did not have proper access to all the required information. Financial statements were prepared manually. There were no controls or reviews. From day one, I set out to improve our close time to achieve one of my professional goals of a continuous close process or daily close. Through a combination of tooling, process, and resourcing improvements over the last two years, we’ve cut Ramp’s close time down to five days.

My experience at Ramp and similar companies demonstrates how automation can transform the relationship that controllers and accountants have with their close. By offloading some of the most repetitive and time-consuming tasks to technology, my team members no longer feel chained to the close calendar and spend more time on strategic projects and cross-functional initiatives. They have a better work-life balance too.

Our company management has benefited as well from faster insights. After all, the accounting mandate is to deliver timely and accurate information to management so they act promptly. A study from Ventana Research shows only 39% of finance departments with month-end close periods longer than six days say they can provide timely information to the business. This increases to 62% if the close takes six days or less.

Despite these findings, some CFOs and finance leaders remain reluctant to invest in new tools. While they understand the benefits of automation in theory, they often feel their operations are unique and implementing new technology would require significant financial and time investment.

However, wholesale change simply isn’t necessary. There are a few strategies that businesses can take to speed up the month-end close with minimal disruption to operations; here are my top recommendations:

1. Start by auditing your close

Run a comprehensive audit to identify where you can formalize roles and processes, and reduce unnecessary work. Create a detailed checklist that outlines all the steps involved in the close. How are you reviewing cash transactions and prepaid account reconciliations? Who’s responsible for verifying that invoices are categorized to the correct accounts? How are you reconciling your account receivables? How often do you review your provision? Assign an owner and due date to each of these tasks. Here’s an example close checklist we use at Ramp.

Set up service-level agreements with your internal and third-party partners to enforce accountability and timeliness. Finally, consider adopting specialized close management software, such as FloQast, to streamline the entire workflow.

2. Frontload your credit card and accounts payable reconciliation

The close process doesn’t have to start at the end of the month. With automation, you can frontload much of the reconciliation work needed for card transactions and vendor invoices.

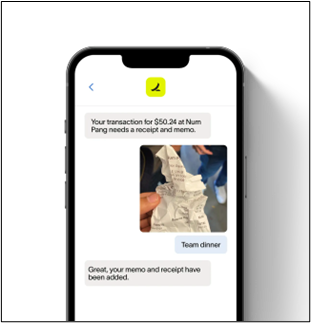

Issue to control employees’ spending and automatically collect their receipts, eliminating the need for manual expense reports. The best card providers offer this kind of software for free. Expense management software can also guide employees to code their own transactions, alleviating more work for your team.

Source: Ramp

Similarly, use AP automation tools to scan your invoices, route them for approval, and two-way match purchase orders to minimize the risk of fraud and payment errors. Sophisticated tools can even extract line items from your invoices and automate coding. This proactive approach not only accelerates the month-end close but also cultivates a more controlled and efficient financial operation.

3. Integrate your tools

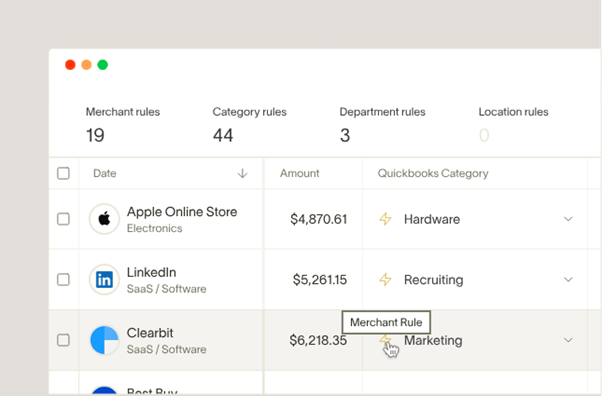

As companies grow, they tend to collect a set of disparate systems and tools for processing card transactions, reimbursements, and AP invoices. Assess your tech stack and see if it’s time to clean up technical debt and invest in integrations. Examples of useful integrations include:

- Connect your organization’s email tools, such as Gmail or Outlook, to your expense management platform to automatically collect employee receipts.

- Link your expense management and AP tools with your ERP to enable real-time data sync and eliminate the need for manual data entry.

Source: Ramp

Consider consolidating tools wherever possible to streamline your workflow and save costs. For instance, spend management platforms can now help you track and process card payments, invoices, and reimbursements all in one place in real-time and sync data directly to the ERP. This allows for smoother data flow and more accurate reporting.

4. Migrate to enterprise ERP software

Speaking of ERPs, if you struggle to prepare consolidated financial statements and need better audit controls across entities, it’s time to upgrade your ERP. Enterprise accounting ERP software, like NetSuite, Sage Intacct, and Xero, are purpose-built to enhance month-end closing efficiency. Our transition from QuickBooks to NetSuite was critical in helping us reduce our close time from ten to five days.

Migrating to a new ERP requires careful planning and executive commitment. Before beginning the transition, it is a good idea to craft a comprehensive project plan. Securing executive support, building a capable team, setting realistic timelines, and monitoring progress through regular updates are all crucial for success. I recommend working with an ERP implementation partner to help you properly assess your current and future needs and choose a solution that aligns with your company’s growth trajectory and financial objectives.

5. Automate internal reporting

Ventana Research says 88% of companies that apply a substantial amount of automation to their close can close their monthly books within six business days, compared to only 40% of those that don’t. After small, repetitive tasks have been automated—for instance, receipt collection or matching and transaction coding—you can work up to larger workflows, like product accounting and other internal reporting.

At Ramp, I worked with the engineering team and our finance partners to automate reports like revenue transaction ledgers, accounts receivable listing, and cashback reports. This streamlined our accounting, reduced our reliance on third parties, and was another key factor in shortening our month-end close time to five days. Leveraging automation allows your team to focus on high-value tasks that require human expertise while routine tasks are executed accurately and swiftly by the software.

Set your finance team free: Start automating your close

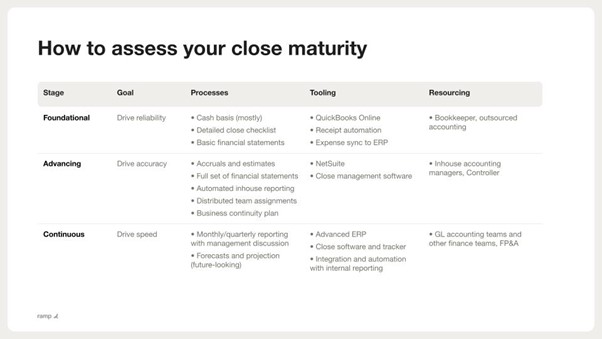

These are a few proven strategies to help you shorten your close. Ultimately, the changes that will have the most impact depend on the current state of your close. Here’s a useful framework to help you assess what changes to consider next.

Source: Ramp

If you’d like to learn more about Ramp’s journey to a five-day close, check out my recent webinar on the topic. For more information about Ramp’s accounting automation, visit ramp.com.