Consumer Opinion Moves Fast – How Financial Services Can Stay Ahead

With the normalization of technology in the form of the smartphone, there’s enormous consumer demand to manage every aspect of modern life via a portable screen, from shopping and travel, through to banking, finances, and money transfers. Seeing this trend as it emerged, fast-moving challenger banks and financial institutions were quick to capitalize on the attention of digital-native consumers.

Slower moving incumbents didn’t have the same pace of digitization; whether that was down to a reliance on existing market share, or the presence of legacy technologies in their infrastructure is entirely moot. But, given the irresistible consumer-led pressure for easy financial management, even the old institutions are adapting. In short, business transformation is digital transformation, and both are 100% necessary to attract and keep consumers and businesses as customers in the financial sector.

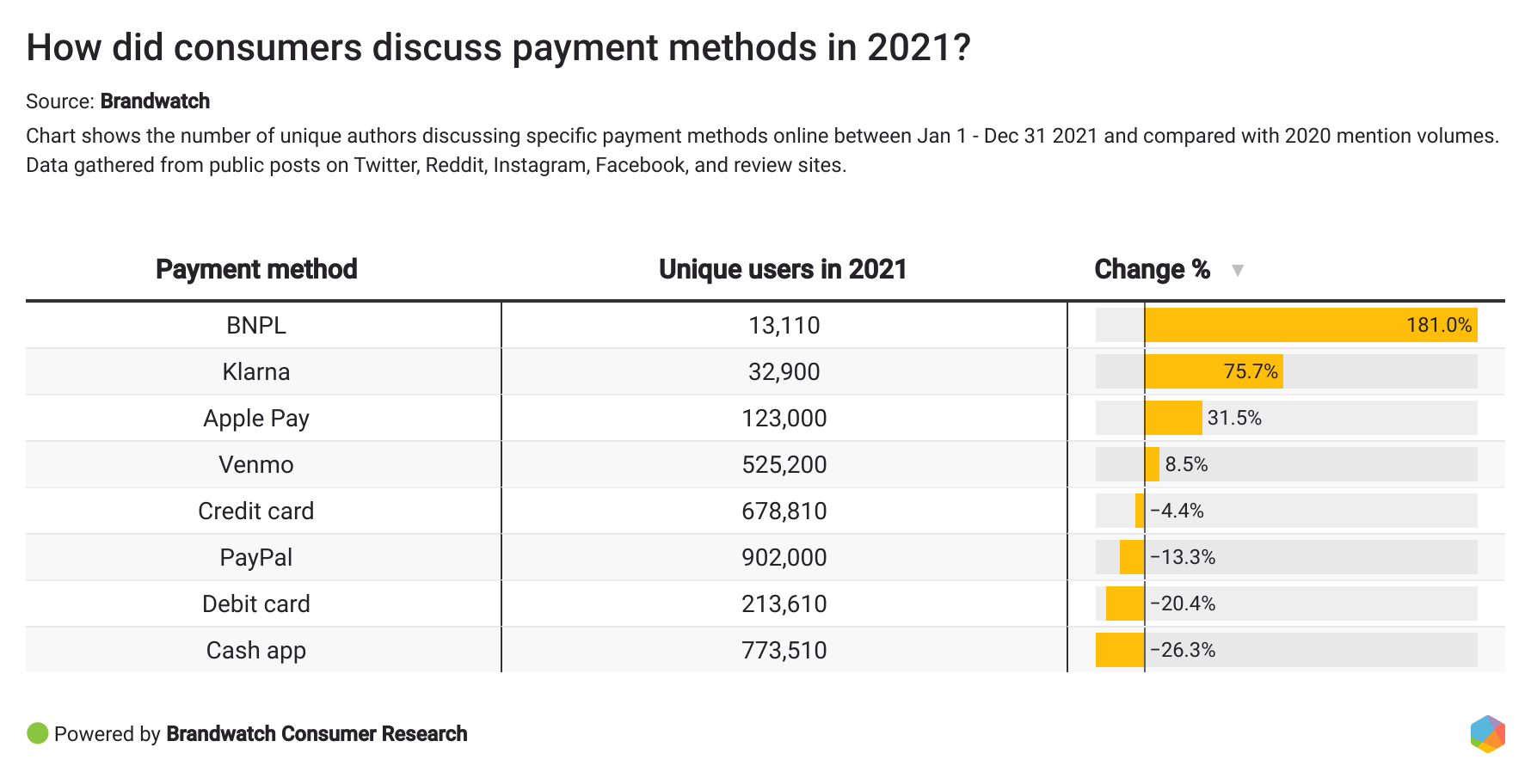

In the last two years, the pressure keg of enforced lockdown and huge economic disruption has changed many aspects of the financial lives of individuals and companies. According to research by digital consumer intelligence company Brandwatch, levels of online conversation around spending have remained relatively high over the last couple of years, but interest levels in the methods of payment have changed — more use of digital-first short-term credit like Klarna and other staggered payment facilities, for example. Conversely, cash spending fell, as did amounts that were saved.

View more insights from Brandwatch’s report here.

There is a great deal of fairly clear cause-and-effect in many of these trends, but a common long-term effect of the internet and the democratization of data it brings has been the way that messages about brands, products, opportunities, and trends have been disseminated. From corporate headquarters all over the world, marketing departments push their messages out onto social platforms and entice, encourage (and pay) others to do the same. But speaking just as loudly, and often louder, are the consumers and users of brands’ products and services.

