Is retail tokenization a path to blockchain enlightenment?

Consumers have gone through an awakening in the last couple of years— the Cambridge Analytica scandal shone an arc light on how our entrustment of personal data to organizations could be so easily exploited.

Big Tech lost its shiny veneer, and society at large now recognizes the value of their data in today’s digital economy.

That fact doesn’t seem to be fading. Online businesses thrive on data for advertising, product development, and to offer personalized services. Consumers are now faced with the conscious choice to trade in their personal information in a value exchange for a product or service— that is today’s understanding of the digital economy.

However, with breaches occurring by the day— by some of the world’s leading brands— both integrity and security hang over every one of those digital ‘handshakes’. Businesses now differentiate themselves on how much their customer-base can trust them.

Consider that the ‘mega breach’ of CapitalOne in 2019— which compromised the details of 100 million of its customers— was the bank’s fourth within the last decade, organizations today have the opportunity to stand head and shoulders above the rest if they can prove that trust and integrity comes first, and earn loyalty as a reward.

The blockchain hype cycle

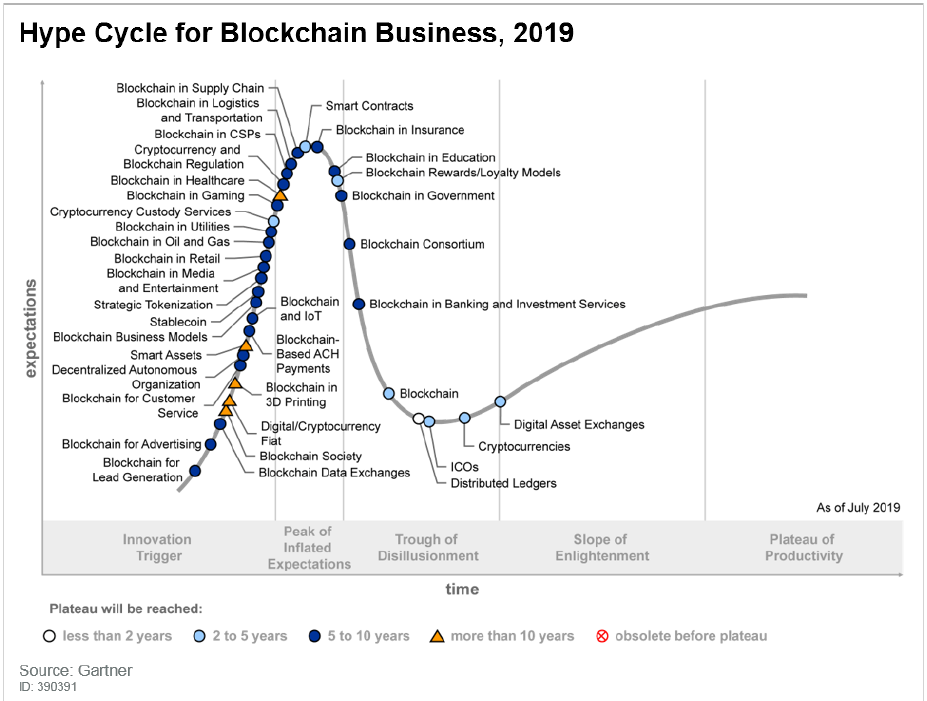

In the last few years, blockchain has been through what Gartner refers to as a ‘hype cycle’. This is when technology, from an initial period of inflated expectations, crashes down into a ‘trough of disillusionment’ before a ‘slope of enlightenment’ brings it towards a ‘plateau of productivity’.

Blockchain ‘hype cycle’. Source: Gartner

It might sound like the words of a spiritual guide, but look at how blockchain has developed in the last few years, and we can see that pattern emerging. Two years’ ago, worldwide crypto-confidence led to a balloon in companies who, collectively, claimed they’d put everything on the blockchain.

From tuna fishing to sewage systems— the rhetoric has been that industries would be turned on their heads by the technology, making them more transparent, more efficient and more secure.

In turned out that in many cases, that there wasn’t actually a need to shoehorn in distributed and encrypted ledgers— proposed implementation of the technology came before the considered utilization, and so followed the trough of disillusionment as the promised wholesale disruption failed to materialize.

That’s not to say the technology lacks potential, however, and throughout that hype cycle, spend on blockchain solutions has continued to rise rapidly year-on-year. It’s now predicted to meet US$12.4 billion in 2022, up from US$1.5 billion in 2018.

As the hype faded, considered, strategic firms— and those with the necessary resources— put utilization first, and found that blockchain could provide a solution.

Global shipping giant Maersk was one of the first large-scale adopters, launching shipping supply chain tracking platform Tradelens.

