Open Banking: Enabling E-Commerce Using Account to Account Payment Solutions

After customers experience the convenience of online shopping, the ease of cashless transactions and advantages of open banking, there is no going back.

Last year, over two billion people shopped online for goods and services, with global e-retail sales totaling more than $4.2 trillion, according to Statista. The report also noted that smartphones accounted for almost 70% of all retail website visits worldwide this year.

The pandemic was the accelerator for changing consumer habits and therefore, changing how businesses send and receive payments. As contactless and social distancing measures were implemented, declining cash usage, migration from in-store to online commerce and adoption of instant payments became significant trends (as shown in a McKinsey report that detailed the three major behavioral shifts). The number of non-cash transactions grew by 6% from 2019 to 2020, with real-time payments jumping by 41% alone.

The number of countries with viable, government-approved real-time payments systems quadrupled to 56 from 2015.

Shifting Toward E-commerce

A recent PwC global survey taken by financial professionals in banking, fintech and payments found that 89% agreed the shift toward e-commerce would continue, and 97% of financial professionals agreed there would be more real-time payments systems approved globally. All industries observed a boom in cashless transactions across the world, though as you might expect, the pace differs by region.

What’s most surprising is how far behind the United States is compared to the rest of the world in going cashless.

“Asia-Pacific will grow fastest,” the PwC survey stated, “with cashless transaction volume growing by 109% until 2025 and then by 76% from 2025 to 2030, followed by Africa (78%, 64%) and Europe (64%, 39%). Latin America comes next (52%, 48%), with the U.S. and Canada growing least rapidly (43%, 35%).”

Demand Increases for Faster Payments

Businesses and their consumers are demanding better, faster payments. A U.S. Federal Reserve survey found that nine out of 10 businesses expect to initiate and receive faster payments by 2023, with many ready to do so now.

High on the list of anticipated outcomes with faster payments are improved cash flow management through immediate access to funds, operational efficiency, receipt of prompt transaction notifications and a reduction in payment errors. Aside from ease of access, payment security is a must, with 90% of those responding to the Federal Reserve’s survey considering it essential to have tools that validate the identity of payers and payees as a means of fraud prevention. As real-time, bank-to-bank transfers become more commonplace, identity validation will become an integral part of any online payment.

Fraud Losses From E-Commerce

The costs of fraud to businesses are increasing as the market embraces electronic payments. A Juniper Research study found e-commerce losses due to fraud will rise by 18% this year from $17.5 billion to over $20 billion. That’s an 11.4% increase, taking the figures at their most conservative.

The increase is attributed to bad actors preying on unfamiliar and unprepared merchants. Tell any stockholders their company would lose over 10% more next year through fraud and the Board would have to take decisive action.

The Juniper Research paper stated that any fraud reduction measures will likely not be adopted if they add extra friction to the checkout process, as merchants fear inducing higher cart abandonment rates and losing competitive edge.

That situation creates an unpleasant balancing act for businesses: how much fraud might be tolerated for the sake of a growing online market? When do revenue gains fail to cover the cost of criminal activities, if the latter increase at a faster rate than sales?

If we accept the uptick in online sales during the pandemic is less of an anomaly and more the shape of the future of commerce, many existing e-commerce traders face a turning point. Not only is there a need to embrace new monetary exchange frameworks (like the UK’s Open Banking protocols), but there is also further investment needed in digital identity and account verification tools.

There also is increased potential for retailers in the insights they can draw from the data they accrue. Just five years ago, “big data” analysis was a research area for academic institutions with access to on-site grid and stream supercomputing clusters. Now “big data” is so commonplace it’s “just data,” and parsing, processing and mining for business advantage is simple and — thanks to Moore’s law — decidedly less expensive.

Even at small outfits, e-commerce platform operators are asking themselves, why accept less than the gamut of e-commerce-enabling solutions like analysis, reporting, sub-merchant onboarding, loyalty programs and other customization on tap?

“Enterprises that have scaled globally or digitally are prepared to pay a premium for sophisticated multi-country processors, local support, enhanced reconciliation, payments-adjacent services, and better payments performance in general,” another McKinsey report said, adding that SMBs are expected to spend more than $100 billion on payments services by 2025.