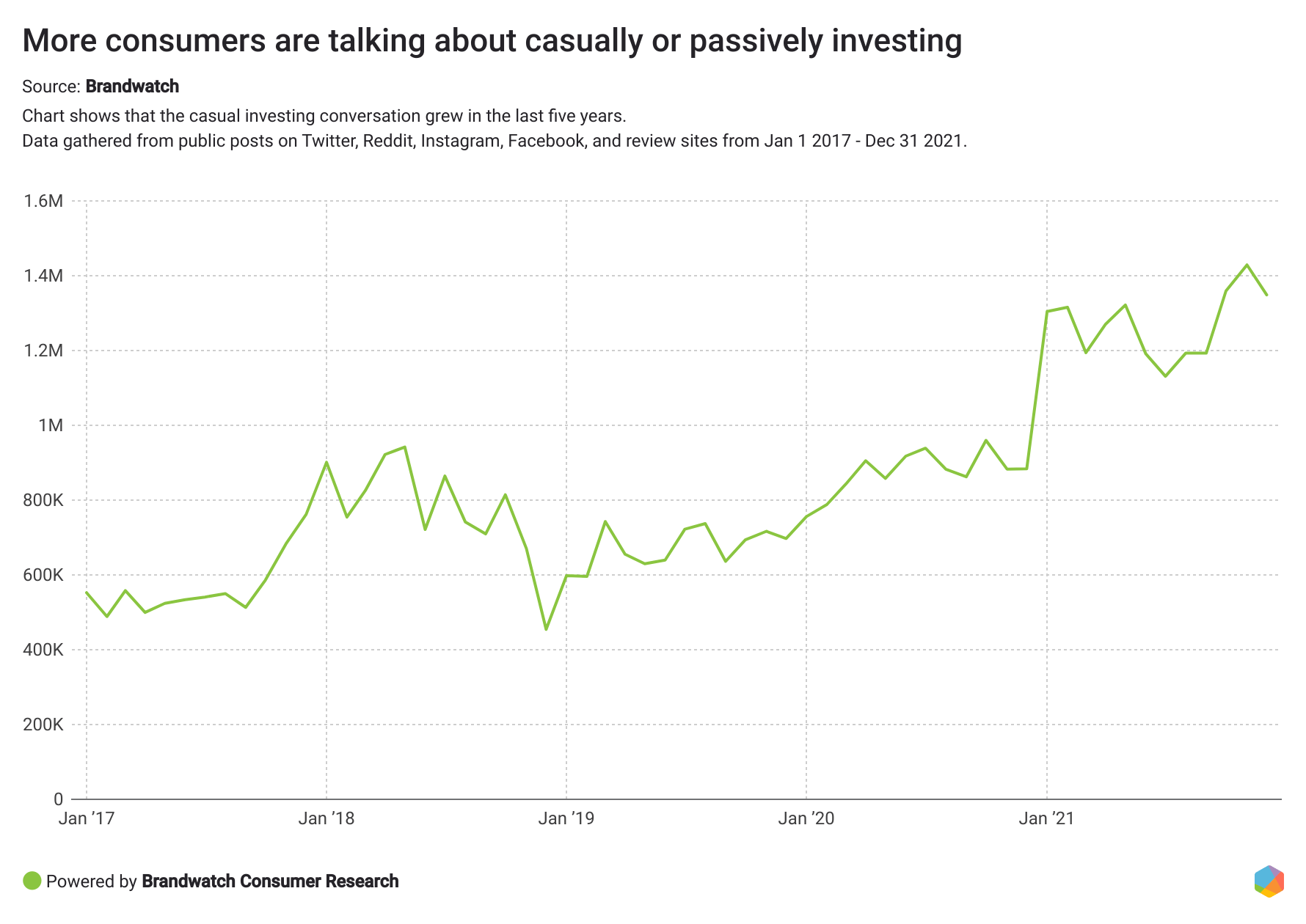

There’s much to learn from listening to what consumers are discussing publicly online. Businesses can spot emerging behavioral trends and new audiences interested in particular financial choices. This is vital intelligence for any financial business’s growth strategy. For example, social intelligence company Brandwatch has reported on the rising interest in casual investing:

View Brandwatch’s full report on consumer finance trends here.

View Brandwatch’s full report on consumer finance trends here.

Social listening platforms have always been deployed by companies that know they need to respond to consumer opinion, needs, and rising expectations. The challenge for these older digital intelligence platforms is to gather meaningful data in real time, from an ever-changing choice of platforms and sources of opinion.

For example, Brandwatch is a leading solution used by many of the world’s biggest brands – including financial giants such as Standard Chartered – for reliable, real-time monitoring and analysis of brand health, corporate reputation, trends in consumer attitudes and behavior, campaign performance, and competitors’ activities too.

