Warehousing Industry Report Shows Automation’s Possibilities

Recent spikes in demand from online orders during lockdown periods have added to the problems being faced by warehouse and distribution centre operators in the UK over the last 18 months. Issues around labour shortages, the unclear status of many EU-originating workers and commercial property market fluctuations have also stirred the pot: 2021 is shaping up to present huge opportunities, albeit ones that come with quite a few headaches.

A paper titled “Robotics Readiness Report – How ready is the UK warehousing industry for the robot revolution?” looks at the specific challenges facing the 3PL, Retail, Grocery & Pharma sectors and considers how and why robotic automation projects might be considered by those sectors’ warehousing operations. It compares other European countries and their use of automated systems with the UK’s, and identifies opportunities for UK-based decision-makers to capitalise on investments in automation technologies.

Historical and Present-Day Contexts

The acquisition of Kiva by Amazon in 2012 placed the global giant in a position where it could further increase its margins and pressurise competitors — the numbers of which grew as it expanded across multiple sectors.

The company’s picking and fulfilment rates are impressive, but according to the Report, not necessarily in every one of its UK facilities, and not in every market sector. There is room for improvement even from the market-leaders, and reasons for optimism, therefore, for everyone else!

The researchers and authors also examined the performance of Ocado against Tesco and Asda, for instance, noting the driving factors behind the online-only retailer’s recent successes especially the investment in automated warehouse & distribution systems the company has made consistently since its inception.

