Welcome to the era of AI-driven insurance

- Agile insurtech startups have turned an uncertain year to their advantage

- Descartes Underwriting joins a batch of firms that have secured significant investments

- The industry is evolving towards one with data and artificial intelligence at its core

Unsurprisingly, it’s a tough time for insurance companies — the industry is navigating uncharted territory. Many firms liable for vast sums of money, many will have changed contracts terms or withdrawn from certain markets, all amid dropped interest rates.

But it has also opened the door for more agile start-ups.

Descartes Underwriting is one of these innovative players now expanding globally into the US and Asia.

The Paris-based Insurtech company specializes in climate risk modeling and transfer. That includes business interruption following natural catastrophes such as earthquakes and floods, as well as financial losses caused by droughts, wildfires, and wildfires, across industries including agriculture, construction, banks, energy, entertainment, retail, and mining.

Having raised US$18.5 million, the firm is now opening new offices in both New York and Singapore.

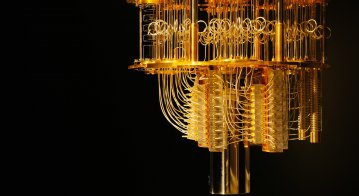

Descartes leverages a mass of different sources — from the internet of things (IoT) to remote sensing devices — to feed AI and computer vision algorithms to make predictions about risk.

The company provides these insights to brokers, insurers, and reinsurers to make property across industries, while also partnering with insurance partners to design custom solutions, pricing engines, backends, and application programming interfaces (APIs).

It’s a prime example of how fast, agile start-ups taking advantage of a sector notoriously lumbered with legacy IT and slow to embrace digital transformation.

Business booms

The insurtech market has been bubbling away for some time. The most recent funds raised by Descartes are just the latest in a long line of developments.

Last year, online platform Next Insurance — which targets niche small business owners like landscaper insurance and personal trainer insurance – raised US$250 million. While in March 2019, CoverHound secured US$58 million before Washington D.C.-based workers’ compensation insurer, Pie Insurance brought in US$45 million.

More recently in June, Planck raised US$16 million for its AI-powered commercial risk insurance platform. “The corporate insurance segment is ripe for disruption as technological intensity and innovation capabilities are taking off,” said Descartes’ co-founder and CEO Tanguy Touffut. The last 18 months have seen Descartes sign on almost 100 corporate customers that include several Fortune 500 companies.

Data-driven business models

The idea of injecting insurance processes with AI isn’t new, but the technology can help to ease uncertainty around the pandemic.

A recent report entitled Data-driven insurance: ready for the next frontier? states that “true leverage will come from partnerships with key data suppliers.”

Insurers will increasingly operate in an environment where they have continuous access to different data sources such as connected cars, homes, and wearables while gaining behavioral insights from consumer and environmental data, the report said.

“The availability of internet-enabled devices and universal connectivity has changed consumer behaviors and expectations, particularly among younger generations,” added the report. Customers now expect rapid access to information, more transparency, as well as more personalized products.

The latest developments are seeing the evolution of new data-driven business models beginning to take form, as more insurers look to go beyond their existing value chain.

“Innovation will continue to transform the insurance industry”, said chief executive officer of Swiss ReLife Capital, Thierry Leger.

“Changing risk environments, shifts in customer attitudes, and accelerating advances in technology will be the key drivers of the next few years. We will need to leverage insights from our data and partnerships to upgrade our business practices,” Leger adds.

Emerging markets

Insurers in emerging markets are evidently leading the way in optimizing potential access to different data sources and consumer optics. Insurtech companies like Descartes would do well to partner with established digital platforms and ecosystems to create a one-stop-shop service that combines features typically offered by independent incumbent organizations.

Regulation is set to play an important role in support of the integration of new technologies and data into insurance businesses across different jurisdictions. The monetization of digitalization potential will mean insurers need to manage local data protection and privacy requirements.

Longer-term, successful insurers will be those that can leverage insights from their investments and partnerships in data and analytics, while also developing solid risk protection solutions aligned with evolving regulations.