The subtle craft of omni-channel identity assurance, with a single platform: IdentityX

In the digital era, customers expect immediate access to all available services and opportunities, which in many cases still require proof of identity. Those identity checks might be lax or stringent (depending on the value of what’s being protected), but the decision is almost always made on the same grounds: is a person who they claim to be?

The difference is in the methods used in proving that case: possessing a valid passport, knowing a secret PIN, presenting the right finger, face, or voice biometric — these vary according to use case, and level of risk.

But these methods also change over time and by channel. SMS authentication seemed fairly sound once upon a time, but its vulnerabilities have been exposed. Facial recognition might be perfect for proving your identity on a smartphone, but less so when speaking to a contact centre agent on a landline phone.

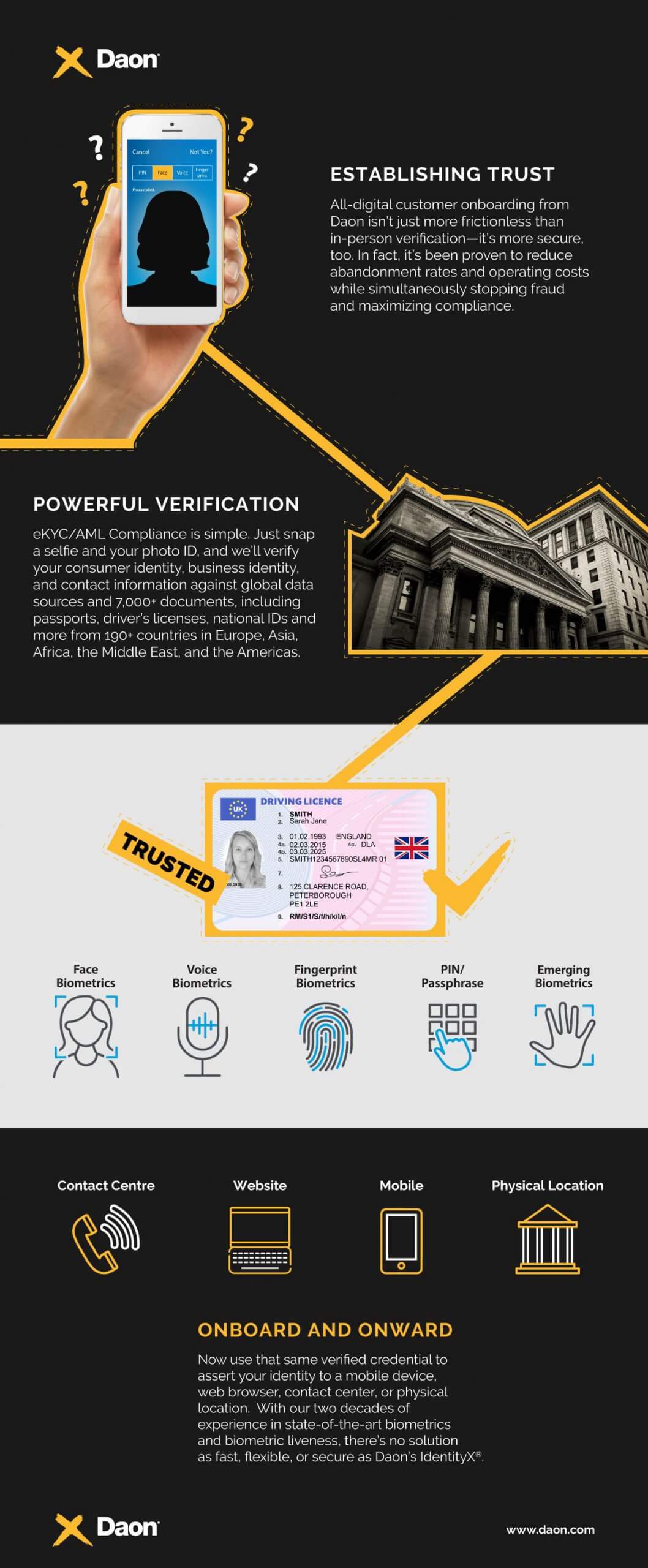

The reality is that customers want (and circumstances necessitate) choice and flexibility in identity assurance. But rather than use two or more identity solutions, many businesses and organisations are using IdentityX, a platform that builds mutual trust between customer and vendor, and provides a seamless flow of continuity across channels, security factors, and waypoints of the customer journey (onboarding, authentication, account and device recovery, etc.). Plus, it does all this securely, digitally, and therefore quickly.

The company that provides IdentityX — usually as a hosted or on premise white-label service — Daon, has built the solution so as to be massively scalable, to be platform-agnostic, to work alongside external verification services, and to be effective in any region in the world and across vertical markets. IdentityX serves as a key technology behind leading financial institutions like USAA, Atom bank, Capitec and Mox Bank, as well as innovators in telcos, healthcare, eCommerce, sports betting, aviation and higher education.

Onboarding of new customers is fast via mobile app or web, and uses partner agencies’ verification processes alongside its own, performing OCR and NFC document verification, biometric capture and cross-checking.For the end-user, the process is fast and seamless whether done inside an app or on a web browser. Behind the scenes, precise and adaptable automated scoring rules can be supplemented by human-checking and facial biometric watchlists to thwart repeat fraudsters, so any level of scrutiny can be easily met.

Once onboarded, users can authenticate themselves anywhere, in any channel, and the methods of verification are responsive to context and risk level. On-device biometrics (Daon is a board-level member of the FIDO alliance) are a popular choice, but server-side biometric matching has other advantages. By combining factors (both biometric and non-biometric) and customising accuracy thresholds, IdentityX clients can accommodate a near-infinite number of authentication scenarios on a single platform. Another advantage of IdentityX is that over time, needs might change, but there would be no need to retool or re-engineer any aspect of the solution, either as an app update or data centre realignment.

The heavy lifting of biometric or other forms of authentication is carried out by Daon, with development teams having to make minimal changes (to API calls, for example). The customer always receives a unified experience, and thanks to the single platform, there are no gaps between point products, where cracks in overall security might otherwise appear.

In particular, IdentityX provides similarly smooth, fast and secure authentication for the contact centre — the most common channel for both fraud and poor customer experience. Here, voice identification is the most frictionless method (Daon has both phrase-dependent and phrase-independent algorithms). But some might opt to use a push notification to the customer’s mobile app for biometric face or finger confirmation, while some institutions might still prefer physical keys.

With easy integration into existing contact centre infrastructure, the Daon solutions mean that users won’t have to re-authenticate if they change operator (or comms channel), and the contact centre’s owner can offer a unified authentication system across their omni-channel provision.

The same high levels of identity management and trustworthiness apply to the physical world, too. If what’s required is physical access control (via QR Code, NFC, etc.), Daon’s Glide solution, powered by IdentityX, leverages the same unified authentication and management engine to secure physical locations like airports (Denver International Airport) and college campuses (Anderson University) and for businesses that want a safe return to the workplace.

The truth is that the need to register and check identities will remain, but preferences for how that’s achieved, and the level at which such checking needs to be done will vary. But having an all-inclusive platform like IdentityX means that whether your organisation prefers device- or server-side authentication (or both), likes biometrics over physical access tokens, wants a quick ID check or in-depth scrutiny, the complexity of the process is made fast, simple and seamless — with the highest security standards — in any and every channel.

To learn more about Daon’s services and the IdentityX platform, request a demo from a representative today.