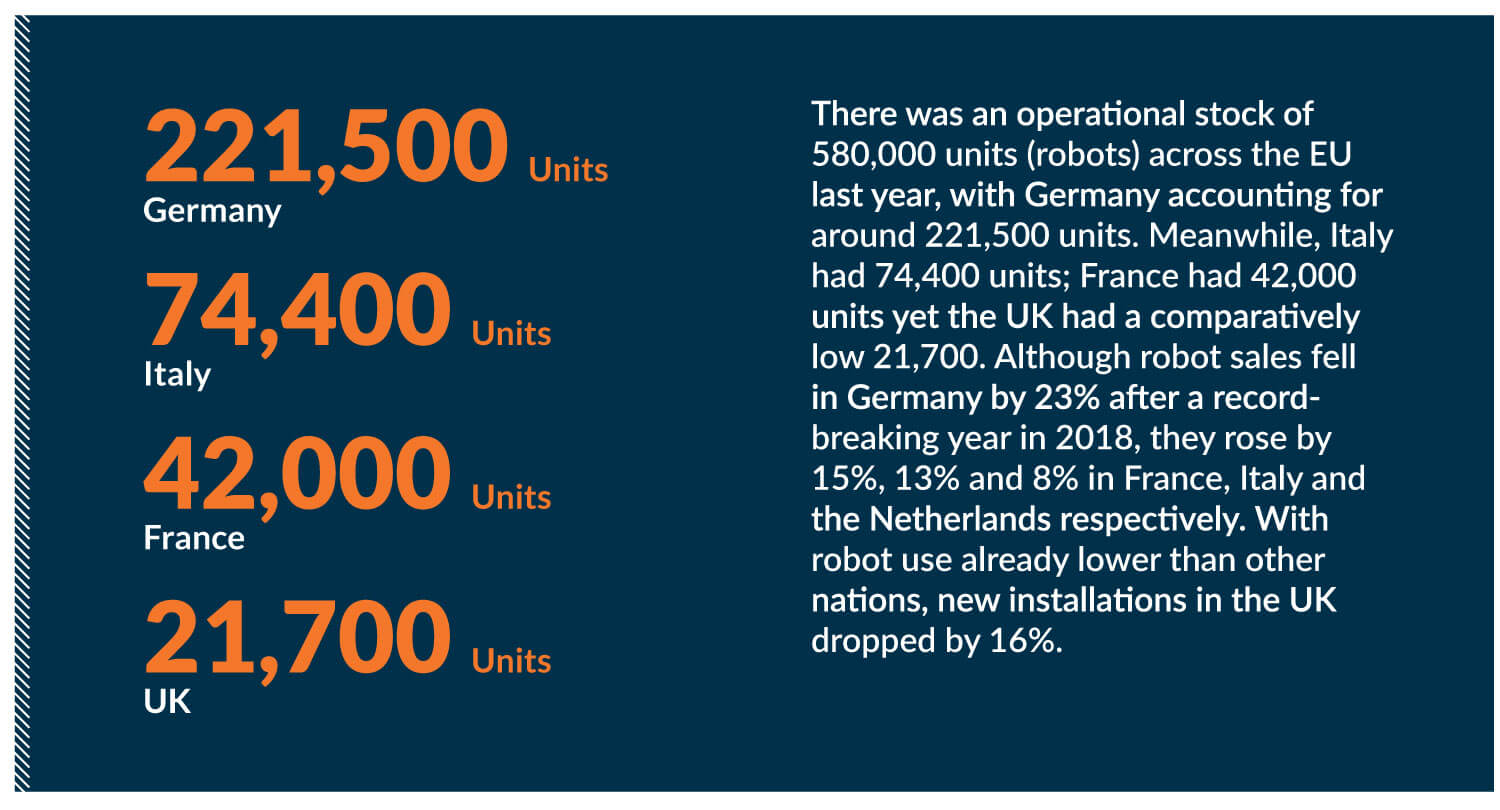

However, what is apparent is that despite some companies’ successes, the UK’s adoption of robotic automation solutions lags behind many of its mainland European counterparts, with Germany’s investment levels in 2020 around ten times that of the UK’s (despite Germany’s investment levels falling by 23% in robots). The irony of the situation is that the constraints on UK warehouse space can be alleviated, with AS/AR solutions saving up to 85% of real estate(1).

The Robotic Readiness Report shows that in addition to helping solve the space issue, the same solutions can also help companies address the post-BREXIT staffing issues that are only just beginning to bite many operators. The points-based immigration system that has been a political hot topic will undoubtedly impact all sectors: the bottom line being, how can contracts be fulfilled even with present SLAs with a declining labour supply?

Finally, no research paper published in the last two years can appear without mentioning the COVID-19 epidemic’s effects. In the warehousing/logistics/supply chain sectors, the demand for decreased handling is a given — yet one that is only partially solved. The current and possible future pandemics mean that the issue of cleanliness is now one that every sector in the warehousing industry has to address. The Report looks at possible lessons from the pharma industry where sanitisation has explicitly always had to have been prioritised.

There has also been an undeniable shift to greater use of e-commerce and delivery for many consumer (and B2B) purchases, so any bottlenecks or problem areas with current fulfilment processes are here to stay — and will probably grow in intensity over the medium to long terms.