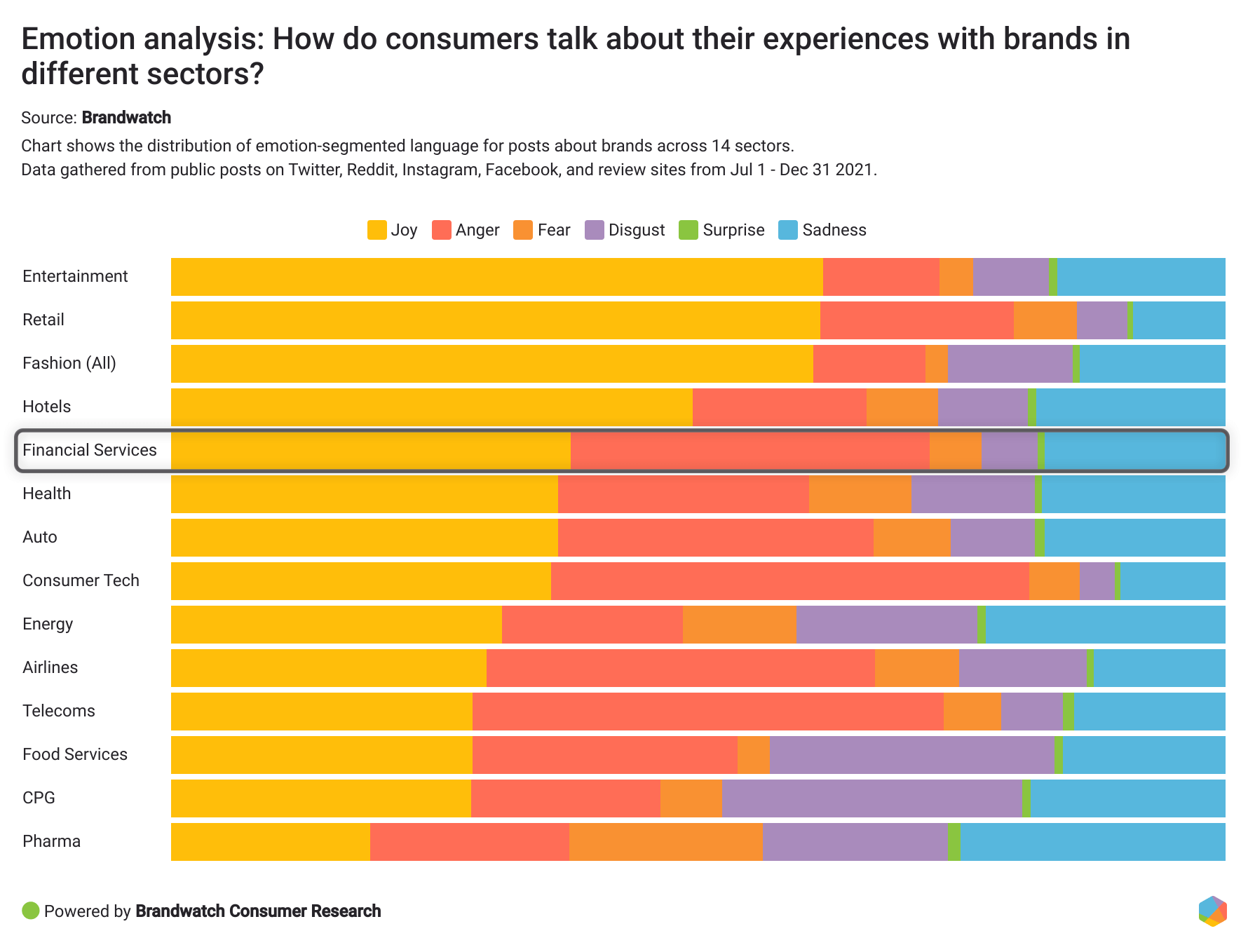

Recent analysis by Brandwatch of how consumers talk about their experiences with brands in different sectors reveals a mixed picture for the financial services industry. Businesses that dig into the online conversation can better understand their strengths and weaknesses:

Here’s a case study example of how a financial service brand is benefiting from Brandwatch’s platform and insights.

Why is real-time analysis of consumer opinion important? The answer is that rankings and reputation are fluid, move quickly, and are driven more by customer opinion than by any marketing activity from a brand. Take as a simple example the search results for “Best Insurance Provider” on Google.com’s homepage. Those companies that rank highly do so because of the closed box of Google’s algorithms.

When a company declines in popularity for whatever reason, its website will receive fewer visits. Shortly thereafter, the company will slip down the Google search results page. Why? Because Google ranks on popularity, amongst other factors. Those changes happen in seconds, and the effects almost look exponential.

The places where consumers and businesses go to source and compare financial products are much more numerous than that single Google page, of course, but comparison sites, aggregation apps and review portals all apply the same types of algorithms on the companies populating their pages. Once a company’s online reputation slips, or it fails to respond to an emerging trend or brand crisis, the effects can snowball right across the internet. Similarly, the same processes can catapult an unknown fintech startup right up there to go shoulder to shoulder with household-name vendors.

The ways that people and companies express themselves and their values online are always changing according to taste, trend, geography and cultural shift. But what’s different in 2022 is the speed at which companies need to react to those expressions. Your digital consumer intelligence platform has to be able to gather relevant consumer conversation and opinion data, segment and analyze it quickly, find meaning in the data, and distribute useful insights in the right format to the right decision makers. To stand a chance of being first-to-market and getting ahead of competitors, crucially, businesses need a fast and smart solution offering state-of-the-art AI.

Read Brandwatch’s analysis of consumer finance trends in full detail, or book a personalized demo of Brandwatch’s digital intelligence platform.