The Integrated Payment System that’s Boosting Enterprise Value

Software providers and SaaS platform operators have invested considerable time and money into developing a customer experience that makes their business unique.

However, at critical points along the customer journey, many SaaS organizations seem all too happy to hand over the stewardship of the customer experience to a third-party payment provider. Today’s next-generation payment service providers offer multiple ways that the individual retailer or marketplace can retain full control over the payment experience — and capitalize on the underlying power of the technology used in multiple new and innovative ways.

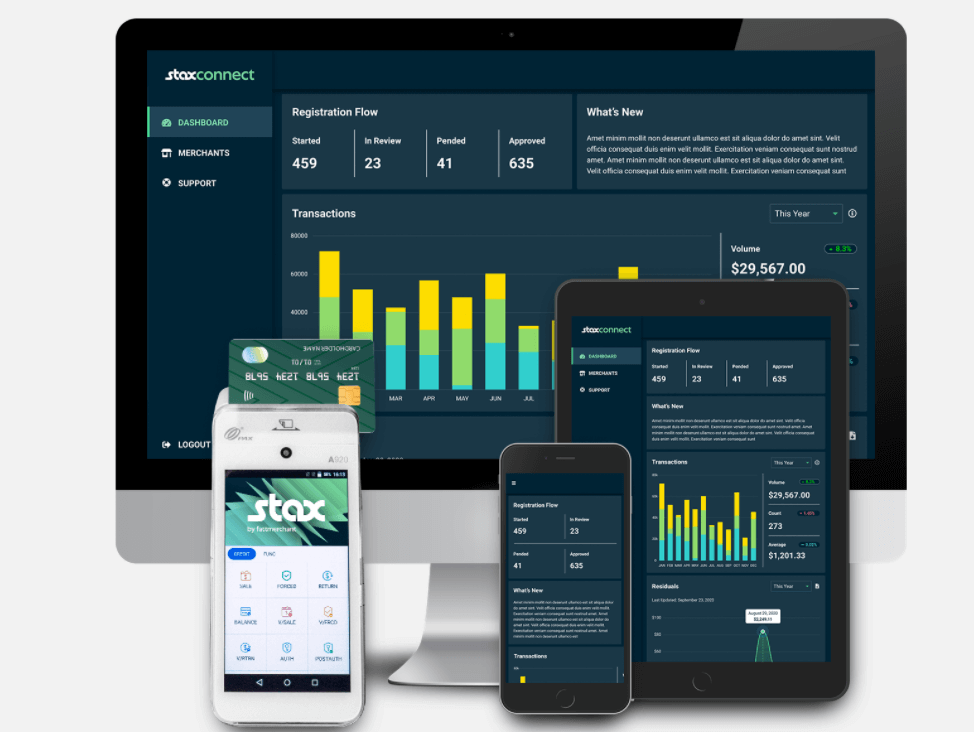

Stax Connect, a fully integrated payment API from Stax by Fattmerchant, offers granular control over every aspect of financial transactions, yet without paying multiple fees like processing levies, currency exchange penalties, Visa or MasterCard rates, and so on. When sofware companies are starting, these costs are usually taken on the chin — they are “just the cost of doing business.” As organizations scale or explore new markets, opportunities from new channels and avenues in the payment processes present themselves. The Stax Connect platform enables these to be creatively explored with highly positive results reflected from day one in income metrics, customer retention rates, resale figures, and overall revenue growth.

By integrating the rest of the enterprise’s software stack via the Stax Connect API (implemention is easy and quickly facilitated), any SaaS company can leverage its in-house existing data resources in their entirety to better create hyper-personalized customer experiences at every touchpoint.

Source: Fattmerchant

To take a single example, a company might offer a simple installment payment plan that can boost cart values and present numerous marketing opportunities, with data drawn from CRM or ERP systems already in play in the organization.

In a broader context, buying patterns, personal preferences and rich historic data can easily create inspired curated offers and reminders to help curate the ideal customer experience. Creative use of cross-selling and upselling opportunities during the online retail and payment processes can maximize revenues from each customer touchpoint – all as part of a crafted customer experience.

Overall, software & SaaS companies taking control by leveraging the Stax Connect Platform are substantially adding to their company’s value. With costs lower than an outsourced payment provider, and maximized revenues from customers that are rapidly transitioning to becoming brand advocates, the book value of the company climbs.

As the business grows, valuable data is gathered from each opportunity, information that (thanks to integrated systems) can inform the other enterprise functions: Marketing, Finance and Operations, for example. Multiple data sharing opportunities from in-house, immersive payment experiences help drive strategic change across the entire business, therefore, as well as in pure customer-facing departments.

Bringing financial payment processing in-house has been a decision that, historically, only exceptionally large enterprises could undertake: the investment in systems, security, and necessary infrastructure was large, and the numbers of governance hoops that had to be jumped through made that course impractical.

That was before this new generation of integrated payment providers came onto the tech scene, as epitomized by the power and adaptability of Stax by Fattmerchant.

Stax Connect offers the kind of convenience and ease of use that customers now expect as a given. As an effective and business outcome focused white-label service, it creates the ability for SaaS companies to place their own style and brand on every step in the customer journey, and acts as the pivot point for strategic shift to a fully customer-focused business strategy right across the enterprise.

Stax Connect gives all the benefits of a wholly owned, in-house developed payment facility, but without the huge lead time and development costs associated with that model. Furthermore, with ready-to-roll integrations and a modern approach that stresses agility and scalability, the Platform empowers companies to shift to a proactive (rather than reactive) stance with regards to new markets and opportunities.

To learn about this full-service yet fully controllable platform, visit the Stax Connect website. You can also request a fully customized demo to learn more about how integrating a payments solution into your SaaS platform can increase your company’s enterprise value.