Industry-Specific

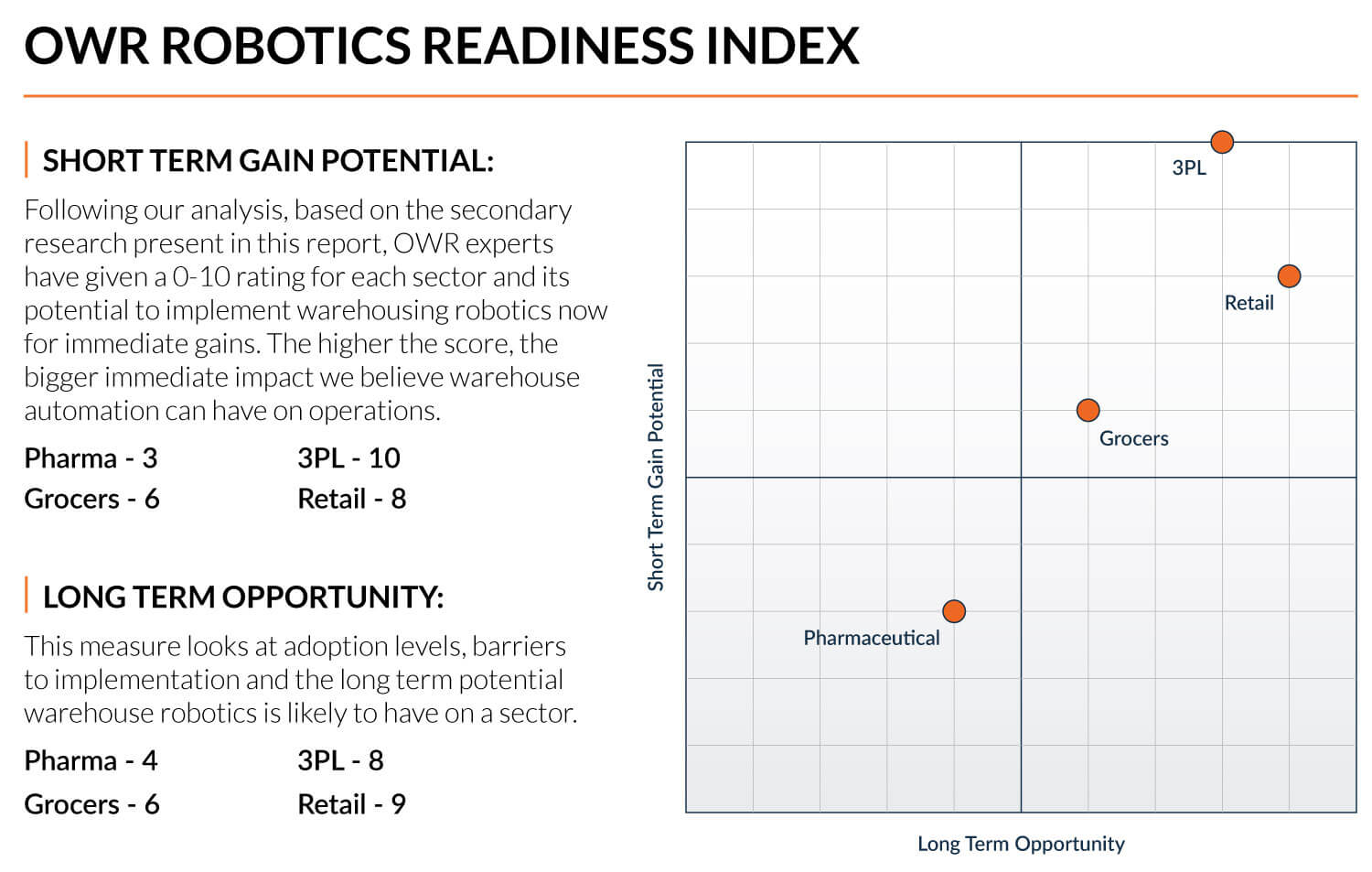

While we urge readers to download the Robotics Readiness report for themselves, here are a few clear opportunities specific to key verticals, as noted in the full Report.

3PL: Technology-savvy customers for 3PL services are more likely to choose providers with a similar mindset, ones that are capable of systems integration and automation.

Retail: Using partnerships with robotic system specialists can means rapid capitalising on changing trends away from high-street stores. With pick-rate stats boosted by up to 600 per person, per hour, partnering robotic warehousing systems specialist can change this sector.

Pharma: Automation and robotics will help hit more stringent quality control demands, compliance with MHRA, and ensure control over future vaccine rollouts.

Grocery: Deeper supply chain automation means better results in inhospitable warehouse environments, like cold-storage.

The Report’s authors combine proprietary and third-party research to assess the issues facing the UK’s affected industries in much greater depth, and the warehousing industry in general. The researchers suggest specific areas that are “quick wins” yet are fully cognisant of the need to scope automation solutions effectively and with due diligence.

Wherever you are in the journey to automated robotic systems, from sandboxed physical trials to production status, download the Robotics Readiness Report here.