Walmart has deployed blockchain technology to track the provenance of vegetables, while French supermarket giant Carrefour claims to be seeing boosted profits and increasing consumer trust, using the technology to track meat, milk, and fruit from farms to stores.

Meanwhile, with 100 blockchain patents filed, Mastercard is the third-biggest blockchain innovator worldwide and has partnered on a number of blockchain platforms for fraud prevention and food traceability.

We find ourselves, therefore, on the slope of enlightenment.

Data security

KPMG’s US Blockchain Lead, Arun Ghosh, told TechHQ that the management consultancy firm has seen “significant demand” from all industry sectors in the last year. Perceptions are shifting from the technology as a revolutionary ‘silver bullet’, to one that can take a role simply as a component; “one of many things that make a digital strategy and a digital plan.”

In particular, Ghosh said, organizations are becoming interested in how blockchain can help them “create trust environments” for their consumers, “especially with every second morning there being some level of data breach or consumer data being lost,” he said.

“Is blockchain going to solve everything? No, but is it going to address a fair amount of these issues? Absolutely.”

Businesses are now seeing blockchain as a technology that can facilitate them becoming “anchors” for secure transactions by their customers, which will ultimately allow them to prove return by embedding customer loyalty. In that sense, as consumers become less trusting of any business entrusted with their digital fingerprint, blockchain could become a solution to bolster that relationship.

“All consumers want to know is there is no discrepancy or there is some level of audit trail of their transactions,” said Ghosh.

“And, by enabling that backbone with the blockchain layer, the organizations that are implementing blockchain are now providing a way for consumers to go and look at what your transaction history was, look at all the ways that we’re using or managing your data.

In many markets, thanks to regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Protection Act this is a requirement by law, or will soon be in any case.

“Most companies are saying, should I go back and revitalize my systems and rip and replace the multimillion-dollar security programs, or should I just layer in another trust layer that makes things more transparent to the consumer.”

YOU MIGHT LIKE

What do real-world blockchain apps look like?

The rise in tokenization

Ghosh believes the uptake of blockchain will be bolstered by a massive rise in tokenization. On the publishing of a report by KPMG on the matter, the firm’s blockchain lead said tokenization is “poised to transform commerce.”

While a younger generation of consumers may not understand blockchain technology or even care for the label, the firm found that 63 percent perceive tokens as an easy form of payment, and 55 percent believe tokens will enable them to make better use of loyalty reward points.

Supporting transparent, immutable and frictionless transactions— tokenization can unlock new models for engagement between businesses and consumers; the individual receives something of value in a transferred token while the issuer receives a touchpoint, a direct point of contact that can be monitored for utilization or more.

Say, for example, a consumer using her iPhone watches a 30-second mobile video ad, promoting a new line of watches. That encounter is captured and reported back to the advertiser, whose marketing team creates a personalized, direct marketing effort to that individual.

With tokenization, the watch company could pay a fee for the package of knowledge and insights gleaned from the engagement, yet privacy is protected because no personal data is obtained.

Instead, a digitized form of currency uses tokens to control and exchange ownership in an asset or something else with perceived value— this enables new ways to purchase products and services, enhance customer experiences, and strengthen customer trust and brand loyalty.

The benefits are mutual; consumers can be rewarded for their interactions with content or advertising, without surrendering personal data, while businesses can leverage and share insights, enjoy enhance customer loyalty, and generate revenue more efficiently.

“By creating more liquidity by using blockchain tokens, the transfer of value is accelerated,” KPMG wrote.

“Thus, loyalty providers can more easily move liquidity off their books and bolster their balance sheets […] organizations [can] leverage blockchain infrastructure and value attributes to build robust security models that are embedding privacy requirements into technology solutions by design.”

Ultimately, Ghosh sees tokenization as becoming a key area for blockchain’s adoption among consumer-facing businesses— particularly in ones where there is already a high degree of consumer loyalty— away from the key areas of financial services and supply chain tracking where the technology has begun to be embraced.

This will be compounded by the increasing prevalence of a sub-millennial generation who are privacy-aware and already understand the concept of digital wallets and, as Ghosh told us, “believe that digital currency of any shape or form is a lot more exciting than just, you know, working with credit cards.”

On blockchain’s maturity— and whether it’s still on the path to becoming the revolutionary technology it was often touted to be two or three years ago, Ghosh is under no pretense that blockchain is a standalone, silver bullet to any organization or use case.

“Can you do [tokenization] without blockchain? Absolutely. But can you do it with the efficiencies that blockchain provides— the trusted ledger? We haven’t seen another competitor to blockchain that can bring that end to end visibility, audibility, and provenance.

“We’re going to see both broader implementation [of blockchain], less of the hype and more of the adoption […] Because at the end of the day, we [consumers] own our own information, and as long as we know how and where it’s being stored and how it’s being used, that’s what matters.”