Insurtech reimagines AI: Driving Change on the Road to Next-Gen AI Chips

One car crash is much the same as another, from the tip of South America to the uppermost reaches of Norway. Or so you’d think. But for insurance companies, assessing the damage to vehicles and the costs of making necessary repairs is a highly complex procedure. As well as capturing images of dents in bodywork and bent pieces of metal and trim, costs and methods of repair vary from country to country.

Historically, human damage assessors have been needed to undertake the task of summing up the costs to the insurance company so it can make better decisions for its customers and shareholders. Now, like in many fields, artificial intelligence is removing the bottlenecks in processes that can be caused by needing human intervention and the many elements of miscommunication and misinterpretation that can creep into complex claims.

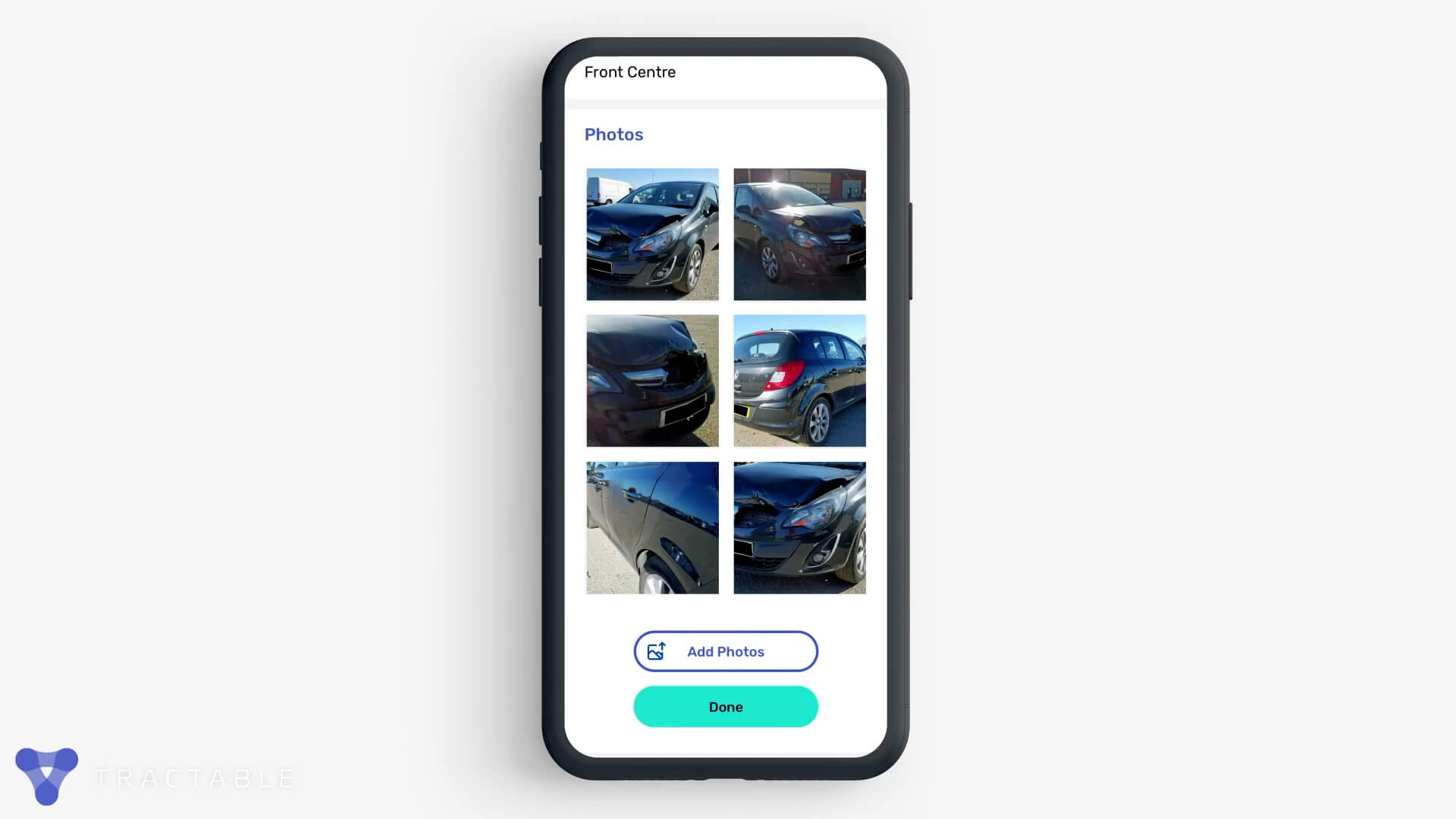

Tractable is a company you’ve probably had dealings with if you’ve ever damaged a vehicle, but one you may never have heard of. Its powerful AI algorithms can evaluate the nature and scale of vehicle damage (often taken at the scene by the people involved in an incident) and calculate the cost of repairs, the extent of necessary compensation, or the price of replacement parts or vehicle(s). It generates detailed price estimates as soon as images of damage come into the insurance company — often taken on smartphone moments after an event.

Source: Graphcore

The company’s tech is now installed at more than 20 of the world’s leading insurance companies, confirming its position as one of the most successful vendors of AI-powered technologies. But as with all great companies, Tractable constantly innovates and explores new approaches to ensure its technology remains competitive.

That’s led the company’s co-founder and CTO, Razvan Ranca, to investigate the gains that can be made by leveraging dedicated chipsets that have been engineered to run complex AI workloads from Graphcore. “We saw a roughly 5X speed gain,” he said. “That means a researcher can now run potentially five times more experiments, which means we accelerate the whole research and development process and ultimately end up with better models in our products.”

The computational demands of Tractable’s platform mean AI algorithms have to improve and change all the time. In different geographies, manufacturers produce different vehicle models and methods of repair, and re-mediation costs and compensation rates vary from country to country. AI code must recognize individual vehicle makes and be aware of every component in every iteration — often going back many years in each manufacturer’s history.

And with vehicles lasting longer and manufacturers constantly innovating and producing new models, the commensurate demands on Tractable’s platform grow, too. That’s why it has turned to dedicated chips as an alternative to widely deployed GPU hardware that has to date been the best computational solution for AI on the market.

The Graphcore IPU (Intelligence Processing Unit) was created to serve the needs of the next generation of AI, with the flexibility to handle the many different interpretations and uses of machine learning. That effectively breaks companies like Tractable out of the situation where it must focus on limited GPU-based processing. Now it can explore the broader interpretations of the science of ML and give its teams the tools they need to create a significant market advantage.

Source: Graphcore

“We’re foremost a machine learning company,” Ranca says. “Our technology is […] our core competitive differentiator, so we view it as crucial for us to build world-class teams and enable them to be as efficient as they possibly can.”

In many ways, Tractable’s example is very relatable for most AI practitioners in finance and insurance. High-end data science and machine learning are at the core of their technology, and results must be both accurate and business outcome-focused to help them deliver practical use cases in a rapidly evolving market. That’s why it has turned to Graphcore’s IPU-POD to accelerate what are very complex and advanced workloads. With significant performance improvements, Tractable is now deploying Graphcore systems more widely. “We’ll be collaborating with the [Graphcore] team to move the rest of our workload over,” Raz confirmed.

To learn more about the Graphcore IPU range and the options available to your data teams, reach out to a Graphcore representative or reseller near you or learn more about Graphcore’s financial solutions here.