Flexible, transparent and trusted: solving payment complexities worldwide with Flywire

The pro ball player, musical maestro or consummate artist makes their particular craft look easy to the untrained eye. Of course, that unmistakable fluency of movement or delicacy of touch all come from many, many years of practice and hard work (combined with more than a little talent). The same principle of seeming simplicity hiding a great deal of work going on under the surface is very much apparent in the online world: who after all really knows how data packets move through networks, or how a touch on a smartphone screen can move thousands of dollars over borders, through banks and exchange systems to their eventual recipient?

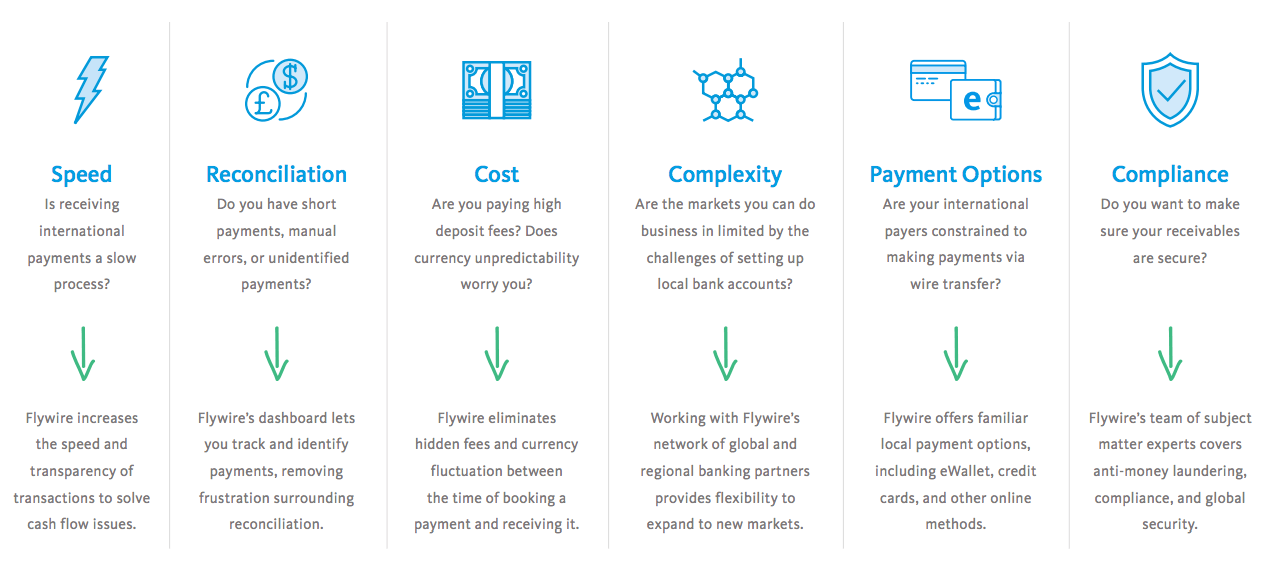

Businesses rarely want or need to know the details of how the tools and instruments they use function. Rather, things just need to work, with specific caveats. For example, when sending or receiving monies, the security and safety of exchange are of absolute paramount importance: that allows a bond of trust between the involved parties. There is a massive reliance therefore on the payment platform in use – it must be absolutely watertight in terms of its security but also be run by a company that’s tuned into the different tranches of regulation, governance, and laws that protect data and the people that use it. As a next-generation payment platform, Flywire has the broad, continent-crossing reach and experience that organizations regardless of size rely on, day in, day out to protect the highly sensitive data that moves billions of dollars a day.

But like the sports pro whose economy of movement hides a power and knowledge to make it all look simple, the platform’s ease of use for those sending or receiving payments hides highly technical underpinnings, and the fact that it searches for, and selects, the very best value for money for all parties at each stage.

It should be said immediately that the platform is not a closed shop: Flywire knows that transparency is also of huge importance, both as a means of establishing trust from all parties, but also as a way that any organization can see up-to-the-minute progress of all monies, transactions and sometimes complex financial interchanges.

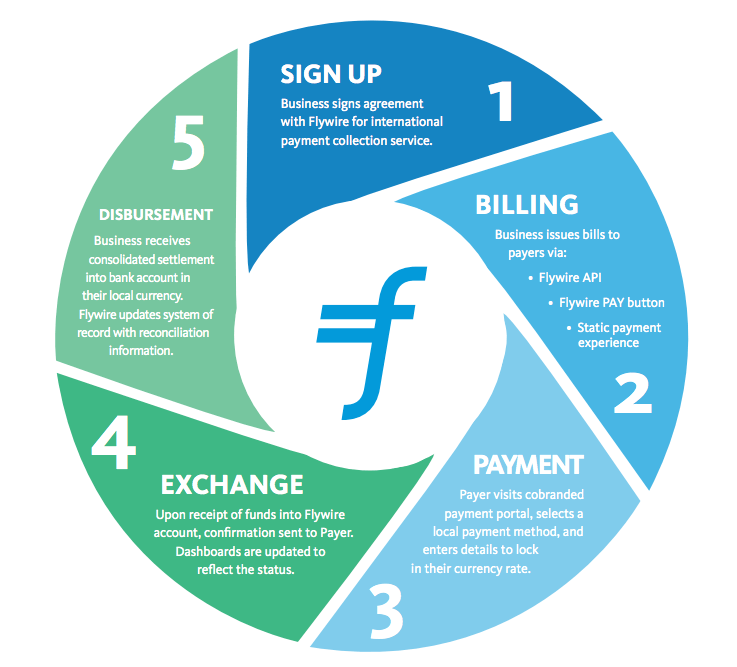

The next-gen payment platform presents the organization or customer making a payment with a range of local and familiar payment options. That encourages the payment process to continue – there’s nothing unfamiliar, payment can be made in the local currency, and the amount due is stated “up front” with no unpleasant surprises down the line. Then, the Flywire platform compares the various exchange options and payment gateways available to source the best rate of transfer. Bank fees are compared on-the-fly, for example, and if the payment involves foreign currency exchange, the best exchanges are sought.

For the company that deploys Flywire, it’s simple to set up payment options (invoices, part payments, deposits, repeat payments, refunds, and so forth) and then monitor the progress of all payments as they pass from the purchaser to their eventual reconciliation. Organizations can offer omnichannel options, so e-commerce, telephone sales, and online payments are available, bi-bidirectionally.

The platform has all the data it requires to enable payments, and so can receive and reconcile seamlessly with the only need for manual intervention cropping up when there is an anomaly. Businesses are finding themselves saving thousands of dollars in recouped staff time, plus they see better exchange rates, lower charges and a highly automated payment system that works simply and transparently for both sides of a transaction.

With support for over 100 currencies and an ethos that helps its customers with customized payment solutions built especially for their industry, including education, healthcare and travel, the Flywire payment platform is at the forefront of financial transactional processing and analysis. Support is continuous and is multilingual, and the company operates globally, constantly upgrading its network of partnerships with banks, foreign exchanges, payment gateways, card services, and portals.

“We’re loving Flywire. It’s not often that you come across a technology-based business solution that ticks so many boxes so easily and so well. Flywire has saved us thousands of dollars in just the first few months. It’s simple, good for the customer, and good for us… Not only is the platform itself excellent, but the support too. From the first contact we had with Flywire right through to post implementation the support has been thorough and flawless. For any business that receives money from abroad, Flywire is a seriously seamless solution.”

Owner, Heli Skiing Company

More case studies and detailed information are available from the company’s website, or you can contact a local representative (who speaks your language) to find out how your enterprise can benefit from Flywire.