Fintech enters the new year with a new look

Since sprouting in the US and UK a decade ago, fintech has emerged with prodigious growth and spread its roots globally.

In countries such as Sweden, only 11 percent of citizens still use cash on a daily basis while the majority of the country pays by card or implanted microchips.

Fintech has since stamped its mark as a household name, with unprecedented growth in investment from US$2 billion in 2010 to US$50 billion in venture capital in 2018.

For example, Kenya’s mobile payment service M-Pesa has supported the banking needs of 18 million active users since its launch in 2017. A range of services such as loans, international transfers, and health provision is within the coverage of this e-payment service.

Fintech is more than a byproduct of digital transformation but has transformed financial services at a national level.

It is here to stay and a few prominent trends are defining the fintech of a new decade.

Decentralized customer data

One of the trends directing the development of fintech is the breaking down of data silos.

Decentralization of customer data is a key trend in the development of fintech as it is breaking down silos.

As organizations realize the significance of bringing data together to see the “bigger picture”, financial sectors are hammering down the walls of siloed customer data for greater business insights and analysis.

The dissemination of data brings along doors of opportunities for upstart fintech innovators to compete with large established financial institutions. Simultaneously, consumers are becoming more aware and conscious of the way data is stored and used.

The emerging concerns pushed for government regulations, such as the EU’s revised Payment Services Directive (PSD2), a move that puts a stop to banks’ monopolization of customer’s data.

“The PSD2 will ensure transparency and fair competition, and break down the entry barriers for new payment services, which will benefit the customers,” said Bjørn Søland, technical expert of Nexus Group.

PSD2 enables large banks to make customer data available to third-party providers with customer permission. The third-party providers may then fulfill financial services with information directly from customer’s bank accounts.

The decentralized system allows customers to leverage their own data for greater access to a variety of financial services.

Embedded fintech

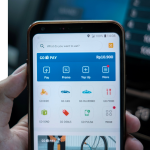

The idea of embedded fintech is the increasingly ubiquitous presence that will soon shed its form as a standalone product and emerge as an integrated feature of other products.

As an example, the debut of Apple Card, Amazon Pay, and just last month, the launch of Facebook Pay consolidates the status of fintech.

Meanwhile, Target and Shopify are planning to offer similar financial services and products.

YOU MIGHT LIKE

UK fintech could face a Brexit staffing shortage

Based on a recent study, a majority (75 percent) of tech-savvy customers subscribe to at least one of the financial products provided by the stated technology giants.

For example, Amazon has recently revived its lending business, offering loans to a number of small merchants selling goods on the company’s online platform.

This has led fintech futurist Brett King to predict that technology giants and large consumer brands will eventually move fintech to the background of the user experience and become gatekeepers of financial products.

Taking Uber as an example, King elaborated on how fintech is a game-changer for many boarding the digital wave to push the boundaries of traditional financial services and products.

“Platforms like Uber, Amazon, and others will be proactively looking for solutions that will end up reforming banking, whether the banks see the need for that reform or not.

“Thinking that Uber is competing with the bank is missing the point. It’s all about the experience. Any friction that isn’t absolutely necessary will be eliminated from the technology layer. Either banks remove friction… or someone else will,” said King.

In brief, the emerging trends indicate how the fintech landscape will transform in the new decade.

However, one thing remains constant—fintech will continue to fill the void for people and communities without access to traditional finance services but perhaps, with a new look or two.