Providing a Sophisticated Account to Account Payment Solution

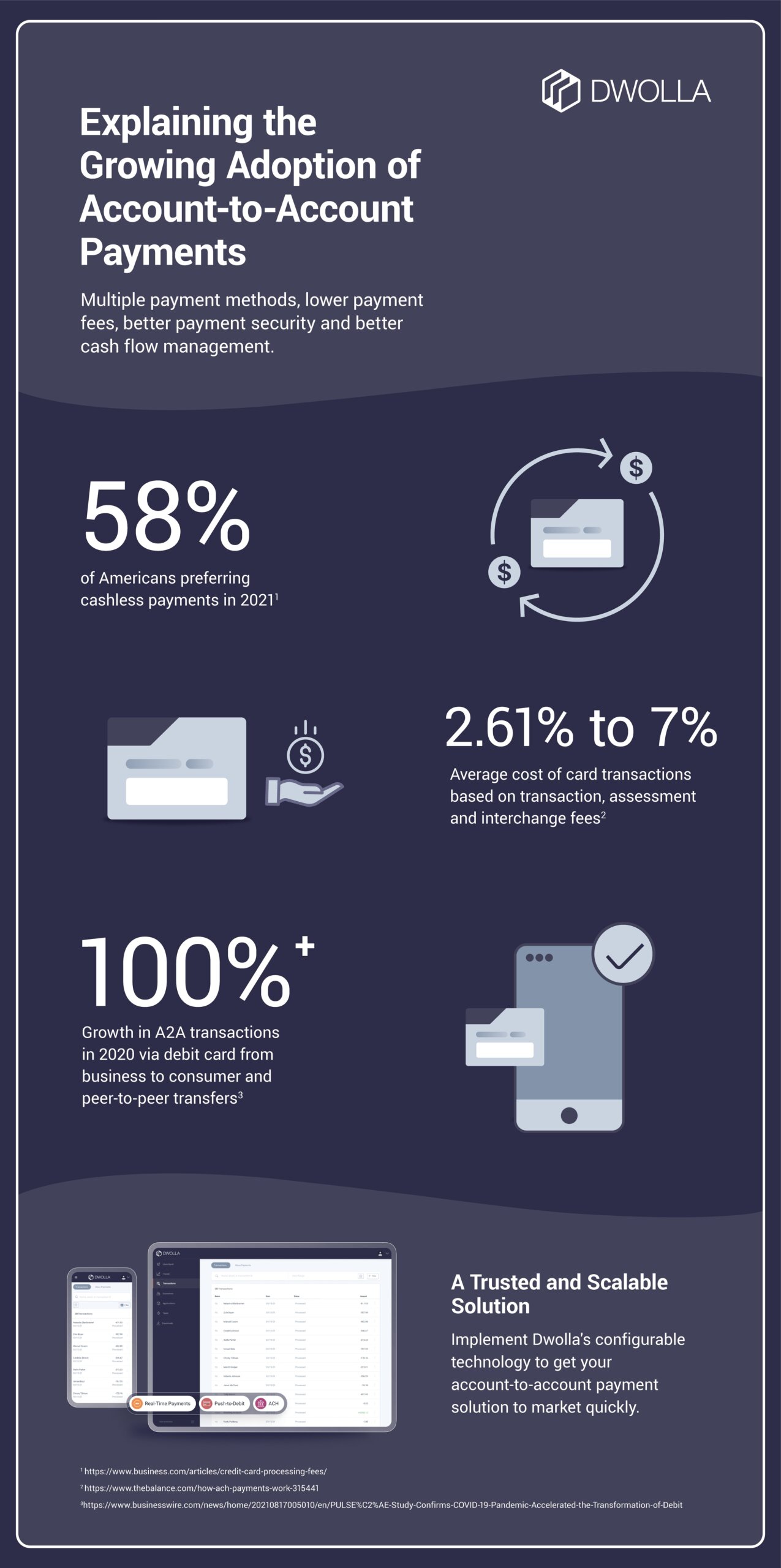

Payment solution providers are listening to what the market is saying. U.S.-based Dwolla, for example, allows businesses to access account-to-account transactions by embedding its payment API into their existing technology. A single integration can give a business access to ACH payments, real-time transactions and push-to-debit payments.

Integrating Dwolla’s payment API is coding at its simplest and allows businesses to realize value quickly. Dwolla has taken an integrative approach and established partnerships with third-party applications to add more features beyond its core function of account-to-account transactions.

That’s fully in line with the way the IT stack as a whole has transformed. Ten years ago, monolithic ERPs dominated the medium-to-enterprise sectors. However, specialist products have proved much more effective and distinctly cheaper, especially when integrated with one another. A collection of powerful, specialized applications that play nice together win every time.

For example, Slack notifications are an everyday part of many business professionals’ lives. Why reinvent a communication platform when “plugging into” Slack is not only simple, but logical? Likewise, API integration is well bedded-in for QuickBooks, and Dwolla’s partnership with Plaid means even startups can instantly verify their clients’ bank accounts for account-to-account transactions such as ACH, real-time and push-to-debit payments.

The Federal Reserve has listed five desired outcomes for improved payments systems: speed, security, efficiency, international capability and collaboration. While many payments providers spend revenue on sleek advertising campaigns (paid for by high per-transaction surcharges), Dwolla has concentrated on developing powerful financial systems and integrations with market-leading specialist platforms that enhance overall capability.

As e-commerce is the new norm, the Fed’s desired outcomes look more like what Dwolla clients already get.

Ready to get started? Sign up today and start transforming your business.