Considering VC funding? Here’s how to stand out to investors

Last year, 27 SaaS companies went public, making up $225 billion in total market capitalization.

There is no shortage of opportunities for investors who want to stake their claim in the tech space. Aside from dominating total market share, tech companies are attractive to VC firms for several other reasons, including:

- Scalability: SaaS can be scaled quickly and efficiently compared to physical products and services because they exist natively on the web.

- Recurring revenue model: most SaaS companies operate using a recurring revenue model, making it easier to forecast growth monthly, quarterly, or yearly.

- A history of innovation: while many tech startups require significant investment in research and development, they promise a steady stream of growth and positive ROI generated by innovative products, services, and features.

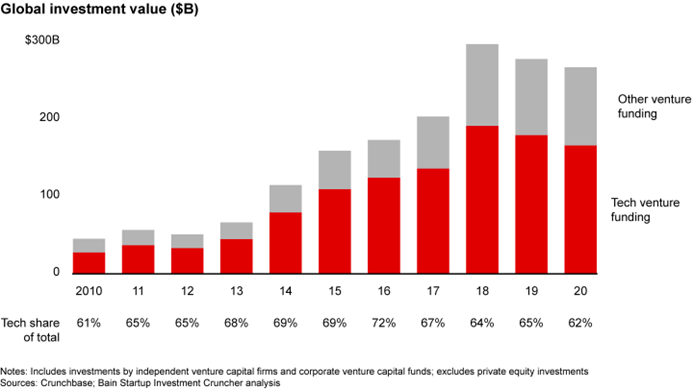

According to Bain & Company, tech startups made up most of venture funding across all deals by independent venture capital (VC) firms and corporate venture capitalists from 2010 through 2020.

(Source: Bain & Company)

Despite the proof that investors are eager to find the next “unicorn,” VCs often have a strict set of criteria they evaluate before investing. And they can afford to be picky. For example, the well-known startup accelerator, Y Combinator, has an average admission rate of 1.5%-2%. Based on these numbers, you’d have better odds of being admitted to an Ivy League school.

So, how can you improve your odds of being accepted as a newly-minted portfolio company with a cash runway that’s miles long? As you prepare to apply for another funding round, here’s what VC firms will expect from you.

What do VCs look for in a portfolio company?

Qualified leadership

Have you built a world-class team?

The pedigree of your executive leadership team is an important factor for VCs. Ideally, your company leaders will have a proven track record of scaling venture-backed companies and generating big returns for their investors. If your founding team has more experience on the technical side, you should be willing to hire experienced and qualified managers from outside your organization.

To fill in any knowledge gaps in an organization, many VC firms will supplement their portfolio companies with fractional CMOs, CFOs, and other executive consultants to help guide them through the beginning and intermediary stages of their business growth.

Product/market fit

What problem are you solving?

What’s your story? Why are you building this, and who is it for? Where are you going?

Serious investors don’t want to waste their time and resources on a company that only looks good on paper. It would be best if you had a clear product/market fit and a thorough understanding of the competitive landscape in your given market. Having these resources on hand helps investors understand how your product is uniquely positioned in the marketplace, who your ideal customers are, and how their investment will be used to help you on the next leg of your journey.

To be clear, not every SaaS company needs to be “disruptive” or “category-defining” to qualify for a round of venture capital. However, owning your specific niche in the marketplace (with room for expansion) signals investors that your company is primed for a successful exit.

Risk assessment

Are you worth the risk?

Even the most sound and practical investments come with some associated risks. Not to mention, most tech startups fail.

It doesn’t matter if you have the perfect pitch deck and a standout product; VCs need to conduct their due diligence to ensure they’re not taking unmitigated risks that could negatively impact their portfolio.

- Could regulatory or legal issues pop up?

- Will this product be needed ten years from now? Or is it a passing trend?

- Is there enough money in the fund to fully meet the founder candidate’s needs?

- What are the chances of a positive ROI or successful exit?

A proper risk assessment is standard procedure in any investment and is a clear sign that your investment partners will be actively involved in the future growth of your venture.

Bullet-proof SaaS metrics

Do you have a proven track record?

Investors can be more forgiving when it comes to having detailed metrics and financial records for startups and seed-stage companies. However, the bar rises after every funding round. Sooner or later, investors need to see data that validates the story in your pitch deck—a single miscalculated SaaS metric can erode investor confidence and wreak havoc on your valuation.

Here are some resources you should have on hand:

Detailed financial reports

As your SaaS venture begins to grow, you’ll have more to worry about than user acquisition and your capital burn rate. Financial maturity is a must if you want investors to take you seriously.

SaaS leaders need to be able to keep up with evolving regulatory changes and report their numbers confidently with financial reports. Quickly pulling reports on revenue, deferred revenue, invoicing, and accounts receivable is a huge competitive advantage when building relationships with potential VC partners.

Ideally, you’ll have access to a dedicated revenue management platform that sits between your CRM and GL to ensure that all your financial records remain up to date. Instead of warehousing data in a spreadsheet, a revenue management tool automatically syncs data across all your systems, so you can quickly pull updated SaaS metrics, easily navigate funding rounds, and gain the trust of potential VCs.

Subscription momentum reports

It’s not enough to be able to produce SaaS metrics for investors.

You need to understand what the numbers say about the health of your business and be able to make operational decisions based on what you’re seeing. A subscription momentum report gives you and your investors valuable insights into how your business segments and product lines are performing.

Cohort analyses

A critical part of running a healthy SaaS business is understanding how your customers use your products and services. In-depth cohort analysis allows you to drill down into your customer cohorts so you can:

- Understand the leading causes of user churn

- Master customer retention based on user feedback

- Develop your product roadmap based on current user behaviors

While cohort analyses are a great internal tool, they help potential investors understand your customer segments and how your SaaS meets their needs.

Need help organizing your performance metrics to stand out to investors? You can access our free SaaS metrics template here.

Source: SaaSOptics

Is now a good time to pursue a funding round?

While a successful funding round could be what separates you from the next step in your company’s growth journey, current volatile market conditions are causing VCs to make investment decisions more cautiously. Due diligence is taking longer, crossover investors are starting to pull back, and the ultimate goal of getting funded is turning into an uphill battle.

Given the circumstances, is now even a good time to raise a VC round? Do you have the cash runway to pursue aggressive growth? Or should you start thinking about exiting?

To help SaaS founders answer these questions, we’ve teamed up with Todd Gardner, founder of RevOps Squared, to create this Equity Calculator. This calculator is designed to help SaaS founders and other shareholders decide if they should sell, raise capital, absorb dilution, grow ARR, or sell later.

You can access the full Equity Calculator here.