Streamlining spend management saves time and gives finance team control

When an organisation enters a growth phase, there is a rise in spending to facilitate taking on the extra business. Although the increase in outlay may differ in different parts of the business, ensuring proper oversight and management is imperative to achieve sustainable growth.

In the organisation’s early days, the business owner will have been able to keep a close eye on spending in all areas of the organisation. After a certain point, spend becomes dispersed, meaning that’s no longer possible. Eventually, systems need to be put in place to give managers the control they need to carefully monitor spend.

As you might expect from the pages of a business technology website such as this, we advocate implementing – in this case – software to help companies of all sizes better manage their spending. Even modestly-sized businesses will have made a significant investment or two in critical systems, like a CRM or work-tracking app. However, some areas of the business will still be run on numerous Excel sheets or an Access database.

Going forward, managing company spend on that basis isn’t practical and will become time-consuming to keep up to date. The danger of errors in spending reports as a result of manual data entry are well known, plus, of course, they’re out of date almost as soon as the information is entered.

Streamline spend management with a dedicated solution

Grouping spend management functions together under one umbrella platform has significant advantages. Not least because the finance decision-makers can be sure that all spending is tracked and managed from one place with no need to switch between applications.

Without such a focus, there’s a significant danger that some spend will go unreported by the finance team, and inaccurate reporting can be business-critical during any audit, internal or external.

Automating finance processes saves time and improves accuracy

Reimbursing individuals in the workforce for out-of-pocket expenses and managing company cards are integral parts of spend management. Good HR practice dictates that (especially in the current economic climate) no employee should be paying expenses out of their own pocket and waiting until the end of the month for reimbursement.

Back in the finance office, a further host of expensive, repetitive and mundane book-keeping tasks can be completely automated with the right software, enabling teams to reclaim days previously lost every month. Chasing missing receipts and correlating card statements against clients is not only time-consuming, but it’s also soul-destroying for employees tasked with administrative work. And an unfortunate truth is that the duller a task, the more likely mistakes will be made.

Streamlining spend management processes means fewer mistakes and the ability for skilled personnel to use their talents to bring much more value to the company instead of wasting their time on administrative trivia. This alone is cause for a company to consider better spend management processes.

Easier spend processes with better control

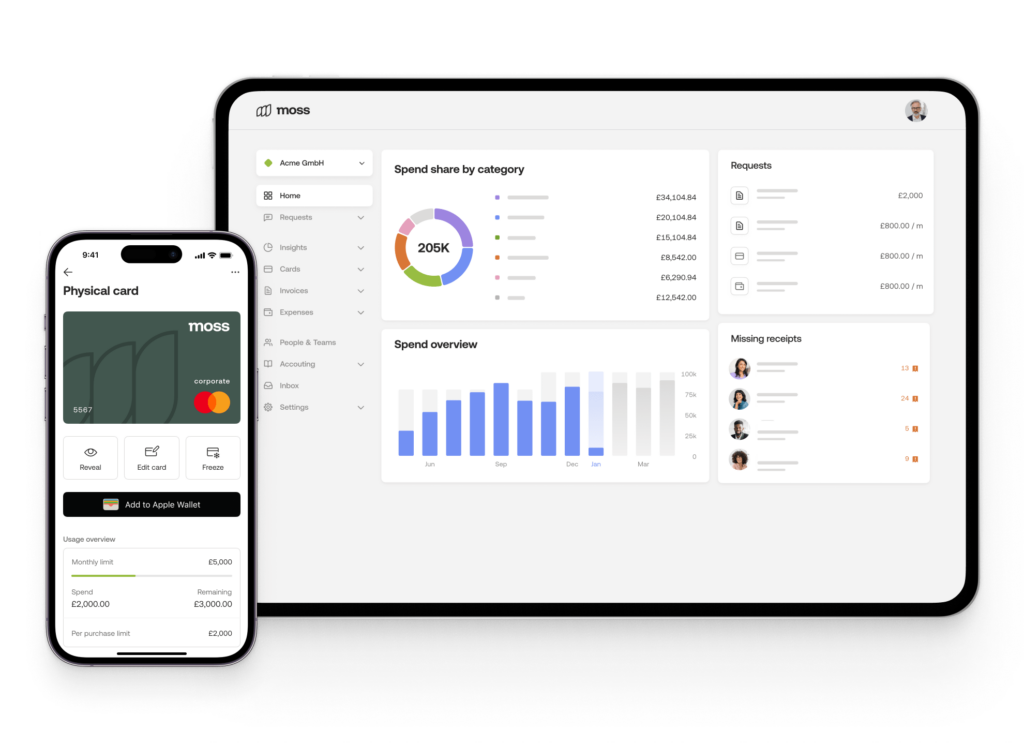

Source: Moss

Primarily, however, spend management systems like the Moss solution can show decision-makers where spend is going each month, which projects are eating funds, which teams are following workflow guidelines, which are not, and a hundred other valuable insights.

Digital tools can also work in the other direction. The Moss spend management platform can set individual or team budgets and spend, so there’s granular control over virtual and physical cards. Employees are empowered to spend within pre-agreed limits, so freedom doesn’t come at an additional cost to the company. Modularity will also allow features to be “bolted-on” as required, granted on the same granular basis. For example, anyone in the workforce might be able to scan an invoice (the Moss system will digitise and OCR a PDF or photo of a paper invoice), but only finance decision-makers would be able to approve and pay the invoice.

In any business, there are chains of command and areas of responsibility. On the Moss spend management platform, admins can create custom approval flows that reflect the business structure. Thresholds are set to automatically approve costs below a certain amount, reducing bottlenecks in time for supplier payment and lowering the admin burden on budget holders to sign off on negligible costs.

Quickly recoup costs with spend management

Source: Moss

When companies grow, there are numerous demands on software investment for decision-makers to consider.

In reality, spend management solutions provide a fast ROI on a relatively modest outlay. Users of such solutions have found that even the smallest change – like guaranteed accuracy in cost code allocation – can alone cover the cost of the investment in the spend management platform. Streamlined spend management processes significantly add to a finance department’s capabilities and drive positive change throughout the business.

A business’s finances, particularly its spending, must be prioritised, but there are often not enough resources to do so. Here, the Moss spend management solution can act as an extra pair of hands for the finance team, helping companies control and gain insight into all monies leaving the business.

From company credit cards to invoice reconciliation and accounting systems integration, check out Moss. Its capabilities grow daily as the company does, bringing benefits to employees, systems and the company finances. This cloud-based platform comes with our recommendation, and we urge you to book an introduction to the platform via the company’s website.